MoneyGram 2013 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

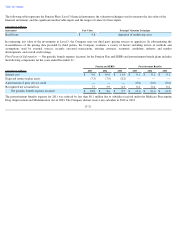

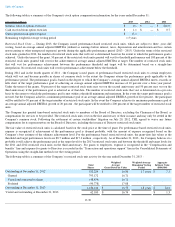

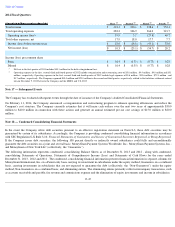

The following table is a summary of the Company's stock option compensation information for the years ended December 31 :

Restricted Stock Units

— During 2013, the Company issued performance-based restricted stock units, which are subject to three -

year cliff

vesting, based on average annual adjusted EBITDA (defined as earnings before interest, taxes, depreciation and amortization and less certain

non-recurring or other unexpected expenses) growth during the applicable performance period (2013 -

2015). Under the terms of the restricted

stock units granted in 2013, the number of restricted stock units that will vest is determined based on the extent to which the performance goal is

achieved. Under the terms of the grant, 50 percent of the restricted stock units granted will vest for threshold performance and 100 percent

of the

restricted stock units granted will vest for the achievement of average annual adjusted EBITDA at target. The number of restricted stock units

that will vest for performance achievement between the performance threshold and target will be determined based on a straight-

line

interpolation. No restricted stock units will vest for performance achievement below the threshold.

During 2012 and in the fourth quarter of 2011 , the Company issued grants of performance-

based restricted stock units to certain employees

which will vest and become payable in shares of common stock to the extent the Company attains the performance goals applicable to the

performance period. The performance goal is based on the degree to which the Company’

s average annual adjusted EBITDA meets, exceeds or

falls short of the target performance goal of achieving an average annual adjusted EBITDA increase of 10 percent over a three

year period.

Under the terms of the grants, 50 percent of the target restricted stock units may vest on the second anniversary and 50 percent

may vest on the

third anniversary if the performance goal is achieved as of that date. The number of restricted stock units that vest is determined on a pro rata

basis by the extent to which the performance goal is met within a threshold minimum and maximum. In the event the target performance goal is

not met, but the Company achieves a minimum performance goal of an average annual adjusted EBITDA growth of five percent

, the participant

will be entitled to 50 percent

of the target number of restricted stock units. In the event the Company achieves its maximum performance goal of

an average annual adjusted EBITDA growth of 20 percent , the participant will be entitled to 200 percent

of the target number of restricted stock

units.

The Company has granted time-

based restricted stock units to members of the Board of Directors, excluding the Chairman of the Board, as

compensation for services to be provided. The restricted stock units vest on the first anniversary of their issuance and may only be settled in the

Company's common stock. Following the settlement of certain stockholders' litigation on July 20, 2012, THL agreed to waive any future

compensation for its representatives on the Board of Directors, including the issuance of Director restricted stock units.

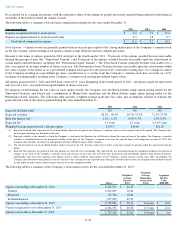

The fair value of restricted stock units is calculated based on the stock price at the time of grant. For performance based restricted stock units,

expense is recognized if achievement of the performance goal is deemed probable, with the amount of expense recognized based on the

Company’s best estimate of the ultimate achievement level. For the performance based restricted stock units, the grant-

date fair values at the

threshold and target performance levels are $8.7 million and $17.3 million , respectively. As of December 31, 2013

, the Company believes it is

probable it will achieve the performance goal at the target level for the 2013 restricted stock units and between the threshold and target levels for

the 2011 and 2012 restricted stock units on the third anniversary. For grants to employees, expense is recognized in the “

Compensation and

benefits” line and expense for grants to Directors is recorded in the “Transaction and operations support”

line in the Consolidated Statements of

Operations using the straight-line method over the vesting period.

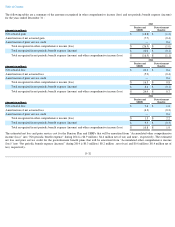

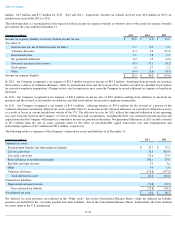

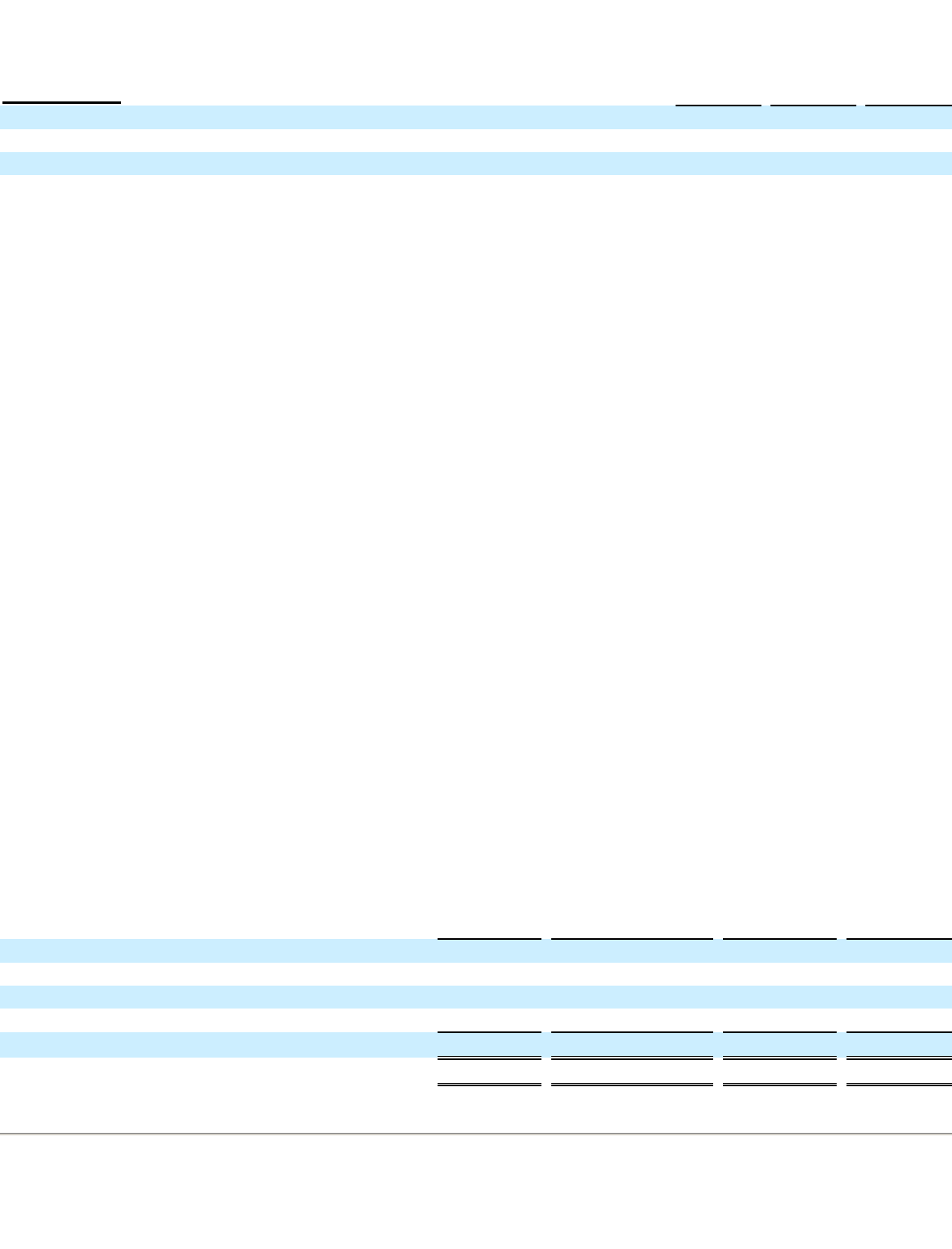

The following table is a summary of the Company’s restricted stock unit activity for the year ended December 31, 2013 :

F-39

(Amounts in millions) 2013

2012

2011

Intrinsic value of options exercised

$

0.1

$

—

$

221.9

Cash received from option exercises

$

1.1

$

—

$

0.7

Unrecognized stock option expense

$

13.3

Remaining weighted-average vesting period

1.5 years

Total

Shares

Weighted

Average

Grant Date Fair Value

Weighted-Average

Remaining Vesting

Period

Aggregate

Intrinsic Value

($000,000)

Outstanding at December 31, 2012

532,224

$

16.80

1.7 years

$

7.1

Granted

793,172

16.71

Vested and converted to shares

(48,474

)

16.71

Forfeited

(90,778

)

17.08

Outstanding at December 31, 2013

1,186,144

$

16.73

1.8 years

$

24.6

Vested and outstanding at December 31, 2013

62,100

$

16.74

$

1.3