National Grid 2014 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

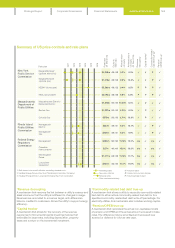

Rate plan

2011

2012

2013

2014

2015

2016

Rate base

(31 Mar 2014)

Equity to

debt ratio

Allowed return

onequity

Achieved return

onequity

(31 Dec 2013)

Revenue

decoupling†

Capital tracker‡

Commodity-related

bad debt true-up§

Pension/

OPEB true-up◊

New York

PublicService

Commission

Niagara Mohawk1

(upstate, electricity) $4,248m 48 : 52 9.3% 8.0% ✓ ✗ P✓

Niagara Mohawk

(upstate, gas) $1,013m 48 : 52 9.3% 10.3% ✓ ✗ P✓

KEDNY (downstate)2$2,390m 48 : 52 9.4% 9.5% P P P ✓

KEDLI (downstate)3$2,094m 45 : 55 9.8% 8.8% P P P ✓

Massachusetts

Department of

PublicUtilities

Massachusetts Electric/

Nantucket Electric $1,812m 50 : 50 10.35% 6.4% ✓P✓ ✓

Boston Gas $1,237m 50 : 50 9.75% 8.0% ✓P✓ ✓

Colonial Gas $278m 50 : 50 9.75% 10.8% ✓P✓ ✓

Rhode Island

Public Utilities

Commission

Narragansett

Electric $567m 49 : 51 9.5% 10.1% ✓ ✓ P✓

Narragansett

Gas $466m 49 : 51 9.5% 9.9% ✓ ✓ P✓

Federal Energy

Regulatory

Commission

Narragansett $499m 50 : 50 11.14% 12.0% n/a ✓n/a ✓

Canadian

Interconnector $27m 40 : 60 13.0% 13.0% n/a ✓n/a ✓

New England

Power $1,277m 65 : 35 11.14% 11.7% n/a ✓n/a ✓

Long Island

Generation $433m 46 : 54 10.0% 11.9% n/a ✓n/a ✓

1. Both transmission and distribution, excluding stranded costs.

2. KeySpan Energy Delivery New York (The Brooklyn Union Gas Company).

3. KeySpan Energy Delivery Long Island (KeySpan Gas East Corporation).

†Revenue decoupling

A mechanism that removes the link between a utility’s revenue and

sales volume so that the utility is indifferent to changes in usage.

Revenues are reconciled to a revenue target, with differences

billed or credited to customers. Allows the utility to support energy

efficiency.

‡Capital tracker

A mechanism that allows for the recovery of the revenue

requirement of incremental capital investment above that

embedded in base rates, including depreciation, property

taxesand a return on the incremental investment.

§Commodity-related bad debt true-up

A mechanism that allows a utility to reconcile commodity-related

bad debt to either actual commodity-related bad debt or to a

specified commodity-related bad debt write-off percentage. For

electricity utilities, this mechanism also includes working capital.

◊Pension/OPEB true-up

A mechanism that reconciles the actual non-capitalised costs

ofpension and OPEB and the actual amount recovered in base

rates. The difference may be amortised and recovered over

aperiod or deferred for a future rate case.

Summary of US price controls and rate plans

Rate filing made

New rates effective

Rate plan ends

Rates continue indefinitely

✓ Feature in place

✗ Feature not in current rate plan

P Feature partially in place

165