MoneyGram 2013 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

and restructuring costs recorded in the “Transaction and operations support” line and facilities and certain related asset write-

off charges

recorded in the “Occupancy, equipment and supplies”

line in the operating expense section of the Consolidated Statements of Operations. During

2011, the Company recognized an impairment charge of $2.4 million for reorganization-related efforts to dispose of land held for non-

operating

purposes.

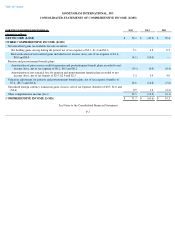

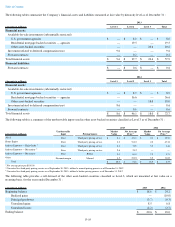

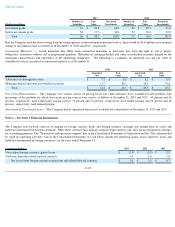

Other (Income) Expense —

Other (income) expense is recorded in a separate section below operating income and includes items based on

management’

s assessment of their nature as these are not directly related to operating activities. Included in other (income) expense are securities

gains, interest expense, debt extinguishment costs and other costs. The following is a summary of other costs for the years ended December 31 :

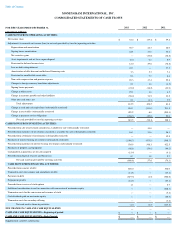

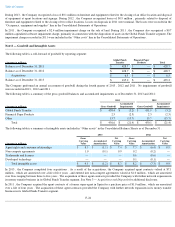

Earnings Per Share

— For discrete periods from January 1, 2008 through June 30, 2011, the Company utilized the two-

class method for

computing basic earnings per common share, which reflects the amount of undistributed earnings allocated to the common stockholders using

the participation percentage of each class of stock. Undistributed earnings were determined as the Company’

s net income less dividends

declared, accumulated, deemed or paid on preferred stock. The undistributed earnings allocated to the common stockholders were divided by the

weighted-average number of common shares outstanding during the period to compute basic earnings per common share.

For all periods in which it is outstanding, the D Stock is included in the weighted-

average number of common shares outstanding utilized to

calculate basic earnings per common share because the D Stock is deemed a common stock equivalent. Diluted earnings per common share

reflects the potential dilution that could result if securities or incremental shares arising out of the Company’s stock-

based compensation plans

and the outstanding shares of the Company’

s Series B Stock were exercised or converted into common stock. Diluted earnings per common

share assumes the exercise of stock options using the treasury stock method and the conversion of the Series B Stock using the if-

converted

method.

Effective for discrete periods beginning after June 30, 2011, the Company no longer applies the two-

class method of calculating basic earnings

per share because the Series B Stock is no longer outstanding and the D Stock is deemed a common stock equivalent.

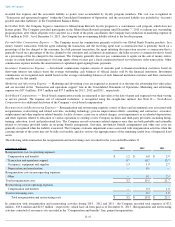

The following table is a reconciliation of the weighted-average amounts used in calculating earnings per share for the period ended

December

31 :

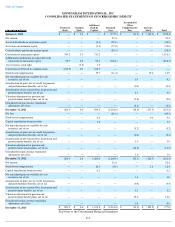

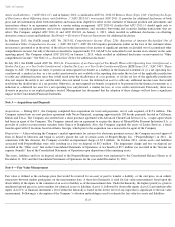

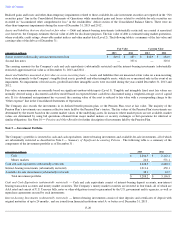

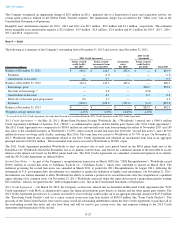

Potential common shares are excluded from the computation of diluted earnings per common share when the effect would be anti-

dilutive. All

potential common shares are anti-dilutive in periods of net loss available to common stockholders. Stock options are anti-

dilutive when the

exercise price of these instruments is greater than the average market price of the Company’

s common stock for the period. The Series B Stock

was anti-dilutive when the incremental earnings per share of Series B Stock on an if-

converted basis is greater than the basic income (loss) per

common share. The following table summarizes the weighted-

average potential common shares excluded from diluted income (loss) per

common share as their effect would be anti-dilutive or their performance conditions are not met for the years ended December 31 :

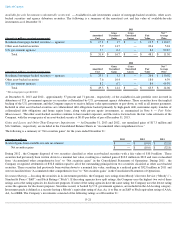

Recent Accounting Pronouncements and Related Developments

— In December 2011, the Financial Accounting Standards Board (“FASB”

)

issued Accounting Standards Update (“ASU”) No. 2011-11, Balance Sheet (Topic 210): Disclosures about Offsetting

F-16

(Amounts in millions) 2013

2012

2011

Capital transaction costs

$

—

$

—

$

6.4

Disposal loss from asset dispositions —

0.1

1.0

Impairment loss from asset dispositions —

—

4.5

Contribution from investors —

0.3

—

Total other costs

$

—

$

0.4

$

11.9

(Amounts in millions) 2013

2012

2011

Basic common shares outstanding

71.6

71.5

48.6

Shares related to stock options

0.2

—

—

Shares related to restricted stock and stock units

0.1

—

—

Diluted common shares outstanding

71.9

71.5

48.6

(Amounts in millions) 2013

2012

2011

Shares related to stock options

3.6

4.9

5.1

Shares related to restricted stock and stock units

0.8

0.5

0.1

Shares related to preferred stock —

—

21.0

Shares excluded from the computation

4.4

5.4

26.2