National Grid 2014 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Remuneration

Report

continued

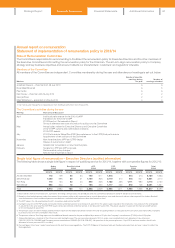

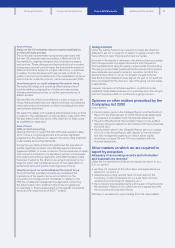

LTPP and DSP (conditional awards) granted during the financial year (audited information)

LTPP Basis of award

Face value

’000

Proportion

vesting at

threshold

performance Number of shares

Performance

period end date

Andrew Bonfield 200% of salary £1,424 25% 194,798

June 2016 and

June 2017

Steve Holliday 225% of salary £2,250 25% 3 0 7,7 9 3

June 2016 and

June 2017

Tom King 200% of salary $2,316 25% 41,225 (ADSs)

June 2016 and

June 2017

Nick Winser 200% of salary £1,092 25% 149,382

June 2016 and

June 2017

1. The face value of the awards is calculated using the share price at the date of grant (27 June 2013) (£7.3101 per share and $56.1784 per ADS).

DSP Basis of award

Face value

’000 Number of shares Release date

Andrew Bonfield 50% of APP value £339 45,706 13 June 2016

Steve Holliday 50% of APP value £423 57,118 13 June 2016

Tom King 50% of APP value $413 7,119 (ADSs) 13 June 2016

Nick Winser 50% of APP value £250 3 3,741 13 June 2016

1. The face value of the awards is calculated using the share price at the date of grant (13 June 2013) (£7.4092 per share and $57.9720 perADS).

2. The award made in 2013/14 is 50% of the 2012/13 APP value.

Performance conditions for LTPP awards granted during the nancial year

Weighting Conditional share awards granted – 2013

Performance measure Andrew Bonfield Steve Holliday Tom King Nick Winser Threshold – 25% vesting Maximum – 100% vesting

TSR ranking 25% 25% 25% 25% At median of comparator group

(FTSE 100)

7.5 percentage points or more

above median

Adjusted EPS 50% 50% 50% 50% EPS growth exceeds RPI

increase by 3 percentage points

EPS growth exceeds RPI

increase by 8 percentage

points or more

UK RoE 12.5% 12.5% – 25% Equal to the average allowed

regulatory return

2 percentage points or more

above the allowed regulatory

return

US RoE 12.5% 12.5% 25% –1 percentage point below

the allowed regulatory return

1 percentage point or more

above the allowed regulatory

return

Conditions for DSP awards granted during the nancial year

DSP awards are subject only to continuous employment.

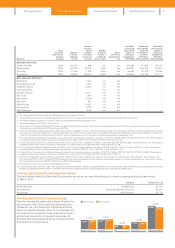

Shareholder dilution

Where shares may be issued or treasury shares reissued to satisfy incentives, the aggregate dilution resulting from executive share-

based incentives will not exceed 5% in any 10 year period. Dilution resulting from all incentives, including all-employee incentives, will not

exceed 10% in any 10 year period. The Committee reviews dilution against these limits regularly and under these limits the Company, as

at 31 March 2014, had headroom of 4.01% and 7.99% respectively.

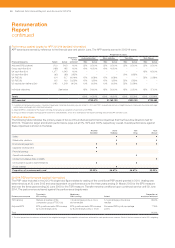

Statement of Directors’ shareholdings and share interests (audited information)

The Executive Directors are required to build up and hold a shareholding from vested share plan awards. Deferred share awards are not

taken into account for these purposes until the end of the deferral period. Shares are valued for these purposes at the 31 March 2014

price, which was 822 pence per share ($68.74 per ADS).

The following table shows how each Executive Director complies with the shareholding requirement and also the number of shares

owned by the Non-executive Directors, including connected persons. For Ken Harvey and George Rose, the shareholding is as at the

date they stepped down from the Board. For all others it is 31 March 2014.

70 National Grid Annual Report and Accounts 2013/14