National Grid 2014 Annual Report Download - page 150

Download and view the complete annual report

Please find page 150 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

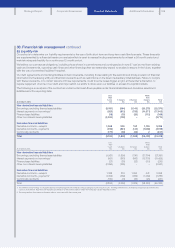

33. Sensitivities on areas of estimation and uncertainty continued

Pensions and other post-retirement benefits assumptions

Sensitivities have been prepared to show how the DB obligations and annual service costs could potentially be impacted bychanges

inthe relevant actuarial assumptions that were reasonably possible as at 31 March 2014. In preparing sensitivities the potential impact

has been calculated by applying the change to each assumption in isolation and assuming all other assumptions remainunchanged.

This is with the exception of RPI in the UK where the corresponding effect on pensions in payment, pensions in deferment and resultant

increases in salary are recognised.

Following the adoption of IAS 19 (revised) the pension sensitivities have been reviewed. The rate of change has been amended in respect

of the impact of discount rate, and life expectancy is now shown as at age 65 (as opposed to age 60). A new sensitivity has been

introduced for the impact of UK RPI. The impacts of salaries and US healthcare trend rates remain unchanged. Comparatives for each

sensitivity have been presented on a consistent basis. The introduction of a new assumption in the UK for increases in salary for service

from 1 April 2013 is reflected in the sensitivity analysis.

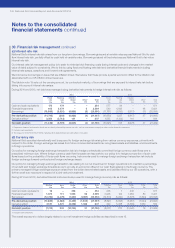

Financial instruments assumptions

Our financial instruments are sensitive to changes in market variables, being UK and US interest rates, the UK RPI and the dollar to

sterling exchange rate. The changes in market variables affect the valuation of our borrowings, deposits, derivative financial instruments

and commodity contracts. The analysis illustrates the sensitivity of our financial instruments to the changes in market variables.

The following main assumptions were made in calculating the sensitivity analysis:

• the amount of net debt, the ratio of fixed to floating interest rates of the debt and derivatives portfolio, and the proportion of

financialinstruments in foreign currencies are all constant and on the basis of the hedge designations in place at 31 March 2014

and2013 respectively;

• the statement of financial position sensitivity to interest rates relates only to derivative financial instruments and available-for-sale

investments, as debt and other deposits are carried at amortised cost and so their carrying value does not change as interest

ratesmove;

• the sensitivity of accrued interest to movements in interest rates is calculated on net floating-rate exposures on debt, deposits

andderivative instruments;

• changes in the carrying value of derivatives from movements in interest rates of designated cash flow hedges are assumed

toberecorded fully within equity; and

• changes in the carrying value of derivative financial instruments designated as net investment hedges from movements in interest

rates are recorded in the income statement as they are designated using the spot rather than the forward translation method.

Theimpact of movements in the dollar to sterling exchange rate are recorded directly in equity.

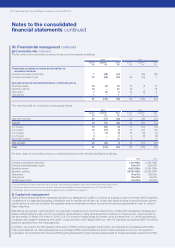

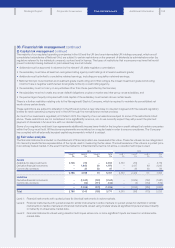

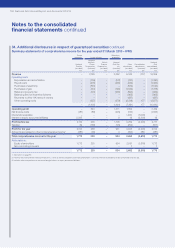

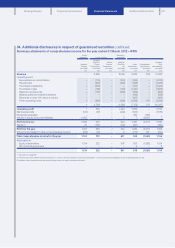

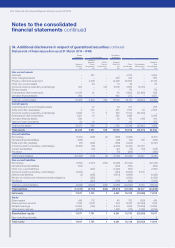

34. Additional disclosures in respect of guaranteed securities

We have three debt issuances (including preferred shares) that are listed on a US national securities exchange and are guaranteed

byother companies in the Group. These guarantors commit to honour any liabilities should the company issuing the debt have any

financial difficulties. In order to provide debt holders with information on the financial stability of the companies providing the guarantees,

we are required to disclose individual financial information for these companies. We have chosen to include this information in the

Group financial statements rather than submitting separate stand-alone financial statements.

The following condensed consolidating financial information, comprising statements of comprehensive income, statements of financial

position and cash flow statements, is given in respect of National Grid Gas plc (subsidiary guarantor), which became joint full and

unconditional guarantor on 11 May 2004 with National Grid plc (parent guarantor) of the 6.625% Guaranteed Notes due 2018 issued in

June 1998 by British Transco Finance Inc., then known as British Gas Finance Inc. (issuer of notes). Condensed consolidating financial

information is also provided in respect of Niagara Mohawk Power Corporation as a result of National Grid plc’s guarantee, dated

29October 2007, of Niagara Mohawk’s 3.6% and 3.9% issued preferred shares. National Grid Gas plc, British Transco Finance Inc.,

andNiagara Mohawk Power Corporation are wholly-owned subsidiaries of National Grid plc.

The following financial information for National Grid plc, National Grid Gas plc, British Transco Finance Inc., and Niagara Mohawk Power

Corporation on a condensed consolidating basis is intended to provide investors with meaningful and comparable financial information

and is provided pursuant to various rules including Rule 3-10 of Regulation S-X in lieu of the separate financial statements of each

subsidiary issuer of public debt securities.

This financial information should be read in conjunction with the other disclosures in these financial statements.

Notes to the consolidated

financial statements continued

148 National Grid Annual Report and Accounts 2013/14