National Grid 2014 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

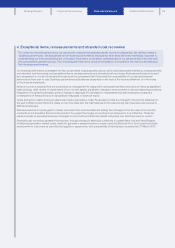

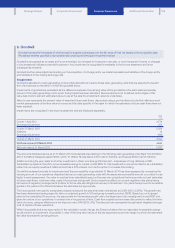

9. Goodwill

Goodwill represents the excess of what we paid to acquire businesses over the fair value of their net assets at the acquisition date.

We assess whether goodwill is recoverable each year by performing an impairment review.

Goodwill is recognised as an asset and is not amortised, but is tested for impairment annually, or more frequently if events or changes

incircumstances indicate a potential impairment. Any impairment is recognised immediately in the income statement and is not

subsequently reversed.

Goodwill and fair value adjustments arising on the acquisition of a foreign entity are treated as assets and liabilities of the foreign entity

and translated at the closing exchange rate.

Impairment

Goodwill is allocated to cash-generating units and this allocation is made to those cash-generating units that are expected to benefit

from the business combination in which the goodwill arose.

Impairments of goodwill are calculated as the difference between the carrying value of the goodwill and the estimated recoverable

amount of the cash-generating unit to which that goodwill has been allocated. Recoverable amount is defined as the higher of fair

valueless costs to sell and estimated value-in-use at the date the impairment review is undertaken.

Value-in-use represents the present value of expected future cash flows, discounted using a pre-tax discount rate that reflects current

market assessments of the time value of money and the risks specific to the asset for which the estimates of future cash flows have not

been adjusted.

Impairments are recognised in the income statement and are disclosed separately.

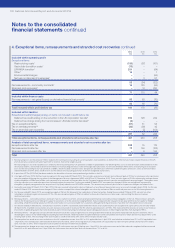

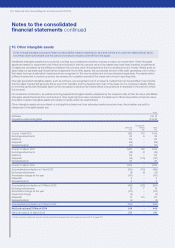

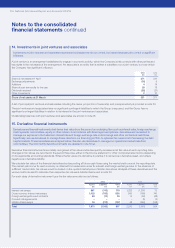

Total

£m

Cost at 1 April 2012 4,776

Exchange adjustments 252

Cost at 31 March 2013 5,028

Additions 12

Exchange adjustments (446)

Cost at 31 March 2014 4,594

Net book value at 31 March 2014 4,594

Net book value at 31 March 2013 5,028

The amounts disclosed above as at 31 March 2014 include balances relating to the following cash-generating units: New York £2,640m

(2013: £2,898m); Massachusetts £987m (2013: £1,082m); Rhode Island £367m (2013: £403m); and Federal £600m (2013: £645m).

Additions during the year relate to a further investment in Clean Line Energy Partners LLC, a developer of long-distance, HVDC

transmission projects in the US to move renewable energy to market. Under IFRS 10, this investment is now accounted for as a subsidiary

rather than an equity investment. National Grid has a 37% interest, but has the option to increase this holding.

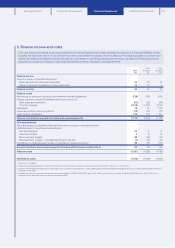

Goodwill is reviewed annually for impairment and the recoverability of goodwill at 31 March 2014 has been assessed by comparing the

carrying amount of our operations described above (our cash-generating units) with the expected recoverable amount on a value-in-use

basis. In each assessment, the value-in-use has been calculated based on five year plan projections that incorporate our best estimates

of future cash flows, customer rates, costs, future prices and growth. Such projections reflect our current regulatory rate plans taking

into account regulatory arrangements to allow for future rate plan filings and recovery of investment. Our plans have proved to be reliable

guides in the past and the Directors believe the estimates are appropriate.

The future growth rate used to extrapolate projections beyond five years has been maintained at 2.25% (2013: 2.25%). The growth rate

has been determined having regard to data on projected growth in US real gross domestic product (GDP). Based on our business’

place in theunderlying US economy, it is appropriate for the terminal growth rate to be based upon the overall growth in real GDP and,

given the nature of our operations, to extend over a long period of time. Cash flow projections have been discounted to reflect the time

value of money, using an effective pre-tax discount rate of 9% (2013: 9%). The discount rate represents the estimated weighted average

cost ofcapital of these operations.

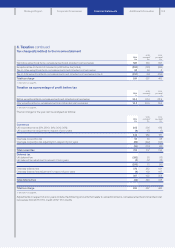

While it is possible that a key assumption in the calculation could change, the Directors believe that no reasonably foreseeable change

would result in an impairment of goodwill, in view of the long-term nature of the key assumptions and the margin by which the estimated

fair value exceeds the carrying amount.

109