National Grid 2014 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

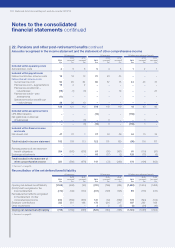

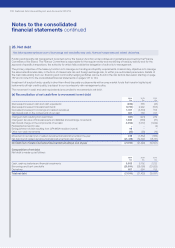

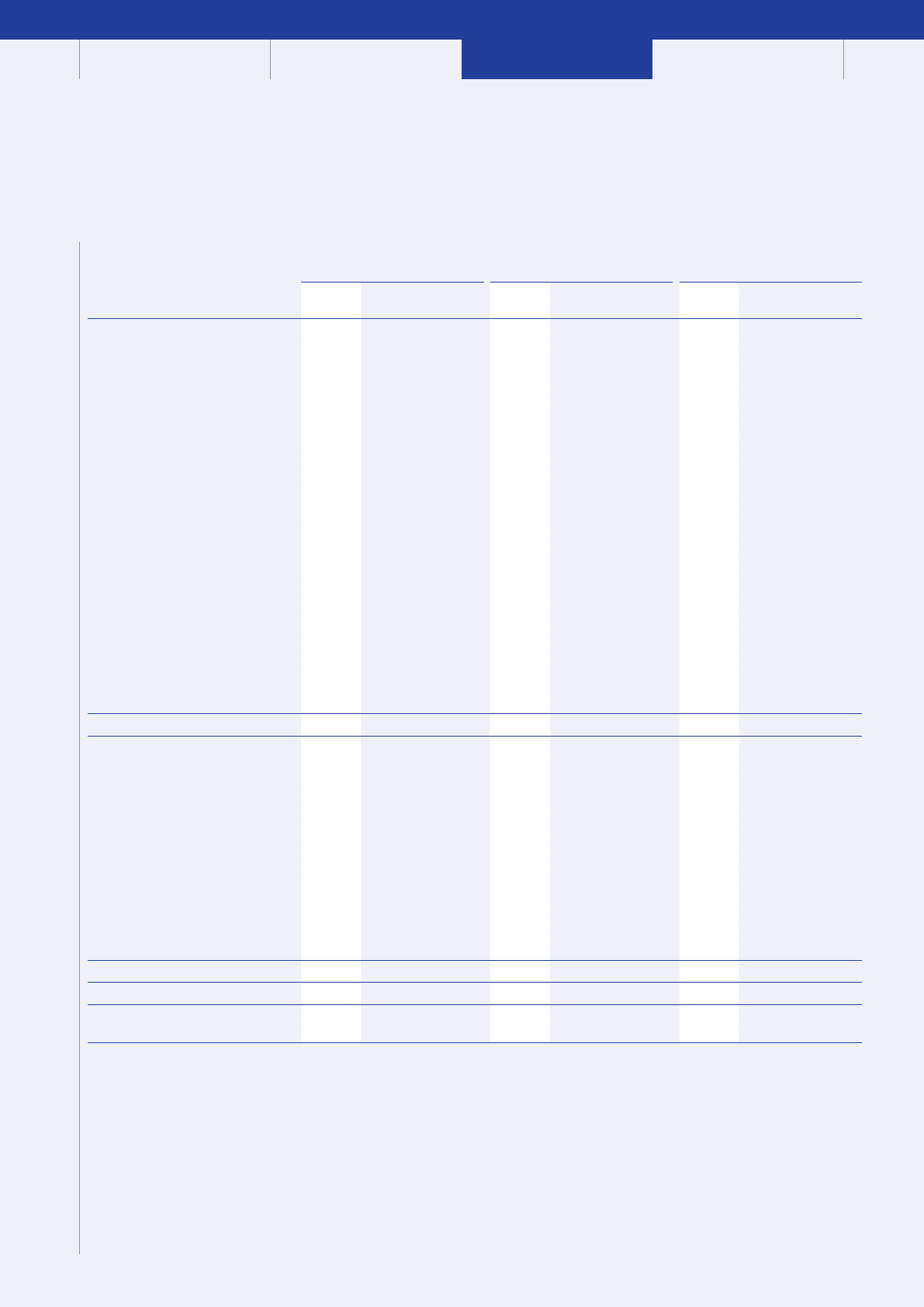

22. Pensions and other post-retirement benefits continued

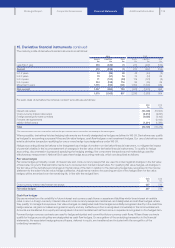

UK pensions US pensions US other post-retirement benefits

2014

£m

2013

(restated)1

£m

2012

(restated)1

£m

2014

£m

2013

(restated)1

£m

2012

(restated)1

£m

2014

£m

2013

(restated)1

£m

2012

(restated)1

£m

Changes in the present value

ofdefined benefitobligations

(including unfunded obligations)

Opening defined benefit obligations (18,561) (16,775) (15,443) (5,115) (4,611) (4,037) (3,020) (2,630) (2,458)

Current service cost (96) (90) (84) (85) (87) (75) (44) (43) (37)

Interest cost (780) (788) (830) (221) (232) (233) (123) (133) (140)

Actuarial gains/(losses) – experience 16 74 (112) (22) 1(13) 47 60 71

Actuarial losses – demographic

assumptions –– – (129) 5(64) (154) (18) (84)

Actuarial gains/(losses) – financial

assumptions 436 (1,765) (1,062) 57 (245) (422) 49 (218) (70)

Past service credit/(cost) –

redundancies 19 7 6 16 36 (19) 119 5(23)

Special termination benefit cost –

redundancies (39) (20) (13) –– – –– –

Past service cost – augmentations (15) (2) (2) –– – –– –

Past service credit – plan amendments 11 – – –– – 19 – –

Transfers in –– 1 –– – –– –

Medicare subsidy received –– – –– – (17) (19) (6)

Liabilities extinguished on settlements –– – –– – 60 – –

Employee contributions (2) (3) (3) –– – –– –

Benefits paid 849 801 767 291 269 268 117 123 127

Transferred to liabilities of businesses

held for sale –– – –– 3 –– 2

Exchange adjustments –– – 456 (251) (19) 267 (147) (12)

Closing defined benefit obligations (18,162) (18,561) (16,775) (4,752) (5,115) (4,611) (2,680) (3,020) (2,630)

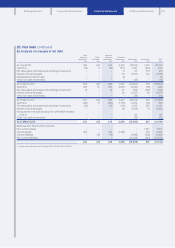

Changes in the fair value of plan

assets

Opening fair value of plan assets 17,392 16,107 15,353 4,378 3,850 3,550 1,515 1,192 1,066

Interest income 733 757 829 194 198 207 69 63 64

Return on assets (less)/greater

thanassumed (98) 1,131 498 175 204 132 108 57 (14)

Administration costs (6) (6) (6) (5) (4) (5) (1) (2) (1)

Transfers out ––(1) –– – –– –

Employer contributions 235 201 198 174 224 217 187 262 198

Employee contributions 23 3 –– – –– –

Benefits paid (849) (801) (767) (291) (269) (268) (117) (123) (127)

Assets distributed in settlements

andtransfers –– – –(39) ––(6) –

Exchange adjustments –– – (396) 214 17 (141) 72 6

Closing fair value of plan assets 17,409 17, 3 9 2 16,107 4,229 4,378 3,850 1,620 1,515 1,192

Actual return on plan assets 635 1,888 1,327 369 402 339 177 120 50

Expected contributions to plans

inthefollowing year 182 181 129 118 183 224 109 196 248

1. See note 1 on page 92.

125