National Grid 2014 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

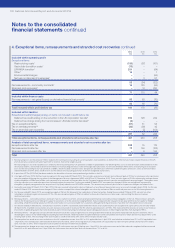

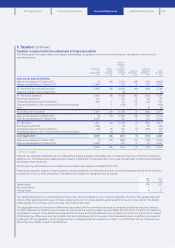

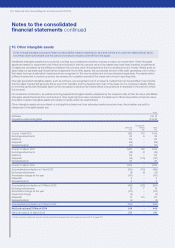

10. Other intangible assets

Other intangible assets includes software and acquisition-related assets (such as brand names and customer relationships), which

are written down (amortised) over the period we expect to receive a benefit from the asset.

Identifiable intangible assets are recorded at cost less accumulated amortisation and any provision for impairment. Other intangible

assets are tested for impairment only if there is an indication that the carrying value of the assets may have been impaired. Impairments

ofassets are calculated as the difference between the carrying value of the asset and the recoverable amount, if lower. Where such an

asset does not generate cash flows that are independent from other assets, the recoverable amount of the cash-generating unit to which

that asset belongs is estimated. Impairments are recognised in the income statement and are disclosed separately. Any assets which

suffered impairment in a previous period are reviewed for possible reversal of the impairment at each reporting date.

Internally generated intangible assets, such as software, are recognised only if: an asset is created that can be identified; it is probable

that the asset created will generate future economic benefits; and the development cost of the asset can be measured reliably. Where

no internally generated intangible asset can be recognised, development expenditure is recorded as an expense in the period in which

itis incurred.

On a business combination, as well as recording separable intangible assets possessed by the acquired entity at their fair value, identifiable

intangible assets that arise from contractual or other legal rights are also included in the statement of financial position at their fair value.

Acquisition-related intangible assets principally comprise customer relationships.

Other intangible assets are amortised on a straight-line basis over their estimated useful economic lives. Amortisation periods for

categories of intangible assets are:

Years

Software 3 to 10

Acquisition-related intangibles 10 to 25

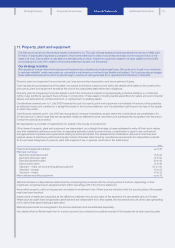

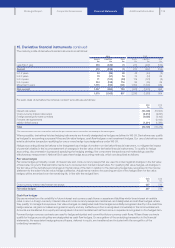

Software

£m

Acquisition-

related

£m

Total

£m

Cost at 1 April 2012 899 116 1,015

Exchange adjustments 20 626

Additions 175 –175

Disposals (26) –(26)

Reclassifications1(37) –(37)

Cost at 31 March 2013 1,031 122 1,153

Exchange adjustments (38) (7) (45)

Additions 179 –179

Disposals (16) (115) (131)

Reclassifications166 –66

Cost at 31 March 2014 1,222 –1,222

Accumulated amortisation at 1 April 2012 (353) (116 ) (469)

Exchange adjustments (6) (6) (12)

Amortisation charge for the year (101) –(101)

Disposals 9 – 9

Reclassifications19 – 9

Accumulated amortisation at 31 March 2013 (442) (122) (564)

Exchange adjustments 12 719

Amortisation charge for the year (127) –(127)

Impairment charge (5) –(5)

Disposals 12 115 127

Reclassifications1(3) –(3)

Accumulated amortisation at 31 March 2014 (553) –(553)

Net book value at 31 March 2014 669 –669

Net book value at 31 March 2013 589 –589

1. Reclassifications represents amounts transferred (to)/from property, plant and equipment (see note 11 on page 112).

Notes to the consolidated

financial statements continued

110 National Grid Annual Report and Accounts 2013/14