National Grid 2014 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

15. Derivative financial instruments continued

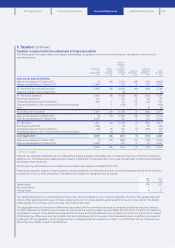

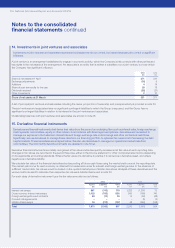

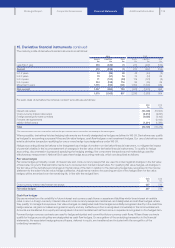

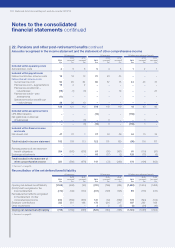

The maturity profile of derivative financial instruments is as follows:

2014 2013

Assets

£m

Liabilities

£m

Total

£m

Assets

£m

Liabilities

£m

Total

£m

Less than 1 year 413 (339) 74 273 (407) (134)

Current 413 (339) 74 273 (407) (134)

In 1-2 years 54 (26) 28 42 (44) (2)

In 2-3 years 73 (57) 16 75 (51) 24

In 3-4 years 71 (103) (32) 119 (121) (2)

In 4-5 years 244 (128) 116 84 (55) 29

More than 5 years 1,115 (510) 605 1,652 (1,003) 649

Non-current 1,557 (824) 733 1,972 (1,274) 698

1,970 (1,163) 807 2,245 (1,681) 564

For each class of derivative the notional contract* amounts are as follows:

2014

£m

2013

£m

Interest rate swaps (15,406) (16,603)

Cross-currency interest rate swaps (8,614) (9,641)

Foreign exchange forward contracts (4,698) (3,142)

Forward rate agreements –(2,443)

Inflation linked swaps (1,391) (1,390)

Total (30,109) (33,219)

*The notional contract amounts of derivatives indicate the gross nominal value of transactions outstanding at the reporting date.

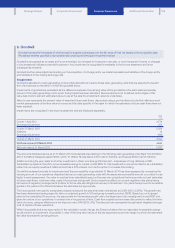

Where possible, derivatives held as hedging instruments are formally designated as hedges as defined in IAS 39. Derivatives may qualify

as hedges for accounting purposes if they are fair value hedges, cash flow hedges or net investment hedges. Our use of derivatives may

entail a derivative transaction qualifying for one or more hedge type designations under IAS 39.

Hedge accounting allows derivatives to be designated as a hedge of another non-derivative financial instrument, to mitigate the impact

of potential volatility in the income statement of changes in the fair value of the derivative financial instruments. To qualify for hedge

accounting, documentation is prepared specifying the hedging strategy, the component transactions and methodology used for

effectiveness measurement. National Grid uses three hedge accounting methods, which are described as follows:

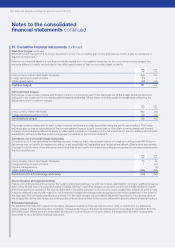

Fair value hedges

Fair value hedges principally consist of interest rate and cross-currency swaps that are used to protect against changes in the fair value

of fixed-rate, long-term financial instruments due to movements in market interest rates. For qualifying fair value hedges, all changes in

the fair value of the derivative and changes in the fair value of the item in relation to the risk being hedged are recognised in the income

statement to the extent the fair value hedge is effective. Adjustments made to the carrying amount of the hedged item for fair value

hedges will be amortised over the remaining life, in line with the hedged item.

2014

£m

2013

£m

Cross-currency interest rate/interest rate swaps 367 732

Fair value hedges 367 732

Cash flow hedges

Exposure arises from the variability in future interest and currency cash flows on assets and liabilities which bear interest at variable

ratesor are in a foreign currency. Interest rate and cross-currency swaps are maintained, and designated as cash flow hedges, where

they qualify, to manage this exposure. Fair value changes on designated cash flow hedges are initially recognised directly in the cash flow

hedge reserve, as gains or losses recognised in equity and any ineffective portion is recognised immediately in the income statement.

Amounts are transferred from equity and recognised in the income statement as the income or expense is recognised on the hedged item.

Forward foreign currency contracts are used to hedge anticipated and committed future currency cash flows. Where these contracts

qualify for hedge accounting they are designated as cash flow hedges. On recognition of the underlying transaction in the financial

statements, the associated hedge gains and losses, deferred in equity, are transferred and included with the recognition of the

underlying transaction.

115