National Grid 2014 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

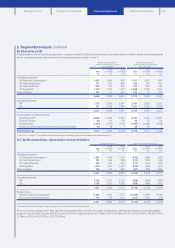

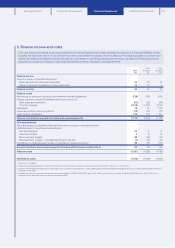

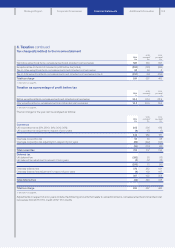

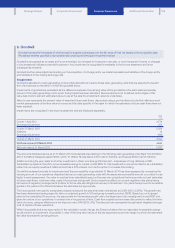

6. Taxation continued

Tax charged/(credited) to other comprehensive income and equity

2014

£m

2013

(restated)1

£m

2012

(restated)1

£m

Current tax

Share-based payment (3) 1(3)

Available-for-sale investments (5) – –

Deferred tax

Available-for-sale investments 22 2

Cash flow hedges 513 (2)

Share-based payment (4) 1 –

Remeasurements of net retirement benefit obligations 172 (179) (342)

167 (162) (345)

Total tax recognised in the statement of comprehensive income 174 (164) (342)

Total tax relating to share-based payment recognised directly in equity (7) 2(3)

167 (162) (345)

1. See note 1 on page 92.

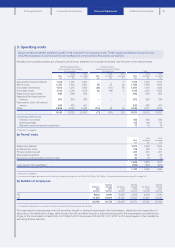

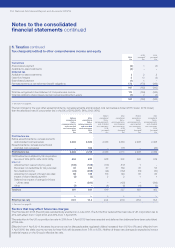

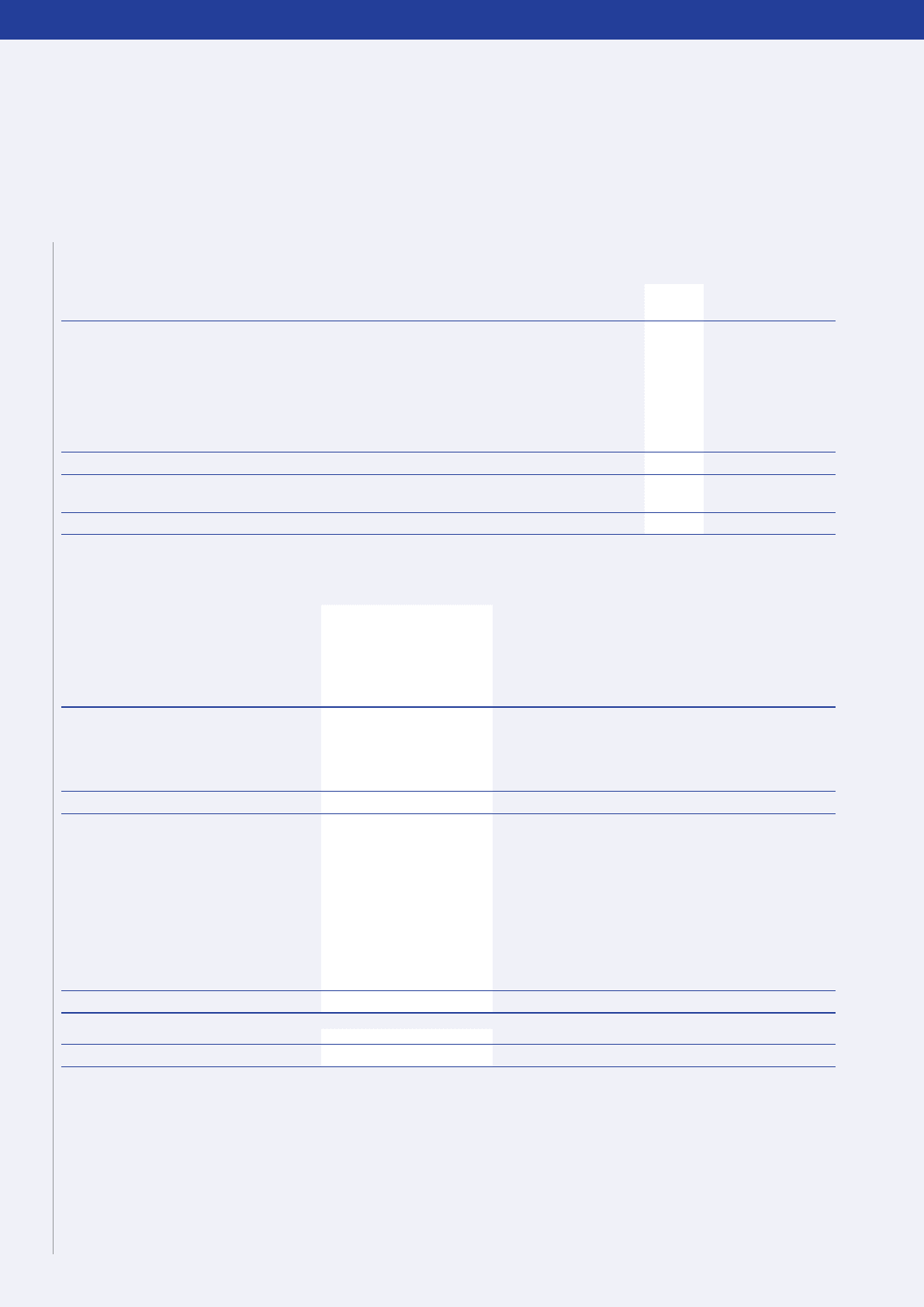

The tax charge for the year after exceptional items, remeasurements and stranded cost recoveries is lower (2013: lower; 2012: lower)

than the standard rate of corporation tax in the UK of 23% (2013: 24%; 2012: 26%).

Before

exceptional

items,

remeasurements

and stranded

cost recoveries

2014

£m

After

exceptional

items,

remeasurements

and stranded

cost recoveries

2014

£m

Before

exceptional

items,

remeasurements

and stranded

cost recoveries

2013

(restated)1

£m

After

exceptional

items,

remeasurements

and stranded

cost recoveries

2013

(restated)1

£m

Before

exceptional

items,

remeasurements

and stranded

cost recoveries

2012

(restated)1

£m

After

exceptional

items,

remeasurements

and stranded

cost recoveries

2012

(restated)1

£m

Profit before tax

Before exceptional items, remeasurements

andstranded cost recoveries 2,584 2,584 2,533 2,533 2,408 2,408

Exceptional items, remeasurements and

stranded cost recoveries –164 –178 –(26)

Profit before tax 2,584 2,748 2,533 2,711 2,408 2,382

Profit before tax multiplied by UK corporation

taxrate of 23% (2013: 24%; 2012: 26%) 594 632 608 651 626 619

Effect of:

Adjustments in respect of prior years (109) (109) (116) (117 ) 1 –

Expenses not deductible for tax purposes 32 284 37 169 36 55

Non-taxable income (24) (268) (24) (152) (19) (30)

Adjustment in respect of foreign tax rates 98 138 116 140 63 63

Impact of share-based payment (3) (3) 2 2 1 1

Deferred tax impact of change in UK and

UStax rates – (390) –(128) –(242)

Other (7) –(4) (8) (11) (3)

Total tax 581 284 619 557 697 463

% % % % % %

Effective tax rate 22.5 10.3 24.4 20.5 28.9 19.4

1. See note 1 on page 92.

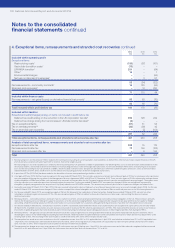

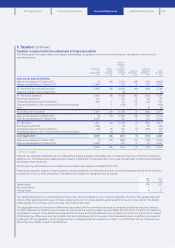

Factors that may affect future tax charges

The Finance Act 2013 (the Act) was substantively enacted on 2 July 2013. The Act further reduced the main rate of UK corporation tax to

21% with effect from 1 April 2014 and 20% from 1 April 2015.

The reduction in the UK corporation tax rate to 20% from 1 April 2015 has been enacted and deferred tax balances have been calculated

at this rate.

Effective from 1 April 2014, the state income tax rate for Massachusetts regulated utilities increased from 6.5% to 8% and, effective from

1 April 2016, the state income tax rate for New York will decrease from 7.1% to 6.5%. Neither of these rate changes is expected to have a

material impact on the Group’s effective tax rate.

Notes to the consolidated

financial statements continued

104 National Grid Annual Report and Accounts 2013/14