MoneyGram 2013 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

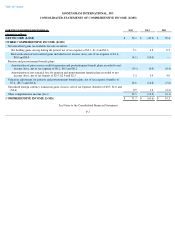

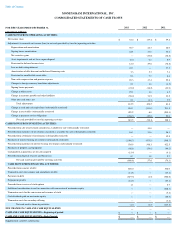

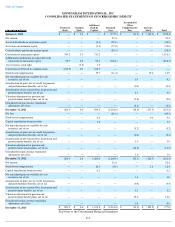

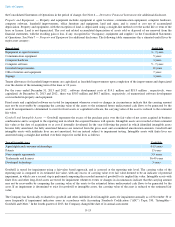

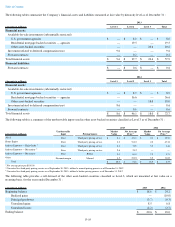

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ DEFICIT

See Notes to the Consolidated Financial Statements

F-9

(Amounts in millions) Preferred

Stock

Common

Stock

Additional

Paid-In

Capital

Retained

Loss

Accumulated

Other

Comprehensive

Loss

Treasury

Stock

Total

January 1, 2011

$

—

$

0.9

$

—

$

(

771.5

)

$

(31.9

)

$

(139.9

)

$

(942.4

)

Net income

—

—

—

59.4

—

—

59.4

Accrued dividends on mezzanine equity

—

—

(

2.1

)

(28.8

)

—

—

(

30.9

)

Accretion on mezzanine equity

—

—

(

1.6

)

(77.0

)

—

—

(

78.6

)

Cash dividends paid on mezzanine equity

—

—

—

(

20.5

)

—

—

(

20.5

)

Conversion of mezzanine equity

394.2

2.9

713.2

—

—

—

1,110.3

Additional consideration in connection with

conversion of mezzanine equity

52.7

0.2

95.6

(366.8

)

—

—

(

218.3

)

1 for 8 reverse stock split

—

(

3.5

)

3.5

—

—

—

—

Conversion of D Stock to common stock

(165.0

)

0.1

164.9

—

—

—

—

Stock-based compensation

—

—

15.7

(11.4

)

—

12.6

16.9

Net unrealized gain on available-for-sale

securities, net of tax

—

—

—

—

0.3

—

0.3

Amortization of prior service credit for pension

and postretirement benefits, net of tax

—

—

—

—

(

0.4

)

—

(

0.4

)

Amortization of net actuarial loss for pension and

postretirement benefits, net of tax

—

—

—

—

4.0

—

4.0

Valuation adjustment for pension and

postretirement benefit plans, net of tax

—

—

—

—

(

5.8

)

—

(

5.8

)

Unrealized foreign currency translation

adjustment, net of tax

—

—

—

—

(

4.2

)

—

(

4.2

)

December 31, 2011

281.9

0.6

989.2

(1,216.6

)

(38.0

)

(127.3

)

(110.2

)

Net loss

—

—

—

(

49.3

)

—

—

(

49.3

)

Stock-based compensation

—

—

8.6

—

—

0.6

9.2

Capital contribution from investors

—

—

3.2

—

—

—

3.2

Net unrealized gain on available-for-sale

securities, net of tax

—

—

—

—

(

5.2

)

—

(

5.2

)

Amortization of prior service credit for pension

and postretirement benefits, net of tax

—

—

—

—

(

0.4

)

—

(

0.4

)

Amortization of net actuarial loss for pension and

postretirement benefits, net of tax

—

—

—

—

3.9

—

3.9

Valuation adjustment for pension and

postretirement benefit plans, net of tax

—

—

—

—

(

14.2

)

—

(

14.2

)

Unrealized foreign currency translation

adjustment, net of tax

—

—

—

—

1.6

—

1.6

December 31, 2012

281.9

0.6

1,001.0

(1,265.9

)

(52.3

)

(126.7

)

(161.4

)

Net income

—

—

—

52.4

—

—

52.4

Stock-based compensation

—

—

10.5

(0.9

)

—

2.8

12.4

Capital contribution from investors

—

—

0.3

—

—

—

0.3

Net unrealized gain on available-for-sale

securities, net of tax

—

—

—

—

1.0

—

1.0

Amortization of prior service credit for pension

and postretirement benefits, net of tax

—

—

—

—

(

0.4

)

—

(

0.4

)

Amortization of net actuarial loss for pension and

postretirement benefits, net of tax

—

—

—

—

5.2

—

5.2

Valuation adjustment for pension and

postretirement benefit plans, net of tax

—

—

—

—

12.6

—

12.6

Unrealized foreign currency translation

adjustment, net of tax

—

—

—

—

0.9

—

0.9

December 31, 2013

$

281.9

$

0.6

$

1,011.8

$

(1,214.4

)

$

(33.0

)

$

(123.9

)

$

(77.0

)