National Grid 2014 Annual Report Download - page 166

Download and view the complete annual report

Please find page 166 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

increases. The A&RPSA allows both parties a RoE reopener in

contract years four to six depending on financial market changes,

and National Grid a one-time rate reopener in contract year six.

The A&RPSA also contains new options for modernising the

power plants through retirement or repowering existing facilities

toreduce energy costs and improve environmental performance.

Rhode Island

Rhode Island 2014/15 electricity and gas infrastructure,

safety,and reliability plans (ISR)

Legislation provides our Rhode Island gas and electricity operating

divisions with rate mechanisms that allow for recovery of capital

investment, including a return, outside of base rate proceedings

through the submission of annual ISR plans.

The electricity plan includes electricity operation expenses

forvegetation management and certain inspection and

maintenance costs.

In December 2013, we filed annual petitions seeking approval

ofour 2014/15 ISR plans for the electricity and gas systems.

ThePUC approved the petitions in March 2014.

The electricity ISR plan encompasses a $74.3 million spending

programme for capital investment and $10.7 million for operating

and maintenance expenses for vegetation management and

inspection and maintenance.

The gas ISR plan encompasses a $71.7 million spending for

capital investment and, for the first time, incremental operation

andmaintenance expense for the hiring, training and supervision

of additional personnel to support increases in leak-prone

pipereplacement.

FERC

Complaint on transmission allowed RoE

In September 2011 and December 2012, complaints were filed

withFERC against certain transmission owners, including our

NewEngland transmission business, to lower the base RoE

fromthe FERC approved rate of 11.14% to 9.2% and 8.7%

respectively. Thetransmission owners argued that the

complainants have not proven the existing rate is unjust and

unreasonable and that the 11.14% base RoE should remain in

effect. Non-binding preliminary findings by a FERC administrative

law judge, suggested a 10.6% base RoE for a 15 month refund

and a 9.7% base RoE prospectively.

Short-term borrowing extension

In October 2013, National Grid filed an application with FERC

onbehalf of its electricity public utility subsidiaries seeking an

extension of the Commission’s prior authorisation to issue

short-term debt, as required by Section 204 of the Federal Power

Act. National Grid explained in its extension request that challenges

associated with the implementation of the US enterprise resource

system had delayed the production of certain FERC financial

reports that are required in any Section 204 filing. FERC denied

the extension request on the grounds that the lack of current

FERC financial reports rendered the Commission unable to make

the required findings under Section 204 as to the Company’s

ability to perform certain public utility functions. As a result,

National Grid implemented a contingency plan aimed at ensuring

that each impacted public utility subsidiary would have sufficient

cash resources pending a new short-term borrowing authorisation.

This contingency plan included the receipt of open account

advances and/or capital contributions permitted under the existing

FERC borrowing authorisation. National Grid intends to file its

Section 204 renewal applications as soon as practicable this year.

New York

Upstate New York 2012 rate plan ling

Effective from 1 April 2013, the upstate New York electricity and

gas businesses began the first year of their new three year rate

plan. The new rate plan provides an increase in electricity delivery

revenue of $43.4 million, $51.4 million and $28.3 million for rate

years one to three respectively. For the gas operations, the rate

plan provides a decrease in delivery revenue of $3.3 million in rate

year one and an increase of $5.9 million and $6.3 million in rate

years two and three respectively. The revenue requirements for

Niagara Mohawk’s electricity and gas businesses are based on

aRoE of 9.3%, which includes a stay out premium for the three

year term, and a capital structure that includes a 48% common

equity component. The final agreement also includes annual

reconciliation mechanisms for certain non-controllable costs.

Downstate New York rate plan extension

In 2013, The Brooklyn Union Gas Company (also known as

KeySpan Energy Delivery New York or KEDNY) received approval

from the PSC to extend its existing five year rate plan by two years.

The extension provides a 9.4% RoE, with a 48% equity structure.

Under the agreement, 80% of any earnings over 9.4% will fund

recovery of prior environmental deferrals with the remaining 20%

being retained by KEDNY. The agreement increased capital

expenditure allowances to $320.1 million in 2013 and $293.7million

in 2014 as compared with the prior capital allowances of

$155.4million per year. The agreement also proposed updates

tovarious customer service and other performance metrics.

2013 New York gas management audit

On 13 February 2013, the PSC announced a comprehensive

management and operations audit of National Grid’s three New

York gas distribution utilities. New York law requires periodic

management audits of all utilities at least once every five years.

Welast underwent a management audit in 2009 when the PSC

audited Niagara Mohawk’s electricity business.

The final report is expected to be filed with the PSC this summer.

The report will make recommendations regarding the operation

and management of our New York gas utilities, and will specify

costs and savings associated with each recommendation. In our

next major gas rate proceeding, the Commission will consider our

effectiveness in implementing the audit recommendations and

seek to reflect the costs and savings associated with the

recommendations in rates.

Long Island

LIPA Amended and Restated Power Supply Agreement

(A&RPSA)

We own and manage a number of power plants on Long Island,

with a generation capacity of 3.8 GW. We supply wholesale

capacity and energy to LIPA under an agreement with LIPA that

was renewed in May 2013. LIPA in turn provides retail electricity

tocommunities and businesses on Long Island.

On 23 May 2013, FERC approved the A&RPSA which expires on

30 April 2028 and replaces the original Power Supply Agreement

that was effective from May of 1998 to May of 2013. LIPA may

terminate the agreement as early as 30 April 2025 upon two years’

advance notice. The A&RPSA became effective on 28 May 2013.

The agreement resulted in a rate decrease of $27.4 million

annuallycompared with the rate in effect for the final year of the

previous PSA. The agreement sets a RoE of 9.75% and a capital

structure with an equity component of 50%. The A&RPSA

continues certain annual rate adjustments, such as pension and

other post-retirement benefit expenses, property tax true-up,

adjustments for new plant in service, and certain inflationary

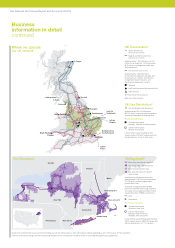

Business

information in detail

continued

164 National Grid Annual Report and Accounts 2013/14