National Grid 2014 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Financial

review

continued

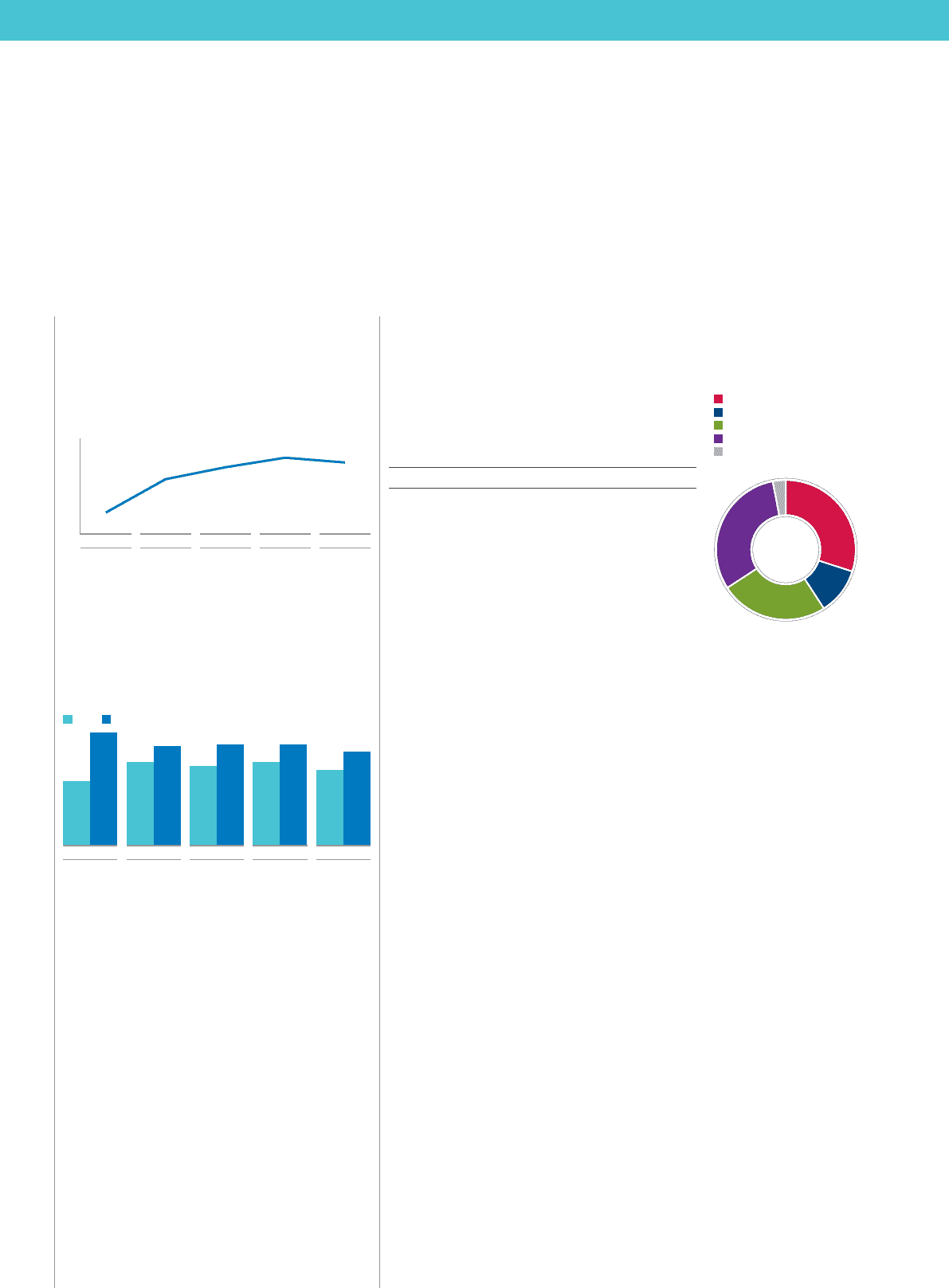

US regulated return on equity

The US RoE has decreased 20bps to 9.0%, mainly

driven by lower allowed rates in our KEDNY and

Long Island Generation businesses following the

introduction of new rate plans during the year.

US return on equity

%

6

8

10

6.9

8.3

8.8 9.2 9.0

Dec 2009 Dec 2010 Dec 2011 Dec 2012 Dec 2013

Return on capital employed

RoCE provides a performance comparison between

our regulated UK and US businesses and is one

ofthe measures that we use to make strategic

andinvestment decisions about our portfolio of

businesses. The table below shows the RoCE

forour businesses over the last five years:

Return on capital employed

%

7.1

8.5

6.8

8.6

7.1

8.6

6.4

8.0

5.5

9.6

2009/10 2010/11 2011/12 2012/13 2013/14

US UK

The UK RoCE has decreased from 8.6% to 8.0%

in2013/14, reflecting the new RIIO regulatory

allowances, including lower cost of debt allowance,

higher gearing assumption in the gas businesses,

and the inclusion of our share of exceptional costs.

The decrease in the US RoCE from 7.1% to 6.4%

isprimarily due to the end of Niagara Mohawk

deferral recoveries and controllable cost increases.

Excluding the impact of major storm costs, the US

RoCE would have been 7.7% in 2012/13.

Net debt

We expect our net debt to continue to grow for the

next few years as we fund our capital investment

programmes and enhance our networks. We

continue to borrow at attractive rates when needed

and believe that the level of net debt remains

appropriate for our business. Our five year net debt

trend is shown on page 91.

Interest cover

The principal measure we use to monitor financial

discipline is interest cover, which is a measure of

thecash flows we generate compared with the

netinterest cost of servicing our borrowings.

Thetable below shows our interest cover for the

lastthreeyears.

Year ended 31 March

Times 2014 2013 2012

Interest cover 4.1 3.9 3.9

The increase in interest cover in 2013/14 reflects

flatfinance costs year on year. Our target long-term

range for interest cover is in excess of 3 times.

Further details on our capital management and

credit ratings can be found in note 30 (f) and on

thedebt investors’ section of our website.

Timing and regulated revenue adjustments

As described on page 20, our allowed revenues are

set in accordance with our regulatory price controls

or rate plans. We calculate the tariffs we charge our

customers based on the estimated volume of energy

we expect will be delivered during the coming

period. The actual volumes delivered will differ from

this estimate. Therefore, our total actual revenue

willbe different from our total allowed revenue.

These differences are commonly referred to as

timing differences.

If we collect more than the allowed level of revenue,

the balance must be returned to customers in

subsequent periods, and if we collect less than the

allowed level of revenue we may recover the balance

from customers in subsequent periods. In the US,

asubstantial portion of our costs are pass-through

costs (including commodity and energy efficiency

costs) and are fully recoverable from our customers.

Timing differences between costs of this type being

incurred and their recovery through revenue are also

included in timing.

The amounts calculated as timing differences are

estimates and subject to change until the variables

that determine allowed revenue are final.

Our operating profit for the year includes a total

estimated in-year under-collection of £42 million

(2012/13: £16 million over-collection). Our closing

balance at 31March 2014 was £60 million

over-recovered.

In the UK, there was a cumulative under-recovery of

£57 million at 31 March 2014 (2013: under-recovery

of £5 million). All other things being equal, the

majority of that balance will normally be recoverable

from customers starting in the year ending

31 March 2016.

Our operations –

performance at a glance

Business analysis 2013/14

%

30

3

31

25

11

UK Electricity Transmission

UK Gas Transmission

UK Gas Distribution

US Regulated

Other activities

Adjusted operating profit

08 National Grid Annual Report and Accounts 2013/14