National Grid 2014 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

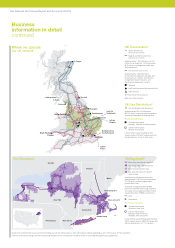

networks (upstate New York, New York City, Long Island,

Massachusetts (2), and Rhode Island). Distribution and

transmission electricity services in upstate New York are

recovered with a combined rate billed to end use customers.

InNew England, retail transmission rates recover wholesale

transmission charges assessed to our electric distribution

companies from our end use customers.

Our rate plans are designed to a specific allowed RoE, by

reference to an allowed operating expense level and rate base.

Some rate plans include earnings sharing mechanisms that allow

us to retain a proportion of the earnings above our allowed RoE

weachieve through improving efficiency, with the balance

benefiting customers.

In addition, our performance under certain rate plans is subject

toservice performance targets. We may be subject to monetary

penalties in cases where we do not meet those targets.

Allowed RoE in context

One measure used to monitor the performance of our regulated

businesses is a comparison of achieved RoE to allowed RoE,

witha target that the achieved should be equal to or above the

allowed. This measure cannot be used in isolation, however, as

there are anumber of factors that may prevent us from achieving

that target in any given year:

• Regulatory lag: in the years following the rate year, costs may

increase due to inflation or other factors. If the cost increases

cannot be offset by productivity gains, the total cost to deliver

will be higher as a proportion of revenue and therefore achieved

RoE will be lowered.

• Cost disallowances: a cost disallowance is a decision by the

regulator that a certain expense should not be recovered in

rates from customers. The regulator may do this for a variety of

reasons. We can respond to some disallowances by choosing

not to incur those costs; others may be unavoidable. As a result,

unless offsetting cost reductions can be found, the achieved

RoE will be lowered.

• Market conditions: if a utility files a new rate case, the new

allowed RoE may be below the current allowed RoE as financial

market conditions may have changed. As such, a utility that

appears to be underperforming the allowed RoE and files a new

rate case may not succeed in increasing revenues.

We work to increase achieved RoEs through: productivity

improvements; positive performance against incentives or earned

savings mechanisms such as energy efficiency programmes,

where available; and, through filing a new rate case when achieved

returns are lower than that which the Company could reasonably

expect to attain through a new rate case.

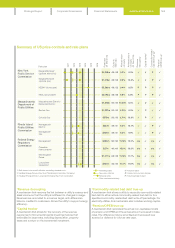

Features of our rate plans

We are responsible for billing our customers for their use of

electricity and gas services. Customer bills typically comprise

acommodity charge, covering the cost of the electricity or gas

delivered, and charges covering our delivery service. Depending

on the state, delivery rates are either based upon actual sales

volumes and costs incurred in an historical test year, or on

estimates of sales volumes and costs, and in both cases may

differ from actual amounts. A substantial proportion of our costs,

in particular electricity and gas purchases for supply to customers,

are pass-through costs, meaning they are fully recoverable from

our customers. These pass-through costs are recovered through

separate charges to customers that are designed to recover

thosecosts with no profit. Rates are adjusted from time to time

toensure any over- or under-recovery of these costs is returned to,

or recovered from, our customers. There can be timing differences

between costs being incurred and rates being adjusted.

Revenue for our wholesale transmission businesses in New

England and New York is collected from wholesale transmission

customers, who are typically other utilities and include our own

New England electricity distribution businesses. With the

exception of upstate New York, which continues to combine retail

transmission and distribution rates to end use customers, these

wholesale transmission costs are incurred by distribution utilities

on behalf of their customers and are fully recovered as a pass-

through from end use customers as approved by each state

commission. Our Long Island generation plants sell capacity to

LIPA under a power supply agreement, approved by FERC, which

provides a similar economic effect to cost of service rate regulation.

US regulatory filings

The objectives of our rate case filings are to ensure we have the

right cost of service with the ability to earn a fair and reasonable

rate of return, while providing a safe and reliable service to our

customers. In order to achieve these objectives and to reduce

regulatory lag, we have been requesting structural changes,

suchas revenue decoupling mechanisms, capital trackers,

commodity-related bad debt true-ups, and pension and other

post-employment benefit (OPEB) true-ups, separately from base

rates. These terms are explained below the table on page 165.

Below we summarise significant developments in rate filings and

the regulatory environment during the year.

Massachusetts

Capital investment programmes

Our Massachusetts gas and electricity operating companies

haverate mechanisms that allow for the recovery of new capital

investment, including a return, outside of base rate proceedings,

subject to further review and reconciliation. Most recently, on the

gas side, MADPU allowed approximately $11.6 million into rates

effective from 1 November 2013, related to incremental additions

to the rate base, and on the electricity side it allowed approximately

$8.8 million into rates effective from 1 March 2014, related to rate

base additions.

Storm fund recovery

The Massachusetts electricity business collects $4.3 million per

year in base rates to credit towards a storm fund devoted to

funding storm restoration. The severity and frequency of storms

inMassachusetts over the last few years left our storm fund in

adeficit position of approximately $212 million. On 3 May 2013,

MADPU allowed us to begin collecting $40 million per year for

three years towards the replenishment of the storm fund, subject

to a review of the prudency of the underlying costs. That review is

under way. The funding of the remaining deficit will be addressed

as part of the prudency review and in future rate proceedings.

Storm management audit

The MADPU’s December 2012 order regarding our performance

during Tropical Storm Irene and the October 2011 snowstorm

requires us to undergo an independent audit regarding our storm

management. This audit is under way, addressing: emergency

management systems, protocols and plans; preparation for and

management of restoration efforts with respect to emergency

events; the Company’s emergency response resources and

allocation of those resources during an emergency event;

communications with state, municipal and public safety officials

and with the DPU; dissemination of timely information to the

public; and identification of management recommendations.

163