National Grid 2014 Annual Report Download - page 183

Download and view the complete annual report

Please find page 183 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

US information reporting and backup withholding tax

Dividend payments made to US Holders and proceeds paid from

the sale, exchange, redemption or disposal of ADSs or ordinary

shares to US Holders may be subject to information reporting to

the US Internal Revenue Service (IRS). Such payments may be

subject to backup withholding taxes unless the holder (i) is a

corporation or other exempt recipient or (ii) provides a taxpayer

identification number on a properly completed IRS Form W-9

andcertifies that no loss of exemption from backup withholding

has occurred.

US Holders should consult their tax advisors regarding these

rulesand any other reporting obligations that may apply to the

ownership or disposition of ADSs or ordinary shares, including

reporting requirements related to the holding of certain foreign

financial assets.

UK inheritance tax

An individual who is domiciled in the US for the purposes of the

Estate Tax Convention and who is not a national of the UK for

thepurposes of the Estate Tax Convention will generally not be

subject to UK inheritance tax in respect of the ADSs or ordinary

shares on the individual’s death or on a gift of the ADSs or ordinary

shares during the individual’s lifetime, unless the ADSs or ordinary

shares are part of the business property of a permanent

establishment of the individual in the UK or pertain to a fixed

basein the UK of an individual who performs independent

personal services.

Special rules apply to ADSs or ordinary shares held in trust. In the

exceptional case where the ADSs or shares are subject both to UK

inheritance tax and to US federal gift or estate tax, the Estate Tax

Convention generally provides for the tax paid in the UK to be

credited against tax paid in the US.

The All-employee Share Plans

The all-employee share plans allow UK- or US-based employees

toparticipate in either HMRC (UK) or Internal Revenue Service

(US) approved plans. We believe by offering participation in such

plans, it encourages all employees (including Executive Directors)

to become shareholders in National Grid.

Sharesave

Employees resident in the UK are eligible to participate in the

Sharesave plan. Under this plan, participants may contribute

between £5 and £250 in total each month, for a fixed period

ofthree years, five years or both. Contributions are taken from

netsalary.

SIP

Employees resident in the UK are eligible to participate in theSIP.

Contributions up to £125 are deducted from participants’ gross

salary and used to purchase ordinary shares in National Grid each

month. The shares are placed in trust.

US Incentive Thrift Plans

Employees of National Grid’s US companies are eligible to

participate in the Thrift Plans, which are tax-advantaged savings

plans (commonly referred to as 401(k) plans). They are DC pension

plans that give participants the opportunity toinvest up to

applicable federal salary limits. The federal limits for calendar year

2013 are: for pre-tax contributions a maximum of 50% of salary

limited to $17,500 for those under the age of 50 and $23,000

forthose over50; for post-tax contributions, up to 15% of salary.

The total contributions (pre-tax and post-tax) are limited to the

lesser of50% of compensation or $51,000. For calendar year

2014, participants may invest up to the applicable federal salary

limits:for pre-tax contributions a maximum of 50% of salary

limitedto$17,500 for those under the age of 50 and $23,000

forthoseover 50; for post-tax contributions up to 15% of salary.

Thetotal contributions (pre-tax and post-tax) are limited to the

lesser of 50% of compensation or $52,000.

ESPP

Employees of National Grid’s US companies are eligible

toparticipate in the ESPP (commonly referred to as a 423(b) plan).

Eligible employees have the opportunity to purchase ADSs on

amonthly basis at a 15% discounted price. Under the plan

employees may contribute up to 20% of base pay each year up

toa maximum annual contribution of $18,888 to purchase ADSs

inNational Grid.

The offer and listing

Price history

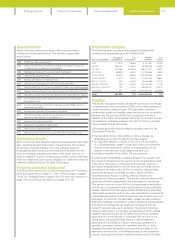

The following table shows the highest and lowest intraday market

prices for our ordinary shares and ADSs for the periods indicated:

Ordinary share (pence) ADS ($)

High Low High Low

2013/14 849.50 711.0 0 70.07 55.16

2012/13 770.00 6 27. 0 0 58.33 49.55

2011/12 660.50 545.50 52.18 45.80

2010/111666.00 474.80 51.00 36.72

2009/10 685.50 511.0 0 56.59 38.25

2013/14 Q4 842.50 769.00 70.07 63.19

Q3 797. 50 725.16 65.39 58.85

Q2 817.75 727.4 5 61.59 55.30

Q1 849.50 711.0 0 64.56 55.16

2012/13 Q4 770.00 678.00 58.33 52.81

Q3 724.97 679.59 58.03 54.28

Q2 70 6.13 635.56 56.72 49.55

Q1 689.50 62 7.0 0 55.00 49.85

April 2014 844.50 806.22 71.23 67. 62

March 2014 839.50 808.00 69.86 67.0 2

February 2014 842.50 777.50 70.07 63.24

Januar y 2014 809.50 769.00 66.40 63.19

December 2013 797. 5 0 742.5 0 65.39 60.67

1. On 20 May 2010, we announced a 2 for 5 rights issue of 990,439,017 ordinary shares at

355 pence per share.

Unresolved SEC staff comments

There are no unresolved staff comments required to be reported.

181