National Grid 2014 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

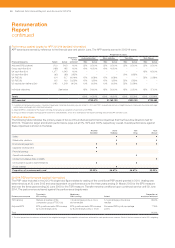

Remuneration

Report

continued

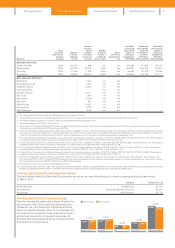

Shareholding requirement

The requirement of Executive Directors to build up and hold a

relatively high value of National Grid shares ensures they share

a significant level of risk with shareholders and their interests

are aligned.

From 2014/15 it is proposed that the existing shareholding

guidelines for Executive Directors will be replaced by a firm

requirement to build up and retain shares in the Company.

Thelevel of holding will increase from 200% of salary to 500%

of salary for the CEO and from 125% of salary to 400% of

salary for the other Executive Directors.

Unless the shareholding requirement is met, Executive

Directors will not be permitted to sell shares, other than to pay

tax or in exceptional circumstances.

Differences in remuneration policy for all employees

The remuneration policy for the Executive Directors is designed

with regard to the policy for employees across the Company as

awhole. However, there are some differences in the structure

ofremuneration policy for the senior executives. In general,

thesedifferences arise from the development of remuneration

arrangements that are market competitive for our various

employee categories. They also reflect the fact that, in the case

ofthe Executive Directors, a greater emphasis tends to be placed

on performance-related pay in themarket, in particular long-term

performance-related pay.

All employees are entitled to base salary, benefits and pension.

Many employees are eligible for an APP award based on Company

and/or individual performance. Eligibility and the maximum

opportunity available is based on market practice for the

employee’s job band. In addition, around 350 senior management

employees are eligible to participate in the LTPP.

The Company has a number of all-employee share plans that

provide employees with the opportunity to become, and to think

like, a shareholder. These plans include Sharesave and the SIP

inthe UK and the 401(k) and 423(b) plans in the US. Further

information is provided on page 60.

Consideration of remuneration policy elsewhere

inthe Company

In setting the remuneration policy the Committee considers

theremuneration packages offered to employees across the

Company. As a point of principle, salaries, benefits, pensions

andother elements of remuneration are benchmarked regularly

toensure they remain competitive in the markets in which we

operate. In undertaking such benchmarking our aim is to be at

mid-market level for all job bands, including those subject to

unionnegotiation.

As would be expected, we have differences in pay and benefits

across the business which reflect individual responsibility and

there are elements of remuneration policy which apply to all,

forexample, flexible benefits and share plans.

When considering annual salary increases, the Committee reviews

the proposals for salary increases for the employee population

generally, as it does for any other changes to remuneration policy

being considered. This will include a report on the status of

negotiations with any trade union represented employees.

The Company includes in its annual employee opinion survey

questions on the appropriateness of the pay arrangements within

the Company. It does not specifically invite employees to comment

on the Directors’ remuneration policy but any comments made by

employees are noted.

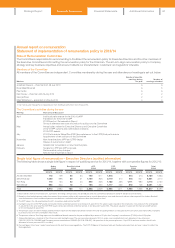

Policy on recruitment remuneration

Salaries for new Executive Directors appointed to the Board will

beset in accordance with the terms of the approved remuneration

policy in force at the time of appointment, and in particular will take

account of the appointee’s skills and experience as well as the

scope and market rate for the role.

Where appropriate, salaries may be set below market level initially,

with the Committee retaining discretion toaward increases

insalary in excess of those of the wider workforce and inflation

tobring salary to a market level over time, where this is justified

byindividual and Company performance.

Benefits consistent with those offered to other Executive Directors

under the approved remuneration policy in force at the time of

appointment will be offered, taking account of local market

practice. The Committee may also agree that the Company will

meet certain costs associated with the recruitment, for example

legal fees, and the Committee may agree to meet certain

relocation expenses or provide tax equalisation asappropriate.

Pensions for new Executive Directors appointed to the Board will

be set in accordance with the terms of the approved remuneration

policy in force at the time of appointment.

Ongoing incentive pay (APP and LTPP) for new Executive Directors

will be in accordance with the approved remuneration policy in

force at the time of appointment. This means the maximum APP

award in any year would be 125% of salary and the maximum

LTPP award would be 300% of salary (350% of salary for a

newCEO).

For an externally appointed Executive Director, the Company

mayoffer additional cash or share-based payments that it

considers necessary to buy out current entitlements from the

former employer that will be lost on recruitment to National Grid.

Any such arrangements would reflect the delivery mechanisms,

time horizons andlevels of conditionality of the remuneration lost.

In order to facilitate buy out arrangements as described above,

existing incentive arrangements will be used to the extent possible,

although awards may also be granted outside of these

shareholder-approved schemes if necessary and as permitted

under the Listing Rules.

For an internally appointed Executive Director, any outstanding

variable pay element awarded in respect of the prior role will

continue on itsoriginal terms.

Fees for a new Chairman or Non-executive Director will be set in

line with the approved policy in force at the time of appointment.

64 National Grid Annual Report and Accounts 2013/14