National Grid 2014 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

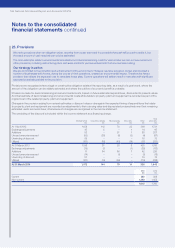

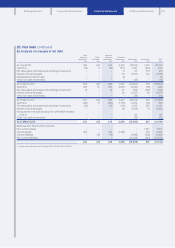

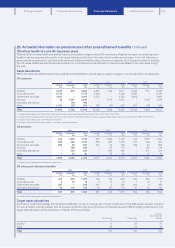

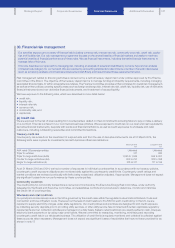

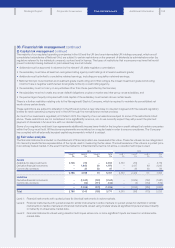

29. Actuarial information on pensions and other post-retirement benefits continued

Actuarial assumptions

The Company has applied the following financial assumptions in assessing DB liabilities:

UK pensions US pensions US other post-retirement benefits

2014

%

2013

%

2012

%

2014

%

2013

%

2012

%

2014

%

2013

%

2012

%

Discount rate14.3 4.3 4.8 4.8 4.7 5.1 4.8 4.7 5.1

Rate of increase in salaries23.6 4.1 4.0 3.5 3.5 3.5 3.5 3.5 3.5

Rate of increase in RPI33.3 3.4 3.2 n/a n/a n/a n/a n/a n/a

Initial healthcare cost trend rate n/a n/a n/a n/a n/a n/a 8.0 8.0 8.0

Ultimate healthcare cost trend rate n/a n/a n/a n/a n/a n/a 5.0 5.0 5.0

1. The discount rates for pension liabilities have been determined by reference to appropriate yields on high-quality corporate bonds prevailing in the UK and US debt markets at the

reportingdate.

2. A promotional scale has also been used where appropriate. The UK assumption stated is that relating to service prior to 1 April 2013. The UK assumption for the rate of increase in salaries

forservice after this date is 2.5%.

3. This is the key assumption that determines assumed increases in pensions in payment and deferment in the UK only. The assumptions for the UK were 3.3% (2013: 3.4%; 2012: 3.2%) for

increases in pensions in payment and 3.3% (2013: 3.4%; 2012: 3.2%) for increases in pensions in deferment.

2014 2013 2012

UK

years

US

years

UK

years

US

years

UK

years

US

years

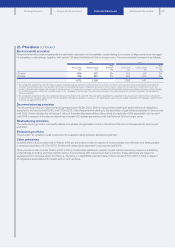

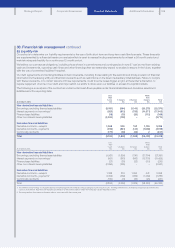

Assumed life expectations for a retiree age 65

Today

Males 22.9 20.6 22.7 19.5 22.5 19.4

Females 25.4 22.9 25.2 21.4 25.0 21.3

In 20 years

Males 25.2 22.8 25.0 21.0 24.9 20.9

Females 27.8 24.7 27.6 22.2 27.5 22.2

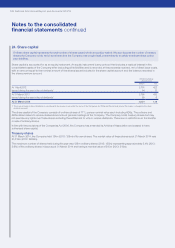

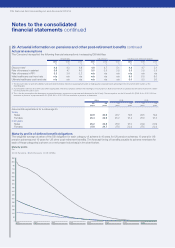

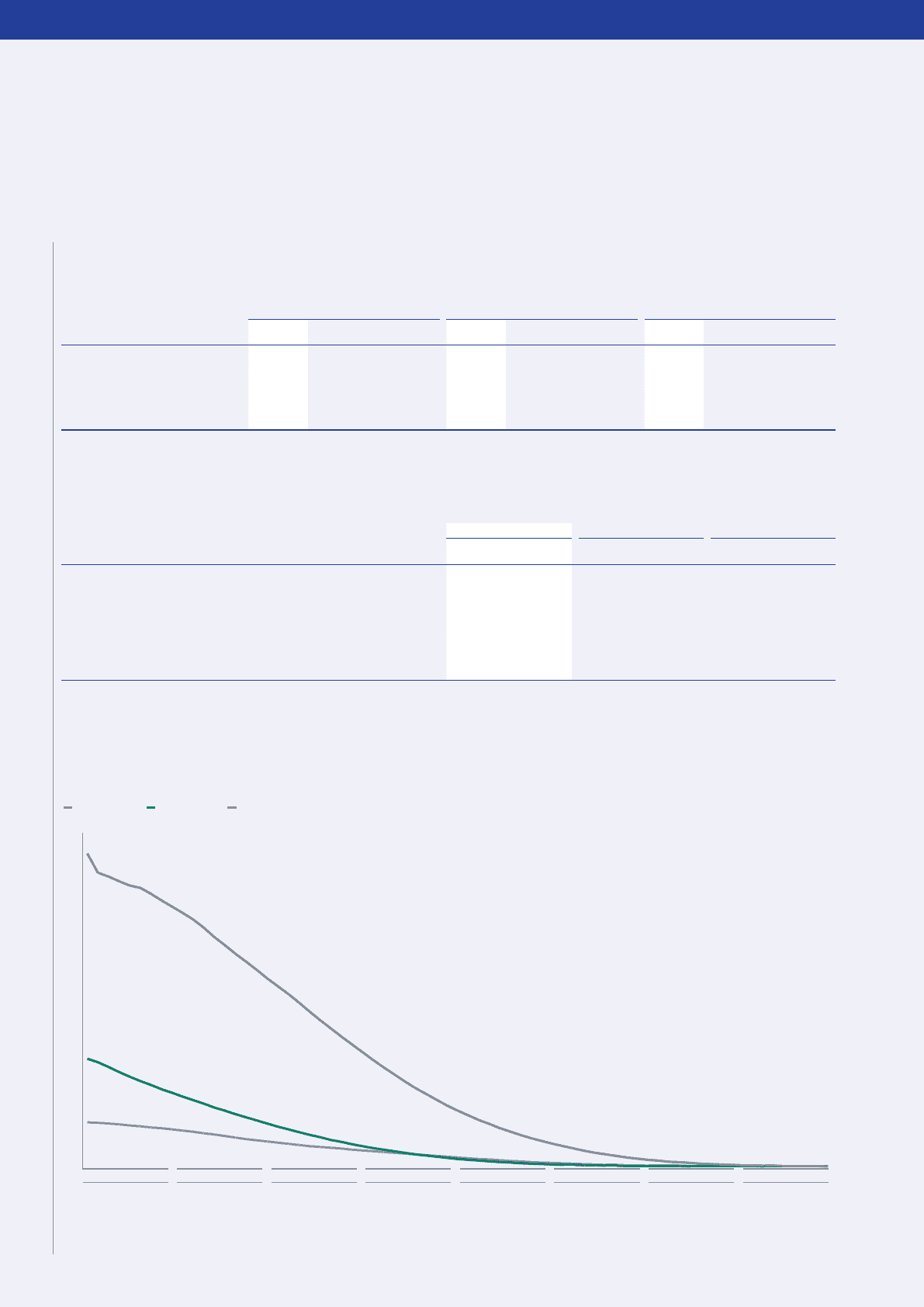

Maturity profile of defined benefit obligations

The weighted average duration of the DB obligation for each category of scheme is 16 years for UK pension schemes; 13 years for US

pension schemes and 15 years for US other post-retirement benefits. The forecast timing of benefits payable to scheme members for

each of these categories is shown on a net present value basis in the chart below.

UK Pensions US Pensions US OPEBs

0

50

100

150

200

250

300

350

500

450

550

400

750

800

700

650

600

850

2015 2025 2035 2045 2055 2065 2075 2085

Maturity profile

£m

Notes to the consolidated

financial statements continued

136 National Grid Annual Report and Accounts 2013/14