National Grid 2014 Annual Report Download - page 163

Download and view the complete annual report

Please find page 163 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

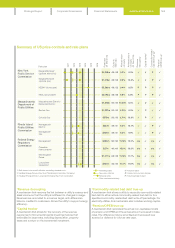

RIIO price controls

Our UK regulator has introduced a new regulatory framework

called RIIO (revenue = incentives + innovation + outputs) that

became effective on 1 April 2013 and lasts for eight years.

Thebuilding blocks of the RIIO price control are broadly similar

tothe historical price controls used in the UK; however there are

some significant differences in the mechanics of the calculations.

How is revenue calculated?

Under RIIO the outputs we deliver are clearly articulated and are

integrally linked to the calculation of our allowed revenue. These

outputs have been determined through an extensive consultation

process which has given stakeholders a greater opportunity to

input to these decisions. The clarity around outputs should lead

togreater transparency of our performance in delivering them.

The six key output categories are:

• Safety: ensuring the provision of a safe energy network.

• Reliability (and availability): promoting networks capable of

delivering long-term reliability, as well as minimising the number

and duration of interruptions experienced over the price control

period, and ensuring adaptation to climate change.

• Environmental impact: encouraging companies to play their

role in achieving broader environmental objectives – specifically

facilitating the reduction of carbon emissions – as well as

minimising their own carbon footprint.

• Customer and stakeholder satisfaction: maintaining high levels

of customer satisfaction and stakeholder engagement, and

improving service levels.

• Customer connections: encouraging networks to connect

customers quickly and efficiently.

• Social obligations (UK GD only): extending the gas network

tocommunities that are fuel poor where it is efficient to do

soand introducing measures to address carbon monoxide

poisoning incidents.

Within each of these output categories are a number of primary

and secondary deliverables, reflecting what our stakeholders want

us to deliver over the coming price control period. The nature and

number of these deliverables varies according to the output

category, with some being linked directly to our allowed revenue,

some linked to legislation, and others having only a reputational

impact. Ofgem, using information submitted by us along with

independent assessments, determines the efficient level of

expected costs necessary to deliver them. Under RIIO this is

known as totex, short for total expenditure, and is similar to the

sum of controllable opex, capex and repex (for UK GD) under the

previous price control.

A number of assumptions are necessary in setting these outputs,

such as certain prices or the volumes of work that will be needed.

As a result, to protect us and our customers from windfall gains

and losses, there are a number of uncertainty mechanisms within

the RIIO framework that can result in adjustments to totex if actual

prices or volumes differ from the assumptions.

Where we under- or over-spend the allowed totex for reasons that

are not covered by uncertainty mechanisms, there is a sharing

factor, ie the under- or over-spend is shared between us and

customers through an adjustment to allowed revenues in a future

year. This sharing factor provides an incentive for us to provide the

outputs efficiently as we are able to keep a portion of the savings,

with the remainder benefiting our customers.

This sharing factor is one of the ways that RIIO has given

innovation more prominence. Innovation includes traditional areas

such as new technologies, as well as the broader challenge of

finding new ways of working to deliver outputs more efficiently.

This broader challenge will have an impact on everyone in

ourbusiness.

Totex is then split between fast and slow money, a new concept

under RIIO, based on a specified percentage. Fast money

represents the amount of totex that we are able to recover

inthecurrent year. Slow money is added to our RAV.

In addition to fast money, in each year we are allowed to collect

adepreciation of and a return on our RAV.

This operates in a similar way to the previous price control,

although there have been changes to the asset lives for electricity

transmission (transition from 20 years to 45 years evenly across

the RIIO period) and the depreciation calculation for UK GD

(changed from 45 years straight line to 45 years sum of digits for

assets added post 2002). We are also allowed to collect additional

revenues related to non-controllable costs and incentives.

The incentive mechanisms can increase or decrease our

allowedrevenue and result from our performance against

variousmeasures related to our outputs. RIIO has introduced

newincentive mechanisms as a way to provide further incentives

toalign our objectives with those of our customers and other

stakeholders. For example, performance against our customer

satisfaction targets can have a positive or negative effect of up

to1% of allowed annual revenues. Incentives will normally affect

our revenues two years after the year of performance.

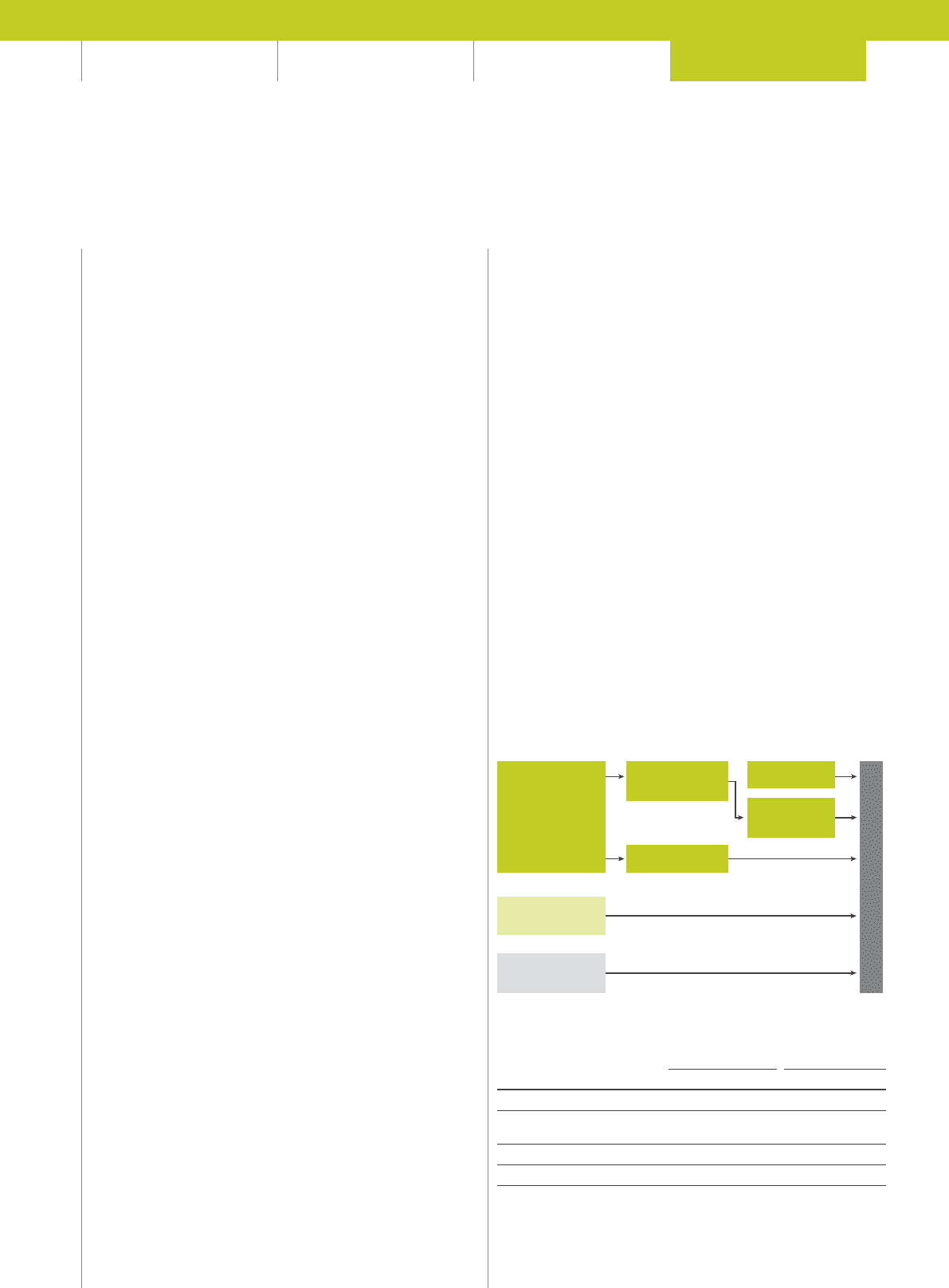

RIIO regulatory building blocks

Revenue

Other costs

eg tax

Performance

against incentives

Totex

(capital invested

+ controllable

operating costs)

Allowed return

Depreciation

of RAV

RAV

(slow money)

Fast money

X

Allowed returns

The cost of capital allowed under RIIO is as follows:

Transmission Gas Distribution

Gas Electricity

Cost of equity (post-tax real) 6.8% 7.0% 6.7%

Cost of debt (pre-tax real) iBoxx 10 year simple trailing average index

(2.92% for 2013/14)

Notional gearing 62.5% 60.0% 65.0%

Vanilla WACC14.38% 4.55% 4.24%

1. Vanilla WACC = cost of debt x gearing + cost of equity x (1- gearing).

161