National Grid 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 National Grid annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

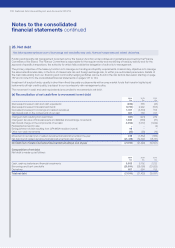

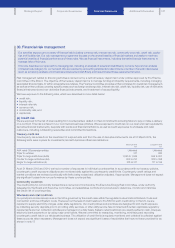

26. Net debt

Net debt represents the amount of borrowings and overdrafts, less cash, financial investments and related derivatives.

Funding and liquidity risk management is carried out by the treasury function under policies and guidelines approved by the Finance

Committee of the Board. The Finance Committee is responsible for the regular review and monitoring of treasury activity and for the

approval of specific transactions, the authority for which falls outside the delegation of authority to management.

The primary objective of the treasury function is to manage our funding and liquidity requirements. A secondary objective is to manage

the associated financial risks, in the form of interest rate risk and foreign exchange risk, to within pre-authorised parameters. Details of

the main risks arising from our financing and commodity hedging activities can be found in the risk factors discussion starting on page

167 and in note 30 to the consolidated financial statements on pages 137 to 144.

Investment of surplus funds, usually in short-term fixed deposits or placements with money market funds that invest in highly liquid

instruments of high credit quality, is subject to our counterparty risk management policy.

The movement in cash and cash equivalents is reconciled to movements in net debt.

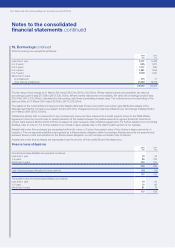

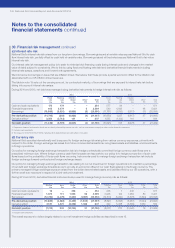

(a) Reconciliation of net cash flow to movement in net debt

2014

£m

2013

£m

2012

£m

(Decrease)/increase in cash and cash equivalents (283) 335 (43)

(Decrease)/increase in financial investments (1,720) 2,992 (553)

Decrease/(increase) in borrowings and related derivatives 1,021 (4,304) 154

Net interest paid on the components of net debt 841 756 721

Change in debt resulting from cash flows (141) (221) 279

Changes in fair value of financial assets and liabilities and exchange movements 1,360 (536) (87)

Net interest charge on the components of net debt (1,053) (1,017) (1,042)

Reclassified as held for sale ––(2)

Extinguishment of debt resulting from LIPA MSA transition (note 4) 98 – –

Other non-cash movements (25) (58) (14)

Movement in net debt (net of related derivative financial instruments) in the year 239 (1,832) (866)

Net debt (net of related derivative financial instruments) at start of year (21,429) (19,597) (18,731)

Net debt (net of related derivative financial instruments) at end of year (21,190) (21,429) (19,597)

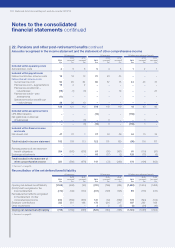

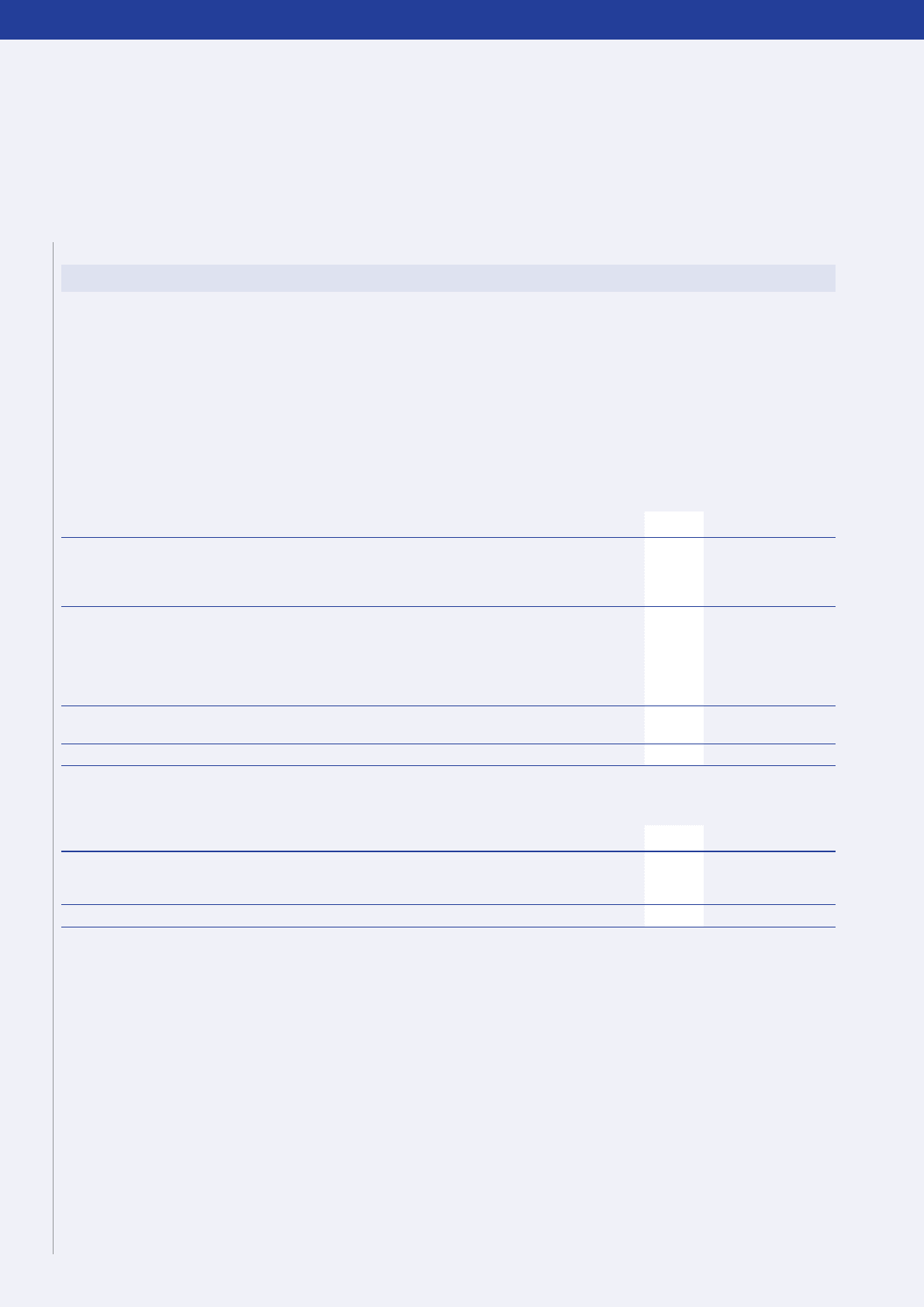

Composition of net debt

Net debt is made up as follows:

2014

£m

2013

£m

2012

£m

Cash, cash equivalents and financial investments 3,953 6,102 2,723

Borrowings and bank overdrafts (25,950) (28,095) (23,025)

Derivatives 807 564 705

Total net debt (21,190) (21,429) (19,597)

Notes to the consolidated

financial statements continued

130 National Grid Annual Report and Accounts 2013/14