National Grid 2014 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

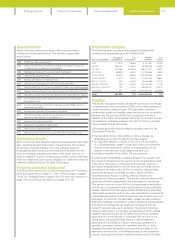

Analysis of the income statement for

theyears ended 31 March 2013 and

31March 2012

Revenue

Revenue for the year ended 31 March 2013 increased by

£527million to £14,359 million driven by the UK ET business,

which increased by £300 million principally due to inflationary

increases inallowable revenue and higher pass-through costs.

The UK GD segment also delivered an additional £114 million

primarily for the same reason. Finally, USRegulated revenue was

£123 million higher due to the recoveryof Niagara Mohawk

deferral revenues and higher FERCrate bases.

For the year ended 31 March 2012, revenue decreased £511 million

compared with the year ended 31 March 2011 to £13,832 million.

Increased UK ET revenue of £275 million under the regulatory

RPI-X pricing formula was offset by reduced US revenues as a

result of warmer winter weather leading to lower gas and electricity

volumes supplied.

Operating costs

Operating costs for the year ended 31 March 2013 of £10,610 million

were £313 million (3%) higher than prior year. The increase in costs

was predominantly due to increases in pass-through costs due

tothe colder winter in the US and inflationary increases in our

controllable costs. Additional costs of £91 million were incurred

inthe stabilisation of our new US enterprise resource system.

Exceptional items included in operating profit of £110 million in

2012/13 consisted of restructuring costs of £87 million, less a gain

on sale of our EnergyNorth gas business and Granite State

electricity business in New Hampshire of £3 million. There were

also gains of £180 million on commodity contract remeasurements.

Operating costs for the year ended 31 March 2012 of £10,297 million

were £320 million (3%) lower than the prior year. This was primarily

due to adverse timing differences of £256 million and higher storm

costs in the US of £116 million due to Tropical Storm Irene and the

October snowstorm in Massachusetts. Other operating costs

were relatively flat year on year, reflecting reduced costs in our US

Regulated segment as a result of the restructuring, offset by higher

costs within the UK due to inflation and additional employment

costs to support both the GDFO system implementation in our UK

GD business and the ongoing increase in our capital investment

programme in UK ET.

Exceptional items included in operating profit of £44 million in

2011/12 consisted of restructuring charges of £101 million,

environmental charges of £55 million, impairment charges of

£64million and commodity contract remeasurements of £94 million.

These were offset by net gains on disposals of subsidiaries of

£97million and stranded cost recoveries of £260 million.

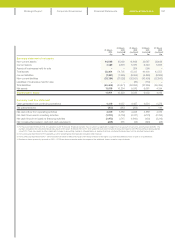

In 2012/13, two major storms in the US, Superstorm Sandy and

Storm Nemo, had a material effect on the results of National Grid.

These two major storms reduced operating profit by £136 million.

In 2011/12, results were also affected by two major storm events,

Tropical Storm Irene and the October snowstorm in Massachusetts,

which reduced operating profit by £116 million. Adjusted operating

profit excluding the impact of timing differences and major storms

was £3,759 million in 2012/13 (2011/12: £3,589 million). Operating

profit including the impact of timing differences and major storms

was £3,869 million in 2012/13 (2011/12: £3,633 million).

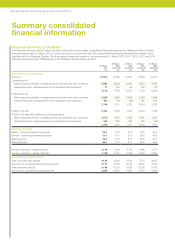

Total finance costs

Total finance costs for the year ended 31 March 2013 were slightly

down compared with 2012 at £1,086 million, due to the reduction

in the cost of our index-linked debt, offset by the cost of carrying

higher debt levels and loss on disposal of financial instruments.

For the year ended 31 March 2012, total finance costs were

£1,188million, down 11% on the prior year primarily due to lower

interest rates on short-term instruments; lower debt repurchase

costs that had peaked in the prior year due to the use of surplus

funds from the rights issue; the benefit of lower average net debt

as a result of those buy backs; and a favourable variance in

pension interest primarily due to a higher than expected rate

ofreturn on US pension assets.

Financial remeasurements relate to net gains and losses on

derivative financial instruments. The year ended 31 March 2013

included a gain of £68 million (2011/12: £70 million loss).

Taxation

For the year ended 31 March 2013, our adjusted tax charge

was£78 million lower than 2011/12, mainly due to changes in

taxprovisions in respect of prior years and a 2% decrease in

theUK statutory corporation tax rate in the year, partially offset

byincreased taxes on higher taxable profits. As a result of this,

oureffective tax rate for 2012/13 was 24.4% (2011/12: 28.9%).

The 2011/12 effective tax rate before exceptional items,

remeasurements and stranded cost recoveries did not change

from 2010/11 because a fall in prior period tax credits was offset,

primarily by a 2% reduction in the UK corporation tax rate and a

change in the UK/US profit mix where higher UK profits were

taxed at UK tax rates, which are lower than those in the US.

Exceptional tax from 2012/13 included an exceptional deferred tax

credit of £128 million arising from a reduction in the UK corporation

tax rate from 24% to 23% applicable from 1 April 2013. A similar

reduction in the UK corporation tax rate in 2011/12 from 26% to

24% resulted in a deferred tax credit of £242 million.

Adjusted earnings and EPS

As a result of the variances described above, adjusted earnings

forthe year ended 31 March 2013 was £1,913 million. For the year

ended 31 March 2012, adjusted earnings was £1,709 million.

The above earnings performance translated into adjusted

EPSgrowth in 2012/13 of 5.4 pence (12%). For the year ended

31March 2012, adjusted EPS growth was 0.6 pence (1%).

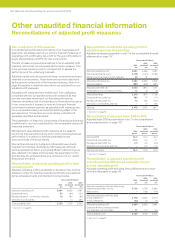

Commentary on consolidated financial statements

fortheyear ended 31 March 2013

In compliance with SEC rules, we present a summarised analysis of movements in the income statement, an analysis of movements

in adjusted operating profit by operating segment and a summarised analysis of movements in the statement of financial position

forthe year ended 31 March 2013. This analysis reflects restated numbers presented as a result of changes to accounting standards

in the year ended 31 March 2014, in particular IAS 19 (revised) ‘Employee benefits’. This should be read in conjunction with the

31March 2014 unaudited commentary included on pages 85, 89, 91 and 96.

183