National Grid 2014 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

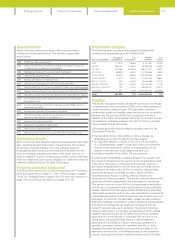

US Regulated

Our US Regulated business was affected by a reduction in timing

differences of £37 million due to in year under-recoveries of

£20million compared with a prior year over-recovery of £17 million

(after adjusting for foreign exchange movements).

The estimated closing over-recovered value at 31 March 2013

was£110 million. This was offset by a year-on-year reduction

inmajor storm costs of £33 million, as the financial impact of

Superstorm Sandy and Storm Nemo was lower than that from

Hurricane Irene and the Massachusetts October snowstorm

in2011/12.

Net costs incurred in the US after insurance proceeds were

£33million lower than 2011/12 (after adjusting for foreign

exchangemovements).

An increase of £135 million in net regulated income reflects deferral

recoveries in our upstate New York businesses together with

higher revenues from our capital tracker regulatory arrangements.

Regulated controllable operating costs increased by £19 million

reflecting inflation and higher spend on IS outsourcing and

security. Post-retirement costs increased by £29 million primarily

due to reductions in discount rates. Bad debt expense reduced by

£33 million in the year due to improving economic conditions and

improved collections.

Depreciation and amortisation increased by £17 million as a result

of our capital expenditure programme in the year. Finally, other

costs increased by £58 million due to increased property tax rates

and assessed values, together with higher environmental costs in

2012/13. As a result, adjusted operating profit for the year was

£1,254 million.

Other activities

Our Other activities were significantly affected by the cost of major

storms in the year, with an additional £51 million cost incurred

compared with the prior year. This was as a result of insurance

costs for Superstorm Sandy incurred in our insurance captive.

Some of these costs are expected to be recovered from the

reinsurance market.

Our metering business made £24 million lower operating profit

than the prior year as a result of the disposal of OnStream in 2012,

together with the impact of third-party disputes on legacy meter

pricing in our regulated metering business.

Other costs increased by £126 million, primarily representing

spend on the implementation of the new US information systems

and financial procedures, offset by increased revenues from the

French interconnector. As a result of these movements, Other

activities recorded an adjusted operating profit of £11 million for

theyear.

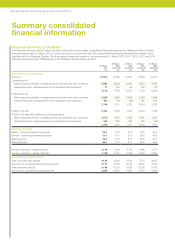

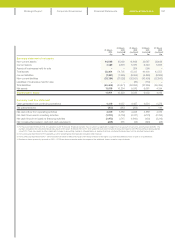

Analysis of the adjusted operating profit by

segment for the year ended 31 March 2013

UK Electricity Transmission

Net regulated revenue increased by £235 million due to an increase

in regulated revenues under UK price control allowances partly

offset by a £10 million increase in charges under the balancing

services incentive scheme. Timing increased by £67 million, with

inyear over-recovery of £29 million compared with a prior year

under-recovery of £38 million.

Our controllable costs increased by £8 million driven by inflation,

recruitment and training costs associated with our capital

investment programme and increases in contribution rates for

ourDB pension schemes.

Depreciation and amortisation increased by £42 million as a result

ofhigher asset values due to our capital investment programme.

UK Gas Transmission

Gas Transmission net regulated revenue increased by £112 million

driven by increased price control revenues partly offset by lower

incentive scheme performance and reduced auction revenues in

our LNG storage business. There was no year-on-year timing

movement due to an in year over-recovery of £17 million compared

with a £17 million over-recovery in 2012/13.

Controllable costs increased by £21 million driven by inflation,

anincrease in our environmental provisions and increases in

contribution rates for our DB pension schemes.

Depreciation and amortisation increased by £16 million due to an

increase in the underlying asset base and some one-time asset

write-offs.

UK Gas Distribution

Net regulated revenue increased by £85 million driven by our

regulatory RPI-X pricing formula and improved performance under

incentive programmes. Timing reduced adjusted operating profit

by £32 million driven by in year under-recoveries of £10 million

compared with an over-recovery in the prior year of £22 million.

The estimated closing under-recovered value at 31 March 2013

was£8 million.

Regulated controllable costs increased by £13 million due to:

inflation, system maintenance costs and one-off contract strategy

costs, partially offset by efficiencies enabled by our new front

office systems. Post-retirement costs increased by £2 million as a

result of increased contribution rates for our DB pension schemes.

Depreciation and amortisation increased by £10 million driven

byhigher average asset values due to the capital investment

programme and new front office systems. Finally, other costs

decreased by £3 million, resulting in an adjusted operating profit

of£794 million for the year.

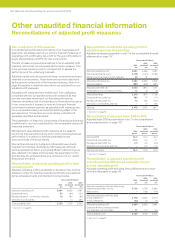

Other unaudited

financial information

continued

184 National Grid Annual Report and Accounts 2013/14