MoneyGram 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Company must recognize the Participation Agreement in its consolidated financial statements as the Company indirectly benefits from the

agreement. A liability and the related expense associated with the Participation Agreement would be recognized by the Company in the period in

which it becomes probable that a liquidity event will occur that would require the Investors to make a payment to Walmart (a “liquidity event”

).

Upon payment by the Investors to Walmart, the liability would be released through a credit to the Company’s additional paid-in capital.

In 2012, one of the Investors sold all of its common stock to an unrelated third-

party, resulting in cumulative participation securities payments in

excess of its original investment basis. The Investor paid $0.3 million

to Walmart for settlement in full of its obligation under the Participation

Agreement and as a result, the Company recognized expense and a corresponding increase to additional paid-

in capital in 2012. As of

December 31, 2013 , the performance condition for only this Investor has been achieved.

Any future payments by the Investors to Walmart may result in an expense that could be material to the Company’

s financial position or results

of operations, but would have no impact on the Company’

s cash flows. As liquidity events are dependent on many external factors and

uncertainties, the Company does not consider a liquidity event to be probable at this time for any other Investors, and has not recognized any

further liability or expense related to the Participation Agreement.

Reverse Stock Split

—

On November 14, 2011, the Company filed a certificate of amendment to its Amended and Restated Certificate of

Incorporation to effect a reverse stock split of the Company’s common stock at a reverse stock split ratio of 1-for-

8 and to decrease the number

of authorized shares of common stock from 1,300,000,000 to 162,500,000 . As the par value of common stock was not affected,

$3.5 million

was transferred from common stock to additional paid in capital. In connection with the reverse stock split, the conversion ratio of the D Stock to

common stock decreased from 1,000 to 1 to 125 to 1

. All share and per share amounts have been retroactively adjusted to reflect the stock split

with the exception of the Company’s treasury stock, which was not a part of the reverse stock split.

Equity Registration Rights Agreement

—

In connection with the 2008 Recapitalization, the Company and the Investors entered into a

Registration Rights Agreement (the “Equity Registration Rights Agreement”)

on March 25, 2008, as amended on May 18, 2011, with respect to

the Series B Stock and D Stock, and the common stock owned by the Investors and their affiliates (collectively, the “Registrable Securities”

).

Under the terms of the Equity Registration Rights Agreement, the Company is required, after a specified holding period, to use the Company's

reasonable best efforts to promptly file with the Securities and Exchange Commission (the “SEC”)

a shelf registration statement relating to the

offer and sale of the Registrable Securities. The Company is obligated to keep such shelf registration statement continuously effective under the

Securities Act of 1933, as amended (the “Securities Act”),

until the earlier of (1) the date as of which all of the Registrable Securities have been

sold, (2) the date as of which each of the holders of the Registrable Securities is permitted to sell its Registrable Securities without registration

pursuant to Rule 144 under the Securities Act and (3) fifteen years . The holders of the Registrable Securities are also entitled to six

demand

registrations and unlimited piggyback registrations during the term of the Equity Registration Rights Agreement. On December 14, 2010, the

Company filed a shelf registration statement on Form S-

3 with the SEC that permits the offer and sale of the Registrable Securities, as required

by the terms of the Equity Registration Rights Agreement. The registration statement also permits the Company to offer and sell up to

$500

million

of its common stock, preferred stock, debt securities or any combination of these, from time to time, subject to market conditions and the

Company’s capital needs. The registration statement was declared effective by the SEC on July 7, 2011.

Secondary Offering —

In November and December 2011, the Company completed a secondary offering pursuant to which the Investors sold an

aggregate of 10,237,524 shares in an underwritten offering. In connection with the secondary offering, 63,950

shares of D Stock were converted

to 7,993,762 shares of common stock, which resulted in a decrease to D Stock of $165.0 million

and an increase to common stock and additional

paid in capital. The Company did not receive proceeds from the offering.

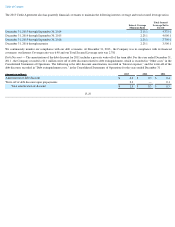

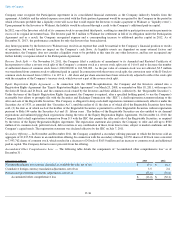

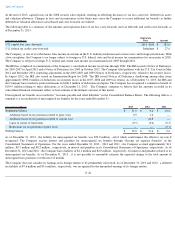

Accumulated Other Comprehensive Loss

— The following table details the components of “Accumulated other comprehensive loss”

as of

December 31 :

F-36

(Amounts in millions) 2013

2012

Net unrealized gains on securities classified as available-for-sale, net of tax

$

17.3

$

16.3

Cumulative foreign currency translation adjustments, net of tax

3.5

2.6

Pension and postretirement benefits adjustments, net of tax

(53.8

)

(71.2

)

Accumulated other comprehensive loss

$

(33.0

)

$

(52.3

)