MoneyGram 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

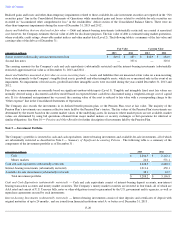

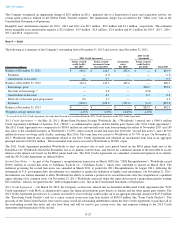

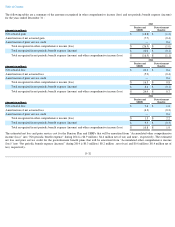

The following table is a summary of the Company’s weighted-

average asset allocation for the Pension Plan by asset category at the measurement

date for the years ended December 31 :

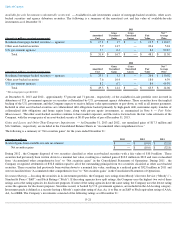

The Company records its pension assets at fair value as described in Note 4 — Fair Value Measurement.

The following is a description of the

Pension Plan’s investments at fair value and valuation methodologies:

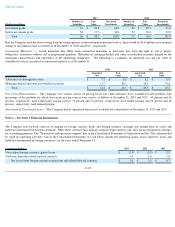

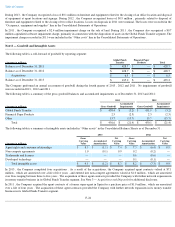

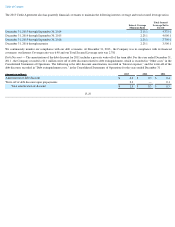

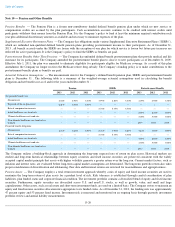

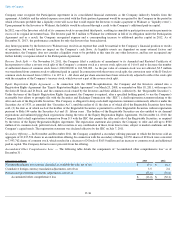

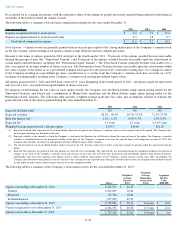

The following tables are a summary of the Pension Plan’s financial assets recorded at fair value, by hierarchy level, as of December 31 :

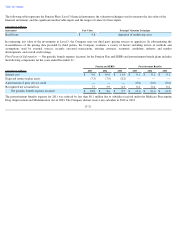

The Company’s pension plan assets include one

security that the Company considers to be a Level 3 asset for valuation purposes. This security

is an investment in a real estate joint venture and requires the use of unobservable inputs in its fair value measurement. The fair value of this

asset as of December 31, 2013 and 2012 was $4.8 million

. The change in reported net asset value for this asset resulted in a nominal unrealized

gain for 2013 and 2012 .

F-30

2013

2012

Equity securities

45.0

%

56.9

%

Fixed income securities

50.8

%

38.4

%

Real estate

3.5

%

4.0

%

Other

0.7

%

0.7

%

Total

100.0

%

100.0

%

• Short-term investment funds —

These securities are valued at historical cost, which approximates fair value.

• Common collective trusts issued and held by the trustee —

The fair values of the underlying funds in the common/collective trusts

are valued based on the net asset value established for each fund at each valuation date. The net asset value of a collective

investment fund is calculated by dividing the fund's net asset value on the calculation date by the number of units of the fund that

are outstanding on the calculation date, which is derived from observable purchase and redemption activity in the collective

investment fund.

•

Mutual Funds

—

The fair value of the mutual fund issued by registered investment companies is determined using quoted market

prices on the day of valuation.

•

Real estate

—

The Pension Plan trust holds an investment in a real estate development project. The fair value of this investment

represents the estimated fair value of the plan’

s related ownership percentage in the project based upon an appraisal of the

underlying real property as of each balance sheet date. The fund investment strategy for this asset is long-term capital appreciation.

2013

(Amounts in millions) Level 1

Level 2

Level 3

Total

Short-term investment fund

$

—

$

0.9

$

—

$

0.9

Common collective trust — equity securities

Large Cap securities

—

32.8

—

32.8

Small Cap securities

—

8.5

—

8.5

International securities

—

16.8

—

16.8

Emerging markets

—

3.4

—

3.4

Common collective trust — fixed income securities

Core fixed income

—

69.4

—

69.4

Real estate

—

—

4.8

4.8

Total financial assets

$

—

$

131.8

$

4.8

$

136.6

2012

(Amounts in millions) Level 1

Level 2

Level 3

Total

Short-term investment fund

$

—

$

0.9

$

—

$

0.9

Common collective trust — equity securities

Large Cap securities

—

46.1

—

46.1

Small Cap securities

—

11.7

—

11.7

International securities

—

11.2

—

11.2

Common collective trust — fixed income securities

Core fixed income

—

46.7

—

46.7

Real estate

—

—

4.8

4.8

Total financial assets

$

—

$

116.6

$

4.8

$

121.4