MoneyGram 2013 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138

|

|

Table of Contents

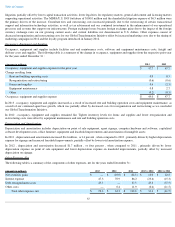

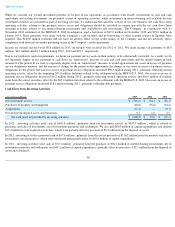

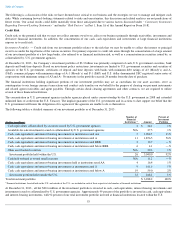

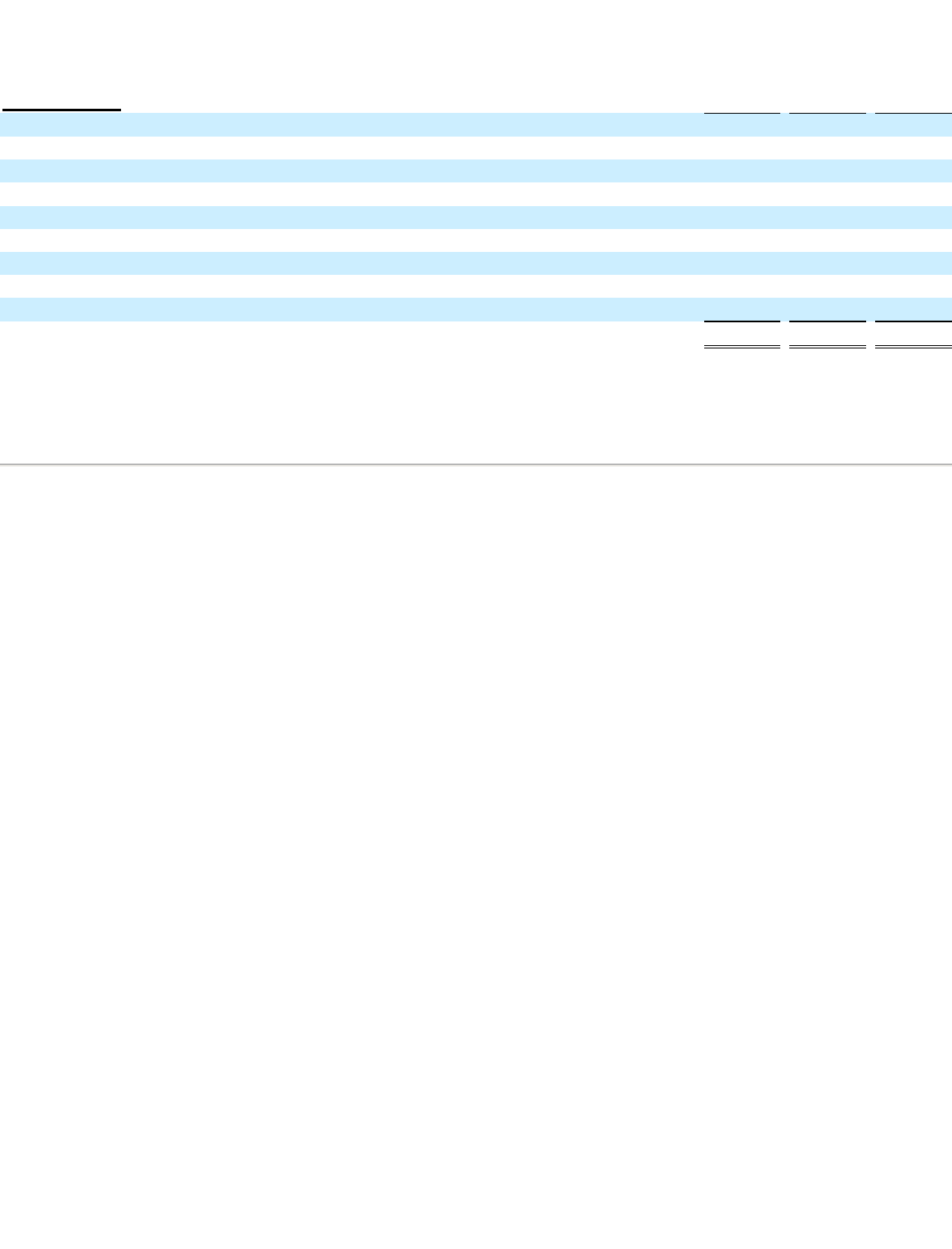

Cash Flows from Financing Activities

In 2013 , financing activities used $1.7 million of cash primarily associated with the 2013 Credit Agreement. In 2012

, financing activities used

$1.5 million of cash associated with payments on debt. In 2011 , financing activities used $117.8 million

of cash primarily associated with the

debt prepayments and transaction costs related to our 2011 Recapitalization and debt refinancing.

47

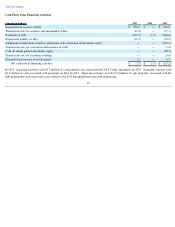

(Amounts in millions) 2013

2012

2011

Proceeds from issuance of debt

$

850.0

$

—

$

536.0

Transaction costs for issuance and amendment of debt

(11.8

)

—

(

17.1

)

Payments on debt

(819.5

)

(1.5

)

(366.6

)

Prepayment penalty on debt

(21.5

)

—

(

23.2

)

Additional consideration issued in connections with conversion of mezzanine equity —

—

(

218.3

)

Transaction costs for conversion and issuance of stock —

—

(

5.4

)

Cash dividends paid on mezzanine equity —

—

(

20.5

)

Transaction costs for secondary offering —

—

(

3.4

)

Proceeds from exercise of stock options

1.1

—

0.7

Net cash used in financing activities

$

(1.7

)

$

(1.5

)

$

(117.8

)