National Grid 2014 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

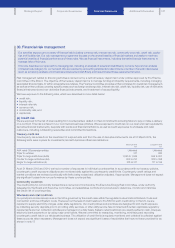

30. Financial risk management

Our activities expose us to a variety of financial risk including currency risk, interest rate risk, commodity price risk, credit risk, capital

risk and liquidity risk. Our risk management programme focuses on the unpredictability of financial markets and seeks tominimise

potential volatility of financial performance of these risks. We use financial instruments, including derivative financial instruments, to

manage risks of this type.

This note describes our approach to managing risk, including an analysis of assets and liabilities by currency type and an analysis

ofinterest rate category for our net debt. We are required by accounting standards to also include a number of specific disclosures

(such as a maturity analysis of contractual undiscounted cash flows) and have included these requirements below.

Risk management related to financing activities is carried out by a central treasury department under policies approved by the Finance

Committee of the Board. The objective of the treasury department is to manage funding and liquidity requirements, including managing

associated financial risks, to within acceptable boundaries. The Finance Committee provides written principles for overall risk management,

as well as written policies covering specific areas such as foreign exchange risk, interest rate risk, credit risk, liquidity risk, use of derivative

financial instruments and non-derivative financial instruments, and investment of excess liquidity.

We have exposure to the following risks, which are described in more detail below:

• credit risk;

• liquidity risk;

• interest rate risk;

• currency risk;

• commodity risk; and

• capital risk

(a) Credit risk

We are exposed to the risk of loss resulting from counterparties’ default on their commitments including failure to pay or make a delivery

on a contract. This risk is inherent in our commercial business activities. We are exposed to credit risk on our cash and cash equivalents,

derivative financial instruments, deposits with banks and financial institutions, as well as credit exposures to wholesale and retail

customers, including outstanding receivables and committed transactions.

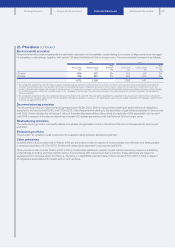

Treasury credit risk

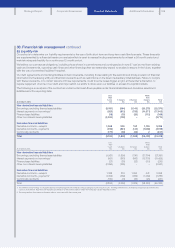

Counterparty risk arises from the investment of surplus funds and from the use of derivative instruments. As at 31 March 2014, the

following limits were in place for investments held with banks and financial institutions:

Maximum limit

£m

Long-term limit

£m

AAA rated G8 sovereign entities Unlimited Unlimited

Triple ‘A’ vehicles 311 263

Triple ‘A’ range institutions (AAA) 1,060 to 1,599 534 to 837

Double ‘A’ range institutions (AA) 633 to 797 322 to 398

Single ‘A’ range institutions (A) 218 to 311 111 to 159

As at 31 March 2013 and 2014, we had a number of exposures to individual counterparties. In accordance with our treasury policies,

counterparty credit exposure utilisations are monitored daily against the counterparty credit limits. Counterparty credit ratings and

market conditions are reviewed continually with limits being revised and utilisation adjusted, if appropriate. Management does not expect

any significant losses from non performance by these counterparties.

Commodity credit risk

The credit policy for commodity transactions is owned and monitored by the Executive Energy Risk Committee, under authority

delegated by the Board and Executive Committee, and establishes controls and procedures to determine, monitor and minimise

thecredit risk of counterparties.

Wholesale and retail credit risk

Our principal commercial exposure in the UK is governed by the credit rules within the regulated codes Uniform Network Code and

Connection and Use of System Code. These set out the level of credit relative to the RAV for each credit rating. Inthe US, we are

required to supply electricity and gas under state regulations. Our credit policies and practices are designed to limit credit exposure

bycollecting security deposits prior to providing utility services, or after utility service has commenced if certain applicable regulatory

requirements are met. Collection activities are managed on a daily basis. Sales to retail customers are usually settled in cash, cheques,

electronic bank payments or by using major credit cards. We are committed to measuring, monitoring, minimising and recording

counterparty credit risk in our wholesale business. The utilisation of credit limits is regularly monitored and collateral is collected against

these accounts when necessary. Management does not expect any significant losses of receivables that have not been provided for as

shown in note 17.

137