National Grid 2014 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

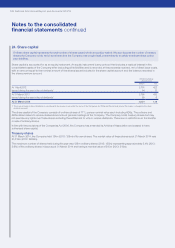

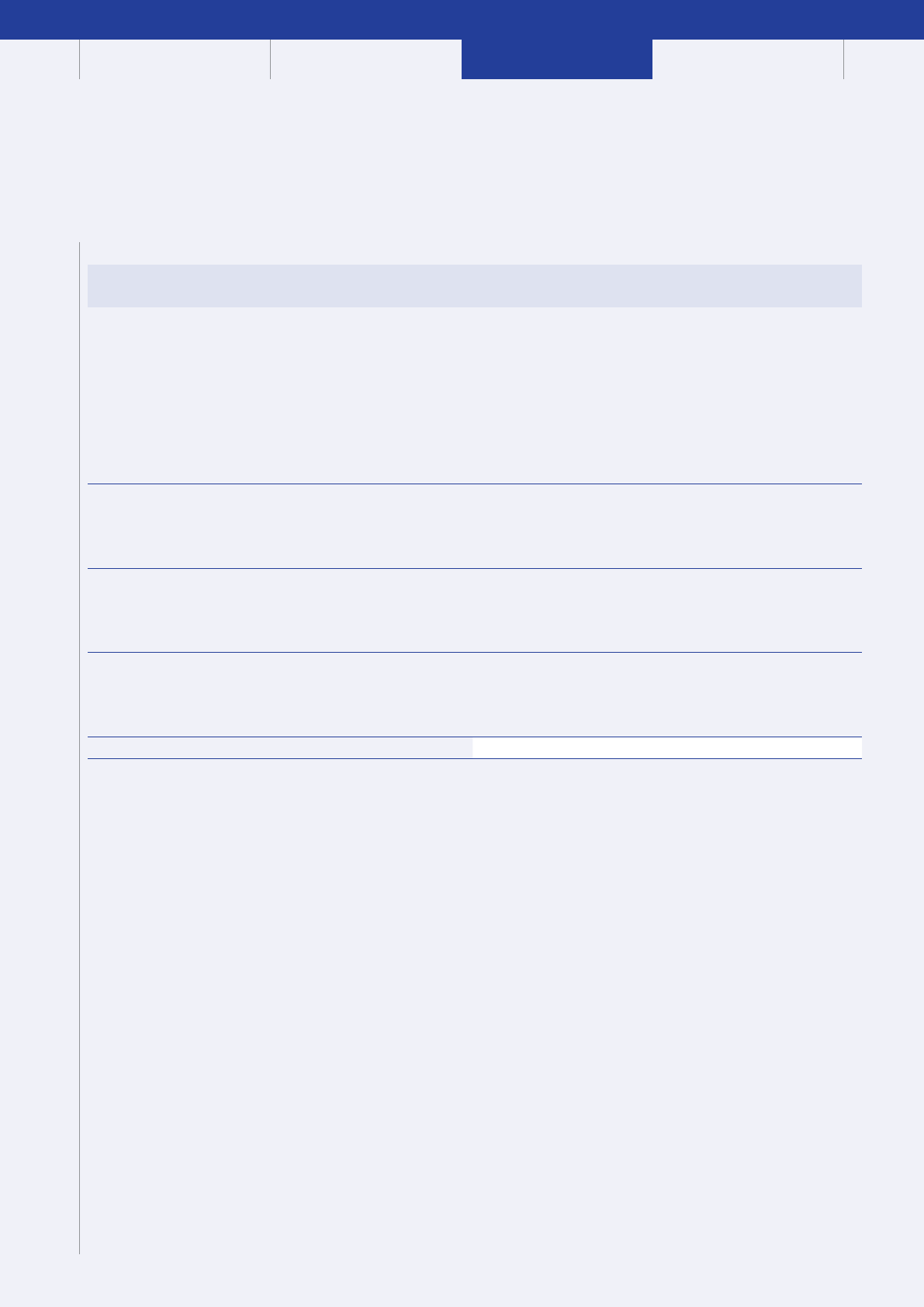

25. Other equity reserves

Other equity reserves are different categories of equity as required by accounting standards and represent the impact of a number of

our historical transactions.

Other equity reserves comprise the translation reserve (see accounting policy B), cash flow hedge reserve (see note 15), available-for-

sale reserve (see note 13), the capital redemption reserve and the merger reserve. The merger reserve arose as a result of the application

of merger accounting principles under the then prevailing UK GAAP, which under IFRS 1 was retained for mergers that occurred prior to

the IFRS transition date. Under merger accounting principles, the difference between the carrying amount of the capital structure of the

acquiring vehicle and that of the acquired business was treated as a merger difference and included within reserves.

As the amounts included in other equity reserves are not attributable to any of the other classes of equity presented, they have been

disclosed as a separate classification of equity.

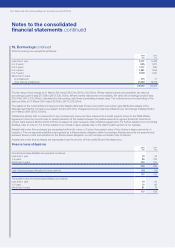

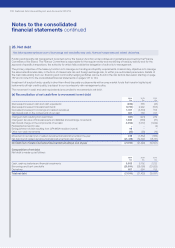

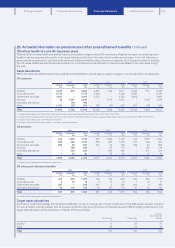

Translation

£m

Cash flow

hedge

£m

Available-

for-sale

£m

Capital

redemption

£m

Merger

£m

Total

£m

At 1 April 2011 319 (103) 60 19 (5,165) (4,870)

Exchange adjustments 27 – – – – 27

Net (losses)/gains taken to equity –(18) 16 – – (2)

Transferred to profit or loss –19 (9) – – 10

Tax – 2 (2) – – –

At 31 March 2012 346 (100) 65 19 (5,165 ) (4,835)

Exchange adjustments 117 – – – – 117

Net (losses)/gains taken to equity –(31) 20 – – (11)

Transferred to profit or loss –73 (10) – – 63

Tax –(13) (2) – – (15)

At 31 March 2013 463 (71) 73 19 (5,165) (4,681)

Exchange adjustments (158) – – – – (158)

Net gains taken to equity –63 6 – – 69

Transferred to profit or loss –27 (14) – – 13

Tax –(5) 3 – – (2)

At 31 March 2014 305 14 68 19 (5,165) (4,759)

The merger reserve represents the difference between the carrying value of subsidiary undertaking investments and their respective

capital structures following the Lattice demerger from BG Group plc and the 1999 Lattice refinancing of £5,745m and merger differences

of £221m and £359m.

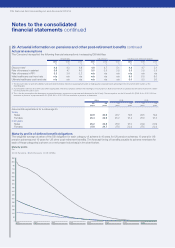

The cash flow hedge reserve on interest rate swap contracts will be continuously transferred to the income statement until the borrowings

are repaid. The amount due to be released from reserves to the income statement next year is £17m (pre-tax) and the remainder released

with the same maturity profile as borrowings due after more than one year.

129