National Grid 2014 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration

Report

Annual statement from the Remuneration

Committee chairman

I am delighted to present my first Directors’ Remuneration Report.

Following the introduction of a new UK regulatory framework

in2013 and the continued evolution of our US business, last

summer the Committee initiated an extensive review of our

executive remuneration strategy. Our objective was to assess

whether the principles on which the current remuneration strategy

is based continued to reflect our business drivers given recent

changes. Ourreview concluded that a number of significant

changes wereappropriate. They are presented in this report

forour shareholders’ consideration and, I hope, approval at

our2014AGM.

The key factor in our discussions was to enhance the alignment

ofinterest between executives and shareholders over the longer

term. National Grid is a long-term business, where decisions

taken today can have significant impact on performance and

profitability over several years. Therefore the Committee believes

that the bulk of incentives to executives should be paid in shares

and that it is essential for high levels of personal shareholdings

tobecome mandatory, rather than simply guidelines.

Having reached provisional conclusions I wrote to a number

ofourlarger shareholders to seek their views. In the light of the

constructive responses we received, the Committee amended

itsproposals and these amendments are incorporated into the

recommendations in this report.

The key components of our recommendations are:

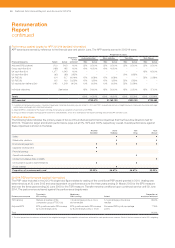

• A rebalancing of variable pay from the Annual Performance

Plan (APP) to the Long Term Performance Plan (LTPP).

It is proposed:

– to reduce the APP maximum from 150% of salary to 125%

ofsalary for the CEO and the other Executive Directors; and

– to increase the LTPP maximum from 225% to 350% of salary

for the CEO and from 200% to 300% of salary for the other

Executive Directors.

• Increased alignment with shareholders by requiring Executive

Directors to retain a significantly higher number of shares

earned. It is proposed:

– for the CEO, the new requirement is a shareholding of 500%

of pre-tax salary, equivalent to over nine years’ post-tax

salary; and

– for theother Executive Directors, the new requirement is a

shareholding of 400% ofpre-tax salary.

• Stronger alignment with our business model and the long-term

value drivers around a dividend-led total return. It is proposed

to move to twokey LTPP metrics – RoE (50% weighting) and

value growth (50%weighting):

– RoE is aimed at focusing management on driving profits

within the business; and

– value growth is viewed as a clearer indicator than EPS of

thelong-term growth of the business and the creation

ofshareholder value.

• Extended holding periods for incentive awards. It is proposed

that any APP award is paid half in cash and half in shares.

Theshares would be paid immediately and be subject to a

minimum holding period of two years. LTPP performance

metrics would be measured over a three year period and

awards would then be subject to a minimum two year

holdingperiod.

The Company’s commitment to increasing the annual dividend

by at least RPI for the foreseeable future would be reflected in

LTPP awards. The Committee will have the explicit power to

reduce LTPP vesting should the Company fail to honour the

dividend commitment, irrespective of the level of vesting

resultingfrom the performance against the LTPP targets set

bythe Committee.

The consequence of all these changes is to reduce near-term

cash incentives (APP) and tilt the balance to longer-term awards

and longer-term shareholding exposure, with a greater proportion

of Executive Directors’ remuneration earned in shares. As a

result, we are striking an important balance between long-term

reward and increased financial risk to executives through very

high levels of mandatory shareholdings. In setting the quantum

of future LTPP awards we have taken account of the reduced

APP opportunity and longer holding periods that we are

proposing. However, I want to assure shareholders that the

Committee’s intention is that any increase in remuneration should

arise from commensurate increases in long-term performance.

We will therefore seek to ensure that targets set for the

LTPPmetrics contain appropriately demanding levels of

performance to justify any increase in executive reward.

For the 2014 LTPP award we are proposing that maximum

payout would require an average annual Group RoE of 12.5%

and an average annual value growth of 12% over the three year

performance period. TheCommittee considers these stretch

targets, in the light of the business plan and recent performance,

to be more challenging to management than those for LTPP set

in the recent past. To achieve such a performance would require

incremental Group pre-tax profits of over £250 million per

annum, which in turn would imply achieved customer savings

inthe region of £100 – £200 million.

We can also confirm that, had the proposed APP andLTPP

targets been applicable for 2013/14, no higher level ofincentive

remuneration would have resulted than was actually achieved

under the current arrangements.

58 National Grid Annual Report and Accounts 2013/14