National Grid 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

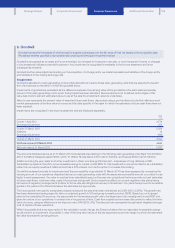

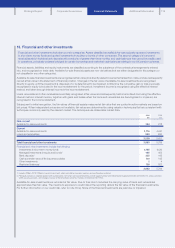

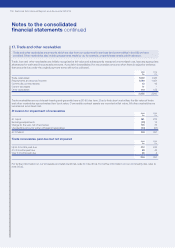

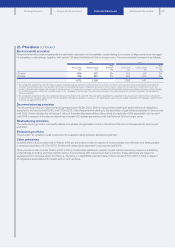

18. Cash and cash equivalents

Cash and cash equivalents includes cash balances, together with short-term investments with a maturity of less than three months

that are readily convertible to cash.

Net cash and cash equivalents reflected in the cash flow statement are net of bank overdrafts, which are reported in borrowings. The

carrying amounts of cash and cash equivalents and bank overdrafts approximate their fair values.

Cash at bank earns interest at floating rates based on daily bank deposit rates. Short-term deposits are made for periods varying between

one day and three months, depending on the immediate cash requirements, and earn interest at the respective short-term deposit rates.

Net cash and cash equivalents held in currencies other than sterling have been converted into sterling at year-end exchange rates.

Forfurther information on currency exposures, refer to note 30 (d).

2014

£m

2013

£m

Cash at bank 75 99

Short-term deposits 279 572

Cash and cash equivalents excluding bank overdrafts 354 671

Bank overdrafts (15) (23)

Net cash and cash equivalents 339 648

At 31 March 2014, £24m (2013: £21m) of cash and cash equivalents were restricted. This primarily relates to cash held in captive

insurance companies.

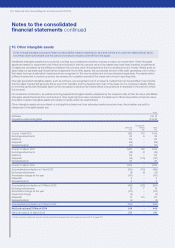

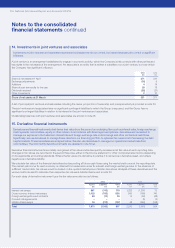

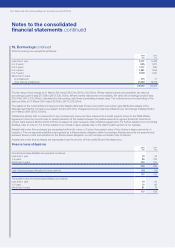

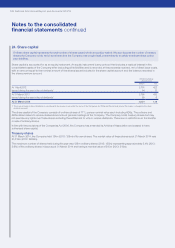

19. Borrowings

We borrow money primarily in the form of bonds and bank loans. These are for a fixed term and may have fixed or floating interest rates

or are linked to RPI. As indicated in note 15, we use derivatives to manage risks associated with interest rates and foreign exchange.

Our strategy in action

Our price controls and rate plans require us to fund our networks within a certain ratio of debt to equity and, as a result, we have

issued a significant amount of debt. As we continue to invest in our networks, the level of debt is expected to increase over time.

Tomaintain a strong balance sheet and to allow us to access capital markets at commercially acceptable interest rates, we balance

the amount of debt we issue with the value of our assets and take account of certain other metrics used by credit rating agencies.

Borrowings, which include interest-bearing and inflation linked debt and overdrafts are recorded at their initial fair value which normally

reflects the proceeds received, net of direct issue costs less any repayments. Subsequently these are stated at amortised cost, using

the effective interest method. Any difference between the proceeds after direct issue costs and the redemption value is recognised over

the term of the borrowing in the income statement using the effective interest method.

The Finance Committee controls refinancing risk by limiting the amount of our debt maturities arising from borrowings in any one year

which is demonstrated by our maturity profile.

2014

£m

2013

£m

Current

Bank loans 1,485 1,194

Bonds 1,730 1,761

Commercial paper 252 438

Finance leases 19 20

Other loans 10 12

Bank overdrafts 15 23

3,511 3,448

Non-current

Bank loans 1,414 1,863

Bonds 20,732 22,435

Finance leases 151 175

Other loans 142 174

22,439 24,647

Total 25,950 28,095

119