MoneyGram 2013 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

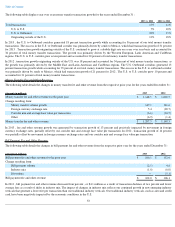

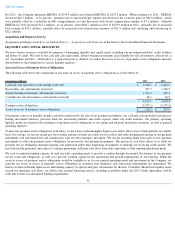

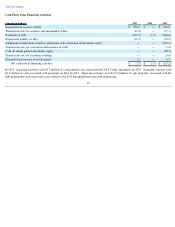

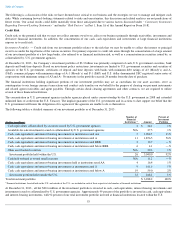

The following table is a summary of our outstanding debt at December 31 :

(1)

Reflects interest expected to be paid in 2014 using the rates in effect on December 31, 2013 , assuming no prepayments of principal.

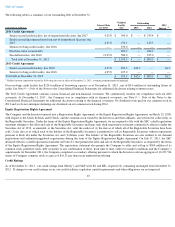

Our revolving credit facility has $124.6 million of borrowing capacity as of December 31, 2013 , net of $0.4 million

of outstanding letters of

credit. See Note 9 — Debt of the Notes to the Consolidated Financial Statements for additional disclosure relating to interest rates.

The 2013 Credit Agreement contains various financial and non-

financial covenants. We continuously monitor our compliance with our debt

covenants. At December 31, 2013 , the Company was in compliance with its financial covenants; see Note 9 — Debt

of the Notes to the

Consolidated Financial Statements

for additional disclosure relating to the financial covenants. No dividends were paid on our common stock in

2013 and we do not anticipate declaring any dividends on our common stock during 2014 .

Equity Registration Rights Agreement

The Company and the Investors entered into a Registration Rights Agreement, or the Equity Registration Rights Agreement, on March 25, 2008,

with respect to the Series B Stock and D Stock, and the common stock owned by the Investors and their affiliates, also referred to collectively as

the Registrable Securities. Under the terms of the Equity Registration Rights Agreement, we are required to file with the SEC a shelf registration

statement relating to the offer and sale of the Registrable Securities and keep such shelf registration statement continuously effective under the

Securities Act of 1933, as amended, or the Securities Act, until the earlier of (1) the date as of which all of the Registrable Securities have been

sold, (2) the date as of which each of the holders of the Registrable Securities is permitted to sell its Registrable Securities without registration

pursuant to Rule 144 under the Securities Act and (3) fifteen years. The holders of the Registrable Securities are also entitled to six demand

registrations and unlimited piggyback registrations during the term of the Equity Registration Rights Agreement. On July 17, 2011, the SEC

declared effective a shelf registration statement on Form S-

3 that permits the offer and sale of the Registrable Securities, as required by the terms

of the Equity Registration Rights Agreement. The registration statement also permits the Company to offer and sell up to $500 million

of its

common stock, preferred stock, debt securities or any combination of these, from time to time, subject to market conditions and the Company’

s

capital needs. In December 2011, the Company completed a secondary offering pursuant to which the Investors sold an aggregate of

10,237,524

shares of Company common stock at a price of $16.25 per share in an underwritten offering.

Credit Ratings

As of December 31, 2013 , our credit ratings from Moody’s and S&P were B1 and BB-, respectively, remaining unchanged from

December 31,

2012 . If changes to our credit ratings occur, our credit facilities, regulatory capital requirements and other obligations are not impacted.

43

Interest Rate

for 2013

Original

Facility

Size

Outstanding

2014

Interest

(1)

(Amounts in millions) 2013

2012

2011 Credit Agreement

Senior secured credit facility, net of unamortized discount, due 2017

4.25

%

$

390.0

$

—

$

339.4

$

—

Senior secured incremental term loan, net of unamortized discount, due

2017

4.25

%

150.0

—

145.5

—

Senior revolving credit facility, due 2016

—

150.0

—

—

—

First lien senior secured debt

690.0

—

484.9

—

Second lien notes, due 2018

13.25

%

500.0

—

325.0

—

Total debt at December 31, 2012

$

1,190.0

$

—

$

809.9

$

—

2013 Credit Agreement

Senior secured credit facility, due 2020

4.25

%

850.0

842.9

—

36.2

Senior revolving credit facility, due 2018

4.25

%

125.0

—

—

—

Total debt at December 31, 2013

$

975.0

$

842.9

$

809.9

$

36.2