National Grid 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

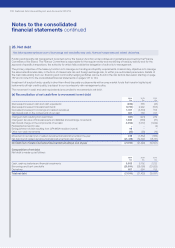

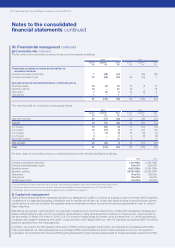

30. Financial risk management continued

(c) Interest rate risk

National Grid’s interest rate risk arises from our long-term borrowings. Borrowings issued at variable rates expose National Grid to cash

flow interest rate risk, partially offset by cash held at variable rates. Borrowings issued at fixed rates expose National Grid to fair value

interest rate risk.

Our interest rate risk management policy is to seek to minimise total financing costs (being interest costs and changes in the market

value of debt) subject to constraints. We do this by using fixed and floating rate debt and derivative financial instruments including

interest rate swaps, swaptions and forward rate agreements.

We hold some borrowings on issue that are inflation linked. We believe that these provide a partial economic offset to the inflation risk

associated with our UK inflation linked revenues.

The table in note 19 sets out the carrying amount, by contractual maturity, of borrowings that are exposed to interest rate risk before

taking into account interest rate swaps.

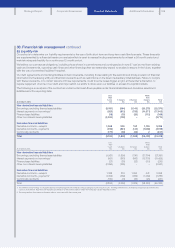

During 2014 and 2013, net debt was managed using derivative instruments to hedge interest rate risk as follows:

2014 2013

Fixed

rate

£m

Floating

rate

£m

Inflation

linked

£m

Other1

£m

Total

£m

Fixed

rate

£m

Floating

rate

£m

Inflation

linked

£m

Other1

£m

Total

£m

Cash and cash equivalents 175 179 – – 354 577 94 – – 671

Financial investments 615 2,979 – 5 3,599 540 4,843 –48 5,431

Borrowings2(15,585) (3,520) (6,836) (9) (25,950) ( 17, 76 7 ) (3,700) (6,617) (11) (28,095)

Pre-derivative position (14,795) (362) (6,836) (4) (21,997) (16,650) 1,237 (6,617) 37 (21,993)

Derivative effect33,359 (2,743) 191 –807 1,555 (1,132) 141 –564

Net debt position (11,436) (3,105) (6,645) (4) (21,190) (15,095) 105 (6,476) 37 (21,429)

1. Represents financial instruments which are not directly affected by interest rate risk, such as investments in equity or other similar financial instruments.

2. Includes bank overdrafts.

3. The impact of 2014/15 (2013: 2013/14) maturing short-dated interest rate derivatives is included.

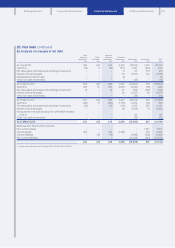

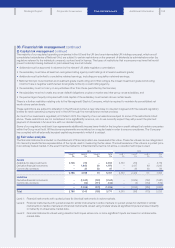

(d) Currency risk

National Grid operates internationally and is exposed to foreign exchange risk arising from various currency exposures, primarily with

respect to the dollar. Foreign exchange risk arises from future commercial transactions, recognised assets and liabilities, and investments

in foreign operations.

Our policy for managing foreign exchange transaction risk is to hedge contractually committed foreign currency cash flows over a

prescribed minimum size. Where foreign currency cash flow forecasts are less certain, our policy is to hedge a proportion of such cash

flows based on the probability of those cash flows occurring. Instruments used to manage foreign exchange transaction risk include

foreign exchange forward contracts and foreign exchange swaps.

Our policy for managing foreign exchange translation risk relating to our net investment in foreign operations is to maintain a percentage

of net debt and foreign exchange forwards so as to provide an economic offset of our cash flows arising in the foreign currency. The

primary managed foreign exchange exposure arises from the dollar denominated assets and liabilities held by our US operations, with a

further small euro exposure in respect of a joint venture investment.

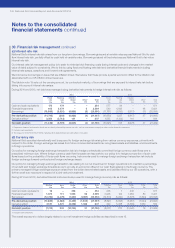

During 2014 and 2013, derivative financial instruments were used to manage foreign currency risk as follows:

2014 2013

Sterling

£m

Euro

£m

Dollar

£m

Other

£m

Total

£m

Sterling

£m

Euro

£m

Dollar

£m

Other

£m

Total

£m

Cash and cash equivalents 16 –338 –354 238 1432 –671

Financial investments 1,879 111 1,553 56 3,599 3,938 124 1,289 80 5,431

Borrowings1(12,780) (4,479) (7,33 0) (1,361) (25,950) (12,573) (5,220) (8,678) (1,624) (28,095)

Pre-derivative position (10,885) (4,368) (5,439) (1,305) (21,997) (8,397) (5,095) (6,957) (1,544) (21,993)

Derivative effect 3,137 4,670 (8,326) 1,326 807 320 5,368 (6,684) 1,560 564

Net debt position (7,74 8) 302 (13,765) 21 (21,190) (8,077) 273 (13,641) 16 (21,429)

1. Includes bank overdrafts.

The overall exposure to dollars largely relates to our net investment hedge activities as described in note 15.

Notes to the consolidated

financial statements continued

140 National Grid Annual Report and Accounts 2013/14