National Grid 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

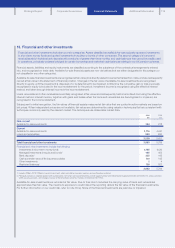

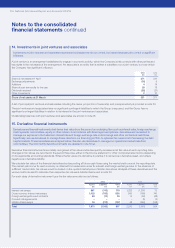

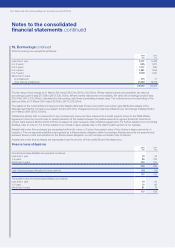

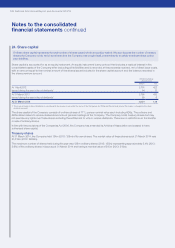

19. Borrowings continued

Total borrowings are repayable as follows:

2014

£m

2013

£m

Less than 1 year 3,511 3,448

In 1-2 years 895 1,872

In 2-3 years 1,177 860

In 3-4 years 1,661 1,255

In 4-5 years 1,509 1,420

More than 5 years:

by instalments 175 71

other than by instalments 17,022 19,169

25,950 28,095

The fair value of borrowings at 31 March 2014 was £28,131m (2013: £30,792m). Where market values were available, fair value of

borrowings (Level 1) was £17,388m (2013: £20,543m). Where market values were not available, fair value of borrowings (Level 2) was

£10,743m (2013: £10,249m), calculated by discounting cash flows at prevailing interest rates. The notional amount outstanding of the

debt portfolio at 31 March 2014 was £25,539m (2013: £27,391m).

The assets of the Colonial Gas Company and the Niagara Mohawk Power Corporation and certain gas distribution assets of the

Narragansett Electric Company are subject to liens and other charges and are provided as collateral over borrowings totalling £438m

at31 March 2014 (2013: £512m).

Collateral is placed with or received from any counterparty where we have entered into a credit support annex to the ISDA Master

Agreement once the current mark-to-market valuation of the trades between the parties exceeds an agreed threshold. Included in

current bank loans is £843m (2013: £730m) in respect of cash received under collateral agreements. For further details of our borrowing

facilities, refer to note 31. For further details of our bonds in issue, please refer to the debt investor section of our website.

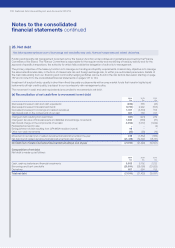

Assets held under finance leases are recognised at their fair value or, if lower, the present value of the minimum lease payments on

inception. The corresponding liability is recognised as a finance lease obligation within borrowings. Rental payments are apportioned

between finance costs and reduction in the finance lease obligation, so as to achieve a constant rate of interest.

Assets held under finance leases are depreciated over the shorter of their useful life and the lease term.

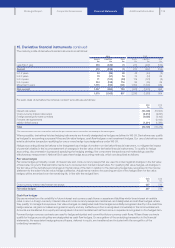

Finance lease obligations

2014

£m

2013

£m

Gross finance lease liabilities are repayable as follows:

Less than 1 year 19 20

1-5 years 89 109

More than 5 years 100 101

208 230

Less: finance charges allocated to future periods (38) (35)

170 195

The present value of finance lease liabilities is as follows:

Less than 1 year 19 20

1-5 years 70 96

More than 5 years 81 79

170 195

Notes to the consolidated

financial statements continued

120 National Grid Annual Report and Accounts 2013/14