National Grid 2014 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

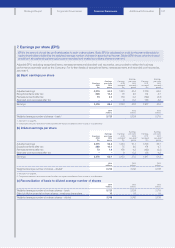

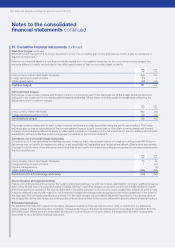

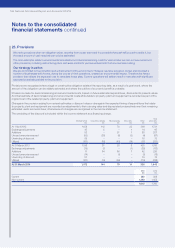

15. Derivative financial instruments continued

Cash flow hedges continued

When a forecast transaction is no longer expected to occur, the cumulative gain or loss that was reported in equity is transferred to

theincome statement.

Where a non-financial asset or a non-financial liability results from a forecasted transaction or firm commitment being hedged, the

amounts deferred in equity are included in the initial measurement of that non-monetary asset or liability.

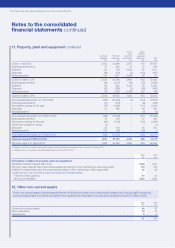

2014

£m

2013

£m

Cross-currency interest rate/interest rate swaps 224 123

Foreign exchange forward contracts (11) 1

Inflation linked swaps (32) (16)

Cash flow hedges 181 108

Net investment hedges

Borrowings, cross-currency swaps and forward currency contracts are used in the management of the foreign exchange exposure

arising from the investment in non-sterling denominated subsidiaries. Where these contracts qualify for hedge accounting they are

designated as net investment hedges.

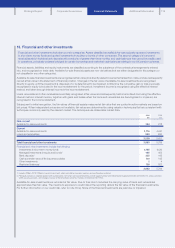

2014

£m

2013

£m

Cross-currency interest rate swaps 342 (56)

Foreign exchange forward contracts 66 (39)

Net investment hedges 408 (95)

The cross-currency swaps and forward foreign currency contracts are hedge accounted using the spot to spot method. The foreign

exchange gain or loss on retranslation of the borrowings and the spot to spot movements on the cross-currency swaps and forward

currency contracts are transferred to equity to offset gains or losses on translation of the net investment in the non-sterling denominated

subsidiaries, with any ineffective portion recognised immediately in the income statement.

Derivatives not in a formal hedge relationship

Our policy is not to use derivatives for trading purposes. However, due to the complex nature of hedge accounting under IAS 39 some

derivatives may not qualify for hedge accounting, or are specifically not designated as a hedge where natural offset is more appropriate.

Changes in the fair value of any derivative instruments that do not qualify for hedge accounting are recognised in remeasurements within

the income statement.

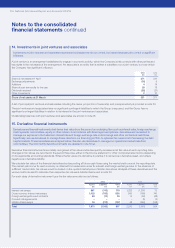

2014

£m

2013

£m

Cross-currency interest rate/interest rate swaps 15 16

Foreign exchange forward contracts 1(10)

Forward rate agreements –(5)

Inflation linked swaps (165) (182)

Derivatives not in a formal hedge relationship (149) (181)

Discontinuation of hedge accounting

Hedge accounting is discontinued when the hedging instrument expires or is sold, terminated, exercised or no longer qualifies for hedge

accounting. At that time, any cumulative gains or losses relating to cash flow hedges recognised in equity are initially retained in equity

and subsequently recognised in the income statement in the same periods in which the previously hedged item affects net profit or loss.

Amounts deferred in equity with respect to net investment hedges are subsequently recognised in the income statement in the event of

the disposal of the overseas operations concerned. For fair value hedges, the cumulative adjustment recorded to the carrying value of

the hedged item at the date hedge accounting is discontinued is amortised to the income statement using the effective interest method.

Embedded derivatives

No adjustment is made with respect to derivative clauses embedded in financial instruments or other contracts that are defined as

closely related to those instruments or contracts. Consequently these embedded derivatives are not accounted for separately from the

debt instrument. Where there are embedded derivatives in host contracts not closely related, the embedded derivative is separately

accounted for as a derivative financial instrument.

Notes to the consolidated

financial statements continued

116 National Grid Annual Report and Accounts 2013/14