National Grid 2014 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

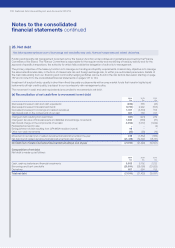

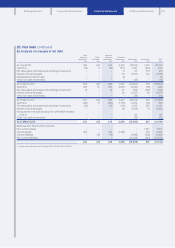

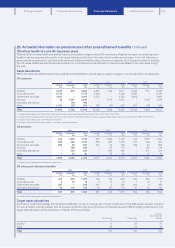

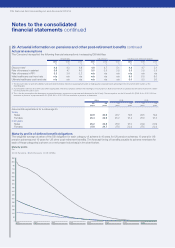

29. Actuarial information on pensions and other post-retirement benefits continued

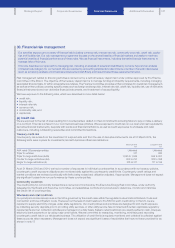

US retiree healthcare and life insurance plans

National Grid provides healthcare and life insurance benefits to eligible retired US employees. Eligibility is based on certain age and

length of service requirements and in most cases retirees contribute to the cost of their healthcare coverage. In the US, there is no

governmental requirement to pre-fund post-retirement health and welfare plans. However, in general, the Company’s policy for funding

theUS retiree healthcare and life insurance plans is to contribute amounts collected in rates and capitalised in the rate bases during

theyear.

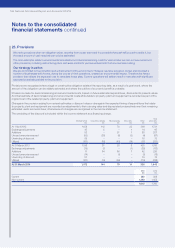

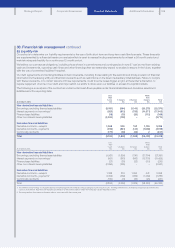

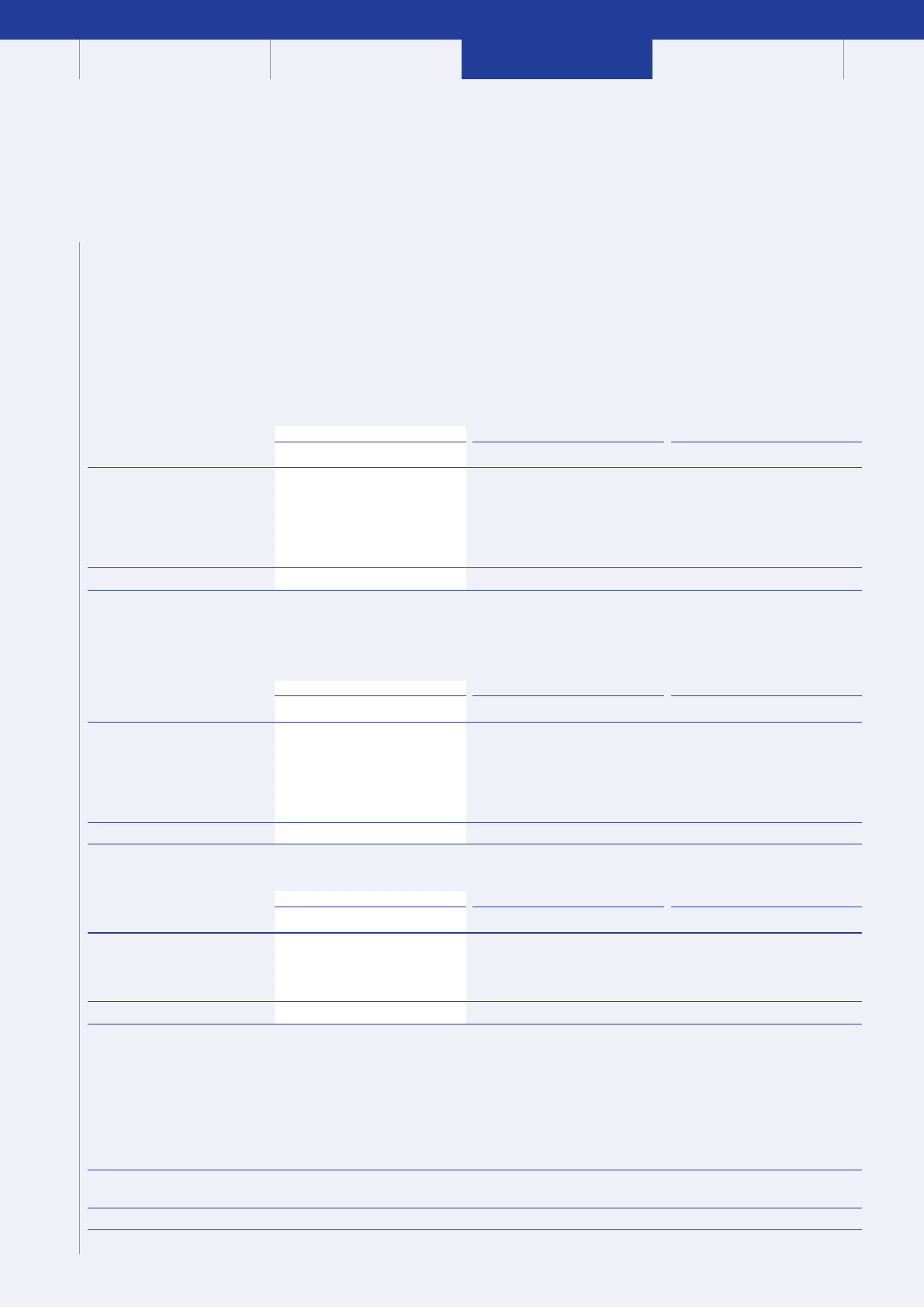

Asset allocations

Within the asset allocations below there is significant diversification across regions, asset managers, currencies and bond categories.

UK pensions

2014 2013 2012

Quoted

£m

Unquoted

£m

Total

£m

Quoted

£m

Unquoted

£m

Total

£m

Quoted

£m

Unquoted

£m

Total

£m

Equities14,045 620 4,665 4,825 546 5,371 4,796 570 5,366

Corporate bonds25,706 –5,706 5,804 –5,804 5,330 –5,330

Government securities 4,161 –4,161 4,743 –4,743 3,906 –3,906

Property 33 1,057 1,090 –1,072 1,072 –1,160 1,16 0

Diversified alternatives3–793 793 ––––––

Other41,031 (37) 994 426 (24) 402 407 (62) 345

Total 14,976 2,433 17,409 15,798 1,594 17, 3 9 2 14,439 1,668 16,107

1. Included within equities at 31 March 2014 were ordinary shares of National Grid plc with a value of £15m (2013: £16m; 2012: £13m).

2. Included within corporate bonds at 31 March 2014 was an investment in a number of bonds issued by subsidiary undertakings with a value of £72m (2013: £69m; 2012: £50m).

3. Includes return seeking non-conventional asset classes.

4. Includes liability-driven investment vehicles, cash and cash type instruments.

US pensions

2014 2013 2012

Quoted

£m

Unquoted

£m

Total

£m

Quoted

£m

Unquoted

£m

Total

£m

Quoted

£m

Unquoted

£m

Total

£m

Equities 508 1,225 1,733 507 1,289 1,796 619 1,025 1,644

Corporate bonds 823 336 1,159 863 295 1,158 733 229 962

Government securities 632 28 660 707 19 726 649 20 669

Property –189 189 –175 175 –148 148

Diversified alternatives1–434 434 –465 465 –411 411

Other –54 54 –58 58 –16 16

Total 1,963 2,266 4,229 2,077 2,301 4,378 2,001 1,849 3,850

1. Includes return seeking non-conventional asset classes.

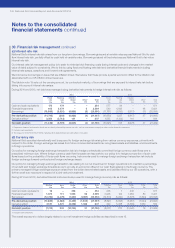

US other post-retirement benefits

2014 2013 2012

Quoted

£m

Unquoted

£m

Total

£m

Quoted

£m

Unquoted

£m

Total

£m

Quoted

£m

Unquoted

£m

Total

£m

Equities 245 852 1,097 195 774 969 252 523 775

Corporate bonds 210 12 211 13 110 11

Government securities 357 1358 361 2363 262 4266

Diversified alternatives143 110 153 43 127 170 87 53 140

Total 647 973 1,620 601 914 1,515 602 590 1,192

1. Includes return seeking non-conventional asset classes.

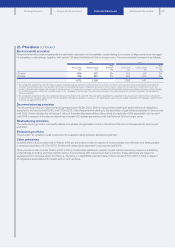

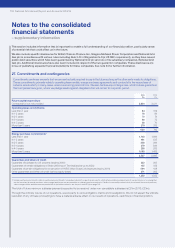

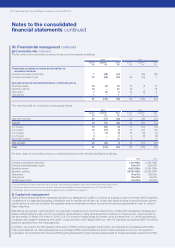

Target asset allocations

Each plan’s investment strategy is formulated specifically in order to manage risk, through investment in diversified asset classes, including

the use of liability matching assets and where appropriate through the employment of interest rate and inflation hedging instruments. The

target asset allocation of the plans as at 31 March 2014 is as follows:

UK pensions

%

US pensions

%

US other

post-retirement

benefits

%

Equities 31 47 70

Other 69 53 30

Total 100 100 100

135