National Grid 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Strategic Report Corporate Governance Financial Statements Additional Information

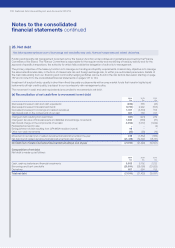

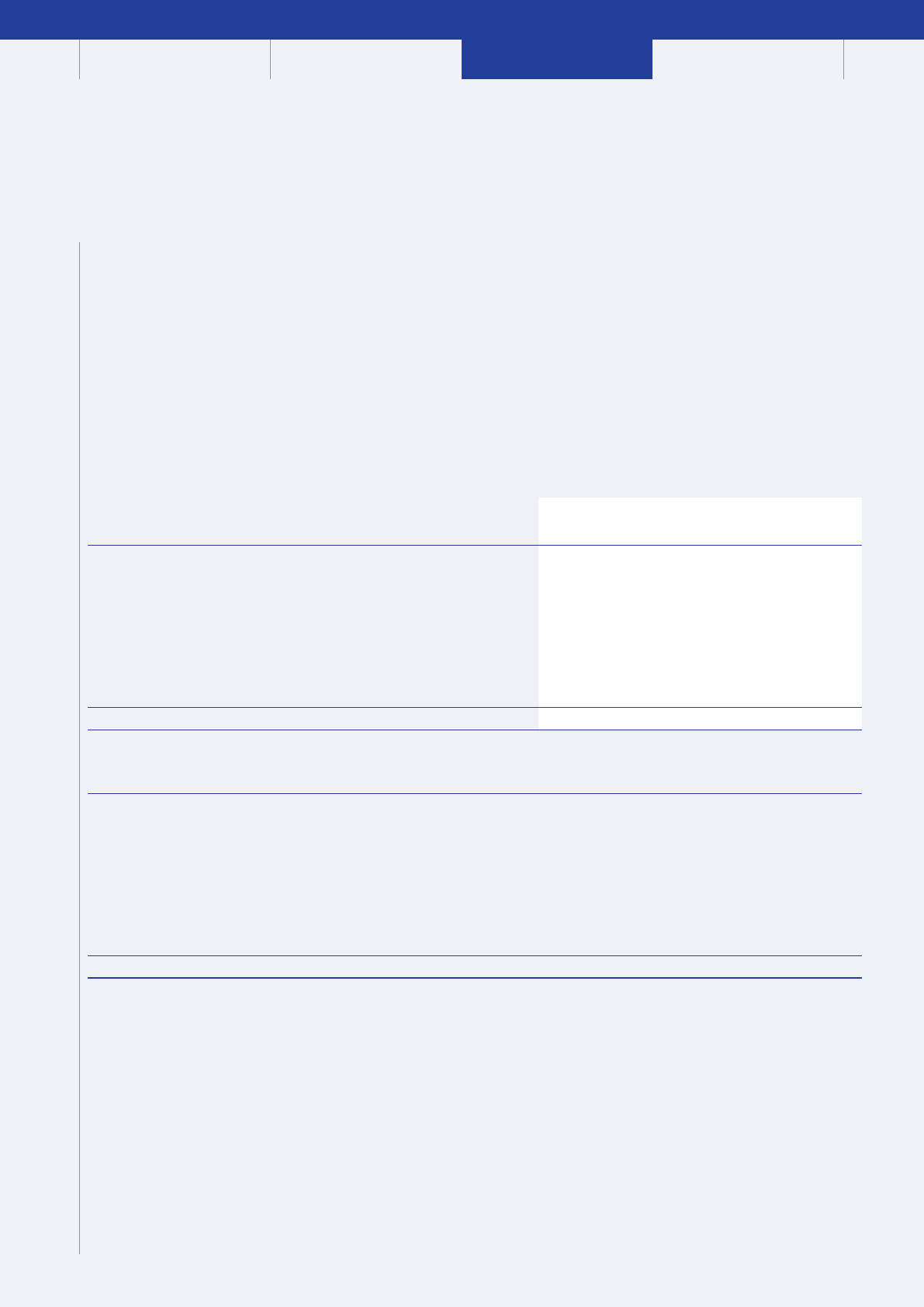

30. Financial risk management continued

(b) Liquidity risk

Our policy is to determine our liquidity requirements by the use of both short-term and long-term cash flow forecasts. These forecasts

are supplemented by a financial headroom analysis which is used to assess funding requirements for at least a 24 month period and

maintain adequate liquidity for a continuous 12 month period.

We believe our contractual obligations, including those shown in commitments and contingencies in note 27 can be met from existing

cash and investments, operating cash flows and other financings that we reasonably expect to be able to secure in the future, together

with the use of committed facilities if required.

Our debt agreements and banking facilities contain covenants, including those relating to the periodic and timely provision of financial

information by the issuing entity and financial covenants such as restrictions on the level of subsidiary indebtedness. Failure to comply

with these covenants, or to obtain waivers of those requirements, could in some cases trigger a right, at the lender’s discretion, to

require repayment of some of our debt and may restrict our ability to draw upon our facilities or access the capital markets.

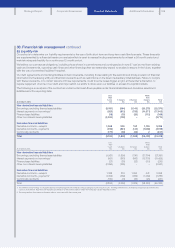

The following is an analysis of the contractual undiscounted cash flows payable under financial liabilities and derivative assets and

liabilities as at the reporting date:

At 31 March 2014

Less

than

1 year

£m

1-2 years

£m

2-3 years

£m

More

than

3 years

£m

Total

£m

Non-derivative financial liabilities

Borrowings, excluding finance lease liabilities (3,091) (864) (1,140) (20,275) (25,370)

Interest payments on borrowings1(826) (812) (796) (14,571) (17,005)

Finance lease liabilities (18) (19) (20) (112) (169)

Other non-interest bearing liabilities (2,584) (190) – – (2,774)

Derivative financial liabilities

Derivative contracts – receipts 1,068 950 153 1,155 3,326

Derivative contracts – payments (556) (861) (144) (1,638) (3,199)

Commodity contracts (177) (30) (22) 2(227)

Total (6,184) (1,826) (1,969) (35,439) (45,418)

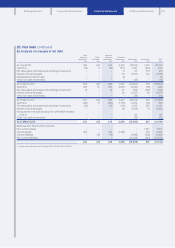

At 31 March 2013

Less

than

1 year

£m

1-2 years

£m

2-3 years

£m

More

than

3 years

£m

Total

£m

Non-derivative financial liabilities

Borrowings, excluding finance lease liabilities (3,061) (1,836) (790) (21,704) ( 2 7,3 9 1)

Interest payments on borrowings1(951) (861) (842) (15,775) (18,429)

Finance lease liabilities (27) (26) (26) (151) (230)

Other non-interest bearing liabilities (2,696) (235) – – (2,931)

Derivative financial liabilities

Derivative contracts – receipts 1,388 816 1,053 441 3,698

Derivative contracts – payments2(1,309) (469) (969) (1,039) (3,786)

Commodity contracts (150) (41) (35) (25) (251)

Total (6,806) (2,652) (1,609) (38,253) (49,320)

1. The interest on borrowings is calculated based on borrowings held at 31 March without taking account of future issues. Floating-rate interest is estimated using a forward interest rate

curve as at 31 March. Payments are included on the basis of the earliest date on which the Company can be required to settle.

2. The comparatives have been restated on a basis consistent with the current year.

139