MoneyGram 2013 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

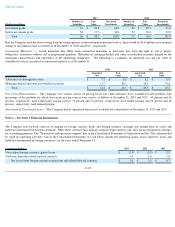

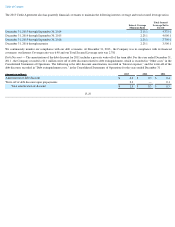

The Company recognized an impairment charge of $2.0 million in 2011

, primarily due to a disposition of assets and acquisition activity, for

certain agent contracts utilized in the Global Funds Transfer segment. The impairment charge was recorded in the “Other costs”

line in the

Consolidated Statements of Operations.

Intangible asset amortization expense for 2013 , 2012 and 2011 was $0.7 million , $0.9 million and $1.1 million

, respectively. The estimated

future intangible asset amortization expense is $2.0 million , $1.9 million , $1.8 million , $1.4 million and $1.2 million for 2014 , 2015 , 2016

,

2017 and 2018 , respectively.

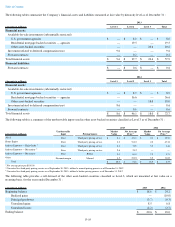

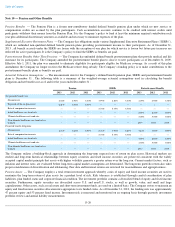

Note 9 — Debt

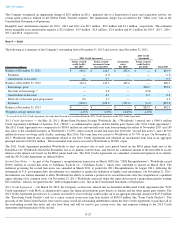

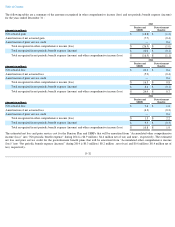

The following is a summary of the Company's outstanding debt at December 31, 2013 and activity since December 31, 2011 :

(1)

As a result of the 2013 Credit Agreement, the entire debt discount was transferred from the 2011 Credit Agreement to the 2013 Credit Agreement.

2011 Credit Agreement — On May 18, 2011, MoneyGram Payment Systems Worldwide, Inc. (“Worldwide”) entered into a

$540.0 million

Credit Agreement with Bank of America, N.A. ("BOA"), as Administrative Agent, and the lenders party thereto (the "2011 Credit Agreement").

The 2011 Credit Agreement was comprised of a $390.0 million six-and-one-half-

year term loan maturing the earlier of November 2017 and 180

days prior to the scheduled maturity of Worldwide’s 13.25% senior secured second lien notes due 2018 (the "second lien notes"), and a

$150.0

million five-year revolving credit facility, maturing May 2016. The term loan was issued to Worldwide at 99.75%

of par. On November 21,

2011, Worldwide entered into an amendment related to the 2011 Credit Agreement and obtained an incremental term loan in an aggregate

principal amount of $150.0 million . The incremental term loan was issued to Worldwide at 98.00% of par.

The 2011 Credit Agreement permitted Worldwide to elect an interest rate at each reset period based on the BOA prime bank rate or the

Eurodollar rate. Worldwide elected the Eurodollar rate as its primary interest basis, and elected for a minimal amount of the term debt to accrue

interest at the interest rate based on the BOA prime bank rate. The 2011 Credit Agreement was amended, restated and replaced in its entirety

with the 2013 Credit Agreement (as defined below).

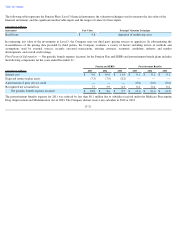

Second Lien Notes — As part of the Company’s recapitalization transaction in March 2008 (the “2008 Recapitalization”),

Worldwide issued

$500.0 million of second lien notes to Goldman, Sachs & Co. (“Goldman Sachs”),

which were scheduled to mature in March 2018. The

indenture governing the second lien notes was amended in March 2011 to permit the 2011 Recapitalization. In August 2011, following the

downgrade of U.S. government debt, the indenture was amended to update the definition of highly rated investments. On November 21, 2011,

the indenture was further amended to allow Worldwide the ability to redeem a portion of its second lien notes after the completion of a qualified

equity offering of its common stock. On November 23, 2011, Worldwide exercised under this right and incurred a prepayment penalty totaling

$23.2 million , which is recognized in the “Debt extinguishment costs” line in the Consolidated Statements of Operations.

2013 Credit Agreement —

On March 28, 2013, the Company, as borrower, entered into an Amended and Restated Credit Agreement (the "2013

Credit Agreement") with BOA, as administrative agent, the financial institutions party thereto as lenders and the other agents party thereto. The

2013 Credit Agreement provides for (i) a senior secured five-year revolving credit facility up to an aggregate principal amount of

$125.0 million

(the "Revolving Credit Facility") and (ii) a senior secured seven-year term loan facility of $850.0 million

(the "Term Credit Facility"). The

proceeds of the Term Credit Facility were used to repay in full all outstanding indebtedness under the 2011 Credit Agreement, to purchase all of

the outstanding second lien notes and also have been and will be used to pay certain costs, fees and expenses relating to the 2013 Credit

Agreement and the purchase of the second

F-25

2011 Credit Agreement

2013 Credit

Agreement

(Amounts in millions)

Senior secured

credit facility

due 2017

Senior secured

incremental term

loan due 2017

Second lien

notes

due 2018

Senior secured

credit facility

due 2020

Total debt

Balance at December 31, 2011

$

339.2

$

146.7

$

325.0

$

—

$

810.9

Payments

—

(

1.5

)

—

—

(

1.5

)

Amortization of discount

0.2

0.3

—

—

0.5

Balance at December 31, 2012

339.4

145.5

325.0

—

809.9

Borrowings, gross

—

—

—

850.0

850.0

Discount on borrowings

(1)

—

0.8

—

(

0.8

)

—

Amortization of discount

—

0.1

—

0.1

0.2

Write-off of discount upon prepayment

0.6

1.7

—

—

2.3

Payments

(340.0

)

(148.1

)

(325.0

)

(6.4

)

(819.5

)

Balance at December 31, 2013

$

—

$

—

$

—

$

842.9

$

842.9

Weighted average interest rate

4.25

%

4.25

%

13.25

%

4.25

%