MoneyGram 2013 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

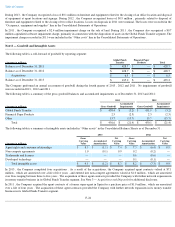

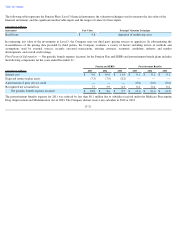

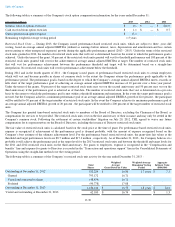

The following tables are a summary of the amounts recognized in other comprehensive income (loss) and net periodic benefit expense (income)

for the years ended December 31 :

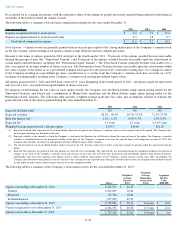

The estimated net loss and prior service cost for the Pension Plan and SERPs that will be amortized from “

Accumulated other comprehensive

income (loss)” into “Net periodic benefit expense” during 2014 is $6.9 million ( $4.4 million net of tax) and none

, respectively. The estimated

net loss and prior service credit for the postretirement benefit plans that will be amortized from “

Accumulated other comprehensive income

(loss)” into “Net periodic benefit expense (income)” during 2014 is $0.3 million ( $0.2 million , net of tax) and $0.6 million ( $0.4 million

net of

tax), respectively.

F-32

2013

(Amounts in millions) Pension and

SERPs

Postretirement

Benefits

Net actuarial gain

$

(18.8

)

$

(1.2

)

Amortization of net actuarial gain

(7.7

)

(0.4

)

Amortization of prior service credit

—

0.6

Total recognized in other comprehensive income (loss)

$

(26.5

)

$

(1.0

)

Total recognized in net periodic benefit expense (income)

$

10.0

$

(0.1

)

Total recognized in net periodic benefit expense (income) and other comprehensive income (loss)

$

(16.5

)

$

(1.1

)

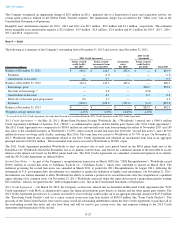

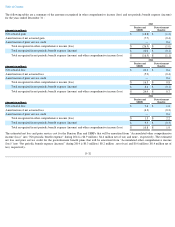

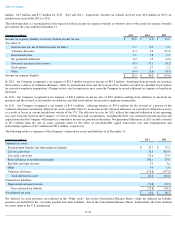

2012

(Amounts in millions) Pension and

SERPs

Postretirement

Benefits

Net actuarial loss

$

22.2

$

0.6

Amortization of net actuarial loss

(5.9

)

(0.4

)

Amortization of prior service credit

—

0.6

Total recognized in other comprehensive income (loss)

$

16.3

$

0.8

Total recognized in net periodic benefit expense (income)

$

8.6

$

(0.1

)

Total recognized in net periodic benefit expense (income) and other comprehensive income (loss)

$

24.9

$

0.7

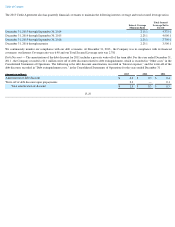

2011

(Amounts in millions) Pension and

SERPs

Postretirement

Benefits

Net actuarial loss

$

7.6

$

1.8

Amortization of net actuarial loss

(6.3

)

(0.2

)

Amortization of prior service credit

—

0.6

Total recognized in other comprehensive income (loss)

$

1.3

$

2.2

Total recognized in net periodic benefit expense (income)

$

9.5

$

(0.3

)

Total recognized in net periodic benefit expense (income) and other comprehensive income (loss)

$

10.8

$

1.9