National Grid 2014 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

Key milestones

Some of the key dates and actions in the corporate history

ofNational Grid are listed below. The full history goes back

muchfurther.

1986 British Gas (BG) privatisation

1990 Electricity transmission network in England and Wales transferred

toNational Grid on electricity privatisation

1995 National Grid listed on the London Stock Exchange

1997 Centrica demerged from BG

1997 Energis demerged from National Grid

2000 Lattice Group demerged from BG and listed separately

2000 New England Electric System and Eastern Utilities Associates acquired

2002 Niagara Mohawk Power Corporation merged with National Grid in US

2002 National Grid and Lattice Group merged to form National Grid Transco

2004 UK wireless infrastructure network acquired from Crown Castle

International Corp

2005 Four UK regional gas distribution networks sold and National Grid

adopted as our name

2006 Rhode Island gas distribution network acquired

2007 UK and US wireless infrastructure operations and the Basslink

electricity interconnector in Australia sold

2007 KeySpan Corporation acquired

2008 Ravenswood generation station sold

2010 Rights issue raised £3.2 billion

2012 New Hampshire electricity and gas distribution businesses sold

Material contracts

Each of our Executive Directors has a service agreement and each

Non-executive Director has a letter of appointment. No contract

(other than contracts entered into in the ordinary course of

business) has been entered into by National Grid within the two

years immediately preceding the date of this report which is, or

may be, material; or which contains any provision under which any

member of National Grid has any obligation or entitlement which is

material to National Grid at the date of this report.

Property, plant and equipment

This information can be found under the heading note 11 property,

plant and equipment on page 111, note 19 Borrowings on pages

119 to 121, Strategic Report pages 12 to 20, where we operate on

page 166 and principal operations on pages 29 to 38.

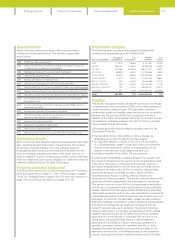

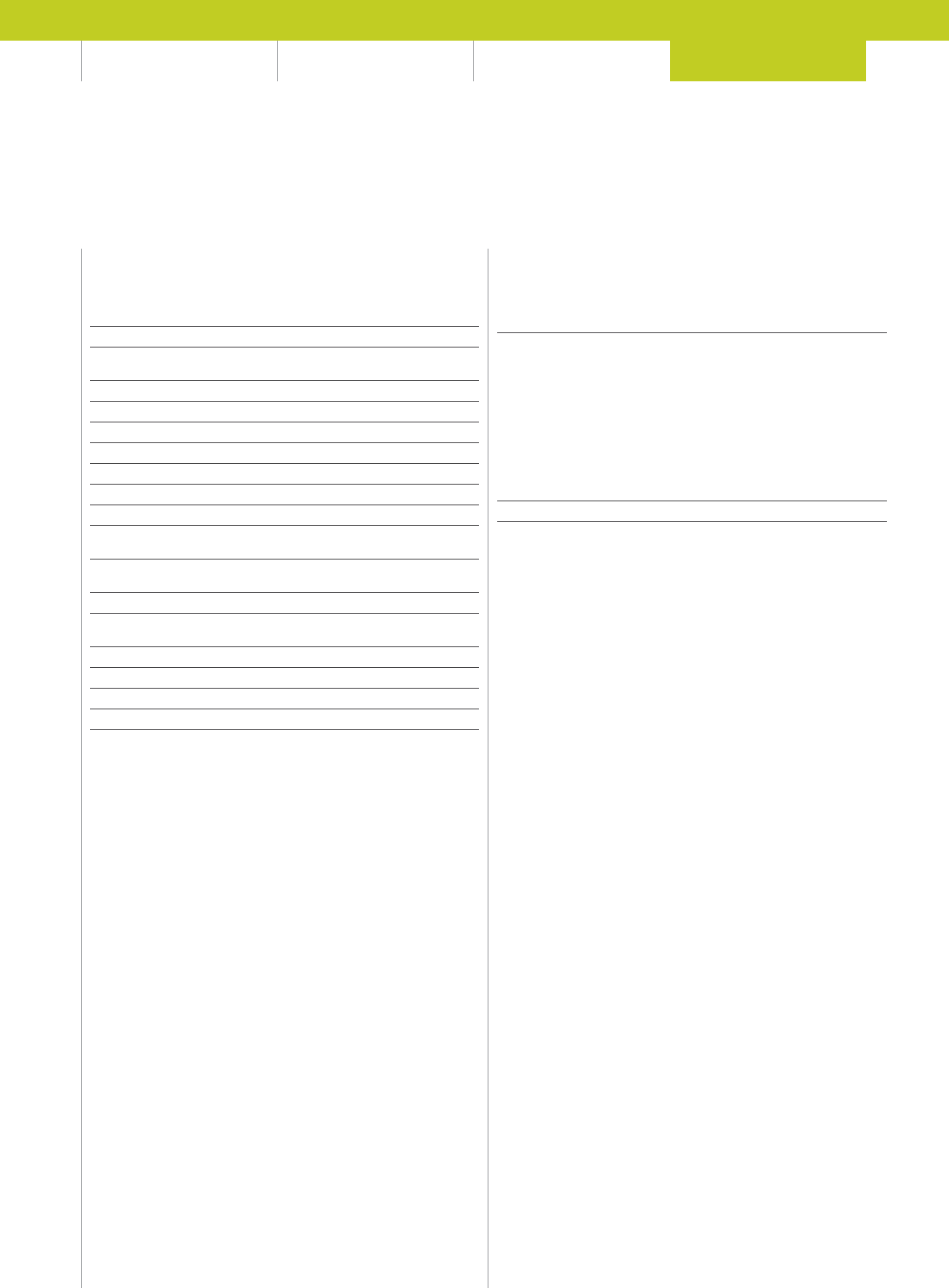

Shareholder analysis

The following table includes a brief analysis of shareholder

numbers and shareholdings as at 31 March 2014.

Size of shareholding

Number of

shareholders

% of

shareholders

Number

of shares

% of

shares

1–50 174,219 17. 6 3 6 6 5,070,597 0.1316

51–100 269,540 2 7. 28 6 2 19,092,359 0.4953

101–500 4 27, 0 8 2 43.2345 89,577,097 2.3241

501–1,000 58,849 5.9574 41,182,96 3 1.0685

1,001–10,000 55,016 5.5694 135,292,646 3.5101

10,001–50,000 2,079 0.2105 37,261,484 0.9667

50,001–100,000 203 0.0206 14,546,599 0.3774

100,001–500,000 429 0.0434 104,413,484 2.709

500,001–1,000,000 122 0.0124 85,852,431 2.2274

1,000,001+ 287 0.029 3,322,050,361 86.18 99

Total 987,82 6 100 3,854,340,021 100

Taxation

This section discusses certain US federal income tax and UK tax

consequences of the ownership of ADSs and ordinary shares by

certain beneficial holders thereof. This discussion applies to

holders who qualify for benefits under the income tax convention

between the US and the UK (the Tax Convention) and are a

resident of the US for the purposes of the Tax Convention and are

not resident or ordinarily resident in the UK for UK tax purposes

atany material time (a US Holder).

US Holders generally will be entitled to benefits under the Tax

Convention if they are:

• the beneficial owner of the ADSs or ordinary shares, as

applicable, and of any dividends that they receive;

• an individual resident or citizen of the US, a US corporation,

oraUS partnership, estate, or trust (but only to the extent the

income of the partnership, estate, or trust is subject to US

taxation in the hands of a US resident person); and

• not also a resident of the UK for UK tax purposes.

If a US Holder holds ADSs or ordinary shares in connection with

the conduct of business or the performance of personal services

in the UK or otherwise in connection with a branch, agency or

permanent establishment in the UK, then the US Holder will not

beentitled to benefits under the Tax Convention. Special rules,

including a limitation of benefits provision, apply in limited

circumstances to ADSs or ordinary shares owned by an

investment or holding company. This section does not discuss the

treatment of holders described in the preceding two sentences.

This section does not purport to be a comprehensive description

of all the tax considerations that may be relevant to any particular

investor. National Grid has assumed that shareholders, including

US Holders, are familiar with the tax rules applicable to investments

in securities generally and with any special rules to which they may

be subject. In particular, the discussion deals only with investors

that will beneficially hold ADSs or ordinary shares as capital assets

and does not address the tax treatment of investors that are

subject to special rules, such as banks, insurance companies,

dealers in securities or currencies, partnerships or other entities

classified as partnerships for US federal income tax purposes,

persons that control (directly or indirectly) 10% or more of our

voting stock, persons that elect mark-to-market treatment,

persons that hold ADSs or ordinary shares as a position in a

straddle, conversion transaction, synthetic security, or other

integrated financial transaction, persons who are liable for the

alternative minimum tax, or the Medicare tax on net investment

income, and persons whose functional currency is not the dollar.

179