National Grid 2014 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

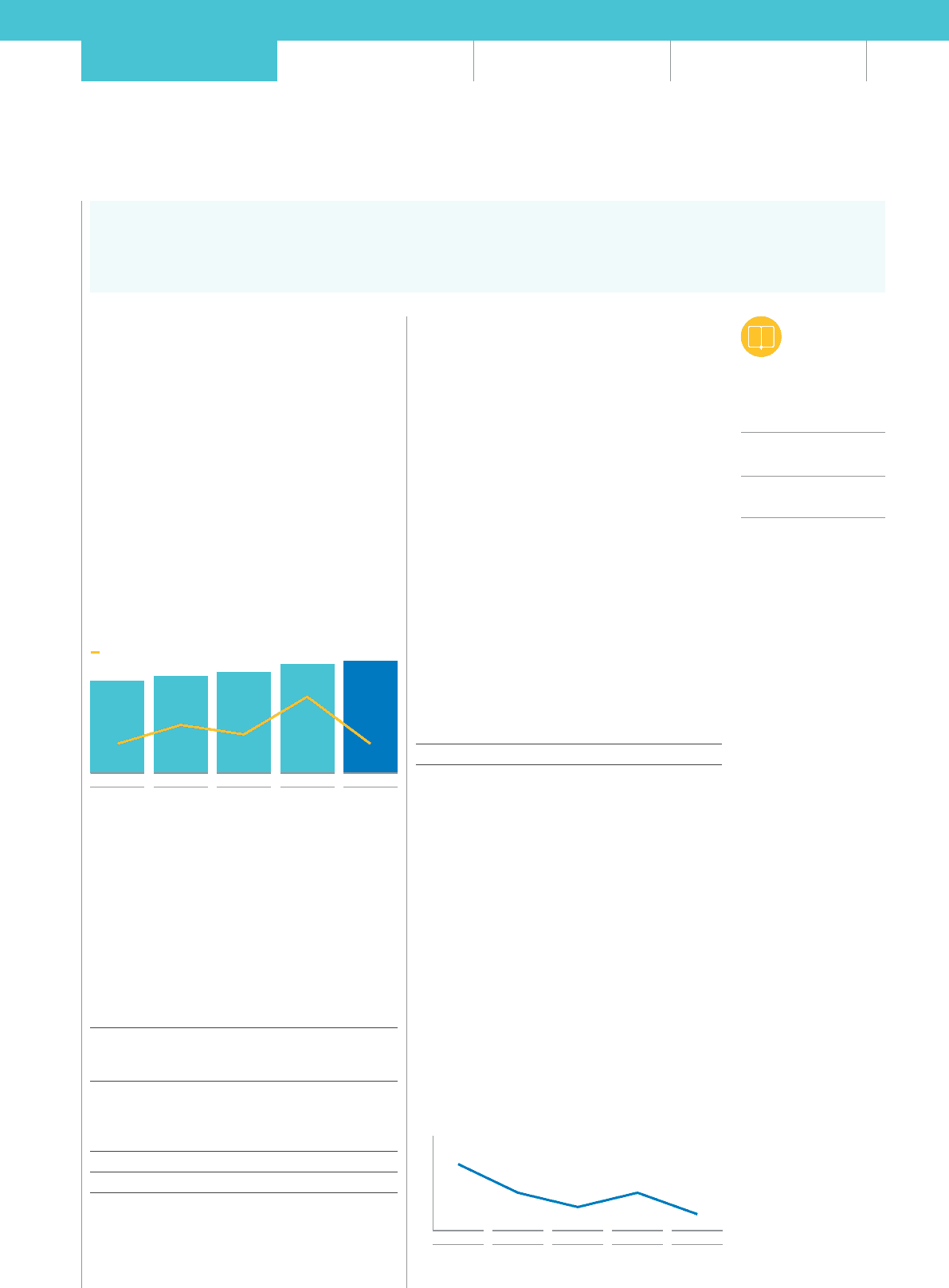

Regulated asset growth

Our regulated assets have increased by 3%

(£1billion) to £34.7 billion, reflecting the continued

high levels of investment in our networks in both

theUK and US. Maintaining efficient growth in our

regulated assets ensures we are well positioned to

continue providing consistently high levels of service

to our customers and increases our revenue

allowances in future years.

The UK regulatory asset value (RAV) increased by

£1.1 billion, reflecting inflation and significant capital

expenditure in our UKElectricity Transmission

business in particular. The US rate base decreased

by £0.1 billion. Foreign exchange movements

decreased the rate base reported in sterling by

£0.9billion. Offsetting this, investment in the networks

and working capital movements increased rate base

by £0.8 billion.

Total regulated assets andregulated asset growth

£bn

28.6129.9131.2 33.7 34.72

2010 2011 2012 2013 2014

5%

4%

8%

3%

3%

Regulated asset growth

1. US rate base calculated as at 31 December for these years.

2. Estimated figure until the conclusion of the regulatory reporting cycle.

Value added

Our dividend is an important part of our returns to

shareholders along with growth in the value of the

asset base attributable to equity investors. These

are reflected in the value added metric that will

underpin our approach to sustainable decision

making and long-term incentive arrangements.

Overall value added in the year was £2.1 billion or

57.2p per share as set out below:

Year ended 31 March Change

£bn at constant currency 2014 2013 £bn

UK regulated assets125.2 24.3 +0.9

US regulated assets211. 2 10.3 +0.9

Other invested capital 1.7 1.5 +0.2

Total assets 38.1 36.1 +2.0

Dividend paid +1.1

Movement in goodwill –

Net debt (21.2) (20.2) -1.0

Value added +2.1

Value added per share 57. 2p

1. Consists of regulated asset values and other regulatory assets and

liabilities of the UK businesses regulated under RIIO price controls.

2. US regulated assets increased from $17.2 billion to $18.7 billion in the

year. These represent rate base plus assets outside of rate base,

including working capital.

The Board is confident that growth in assets,

earnings and cash flows, supported by improving

cash efficiency and an exposure to attractive

regulatory markets, should help the Group to

maintain strong, stable credit ratings and a

consistent prudent level of gearing, while delivering

attractive returns for shareholders.

Other performance measures

Dividend growth

During the year we generated £1.3 billion of

sustainable business net cash flow after our capital

expenditure programmes. This has enabled the

growth of the dividend in line with RPI, being 2.9%

(2012/13: dividend growth of 4%), taking into account

the recommended final dividend of 27.54p.

The high level of take-up of this scrip option in the

last couple of years has led to concerns about the

potential dilutive effect on value of this option. This

meant that we decided not to offer the scrip element

for the 2013/14 interim dividend paid in January this

year, as our forecast capital programme was already

fully funded. We continue tooffer the scrip option for

the year-end dividend.

Year ended 31 March

%2014 2013 2012

Dividend growth 3 4 8

Cash generated from operations

Cash generated from operations was £4,419 million

(2012/13: £4,037 million). Adjusted operating profit

before depreciation, amortisation and impairment

was £81million higher year on year. Changes in

working capital improved by £351million over the

prior year, principally in the US due to the timing of

receivables from LIPA relating to Superstorm Sandy,

higher commodity costs and weather differences

year on year. Partially offsetting these improvements,

cash outflows relating to exceptional items were

£38million higher due to reorganisation in the UK

and LIPA MSA transition costs in the US.

UK regulated return on equity

The UK RoE has decreased 90bps to 12.7%,

reflecting the new regulatory arrangements under

the RIIO framework in place from this year. This

performance represents 260bps outperformance

over allowed returns.

UK return on equity

%

12

14

16

2009/10 2010/11 2011/12 2012/13 2013/14

14.8

13.6

13.0

13.6

12.7

We have changed the way we present our financial information in the Strategic Report to remove duplication. As a result, the analysis

here focuses on our KPIs and other performance measures we use to monitor our business performance. Analysis of our financial

performance and position at 31 March 2014, including the performance of our principal operations, has been relocated to the financial

statements, however this analysis still forms part of our Strategic Report financial review. See page 75 for further information. See

pages 183 to 185 for commentary on our financial performance and position for the year ended 31 March 2013 compared with 2012.

How we make

moneyfrom our

regulated assets

page 20

UK regulation

pages 160 – 162

US regulation

pages 162 – 165

07