MoneyGram 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

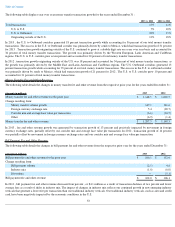

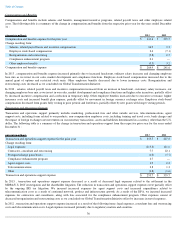

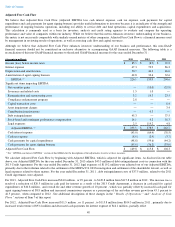

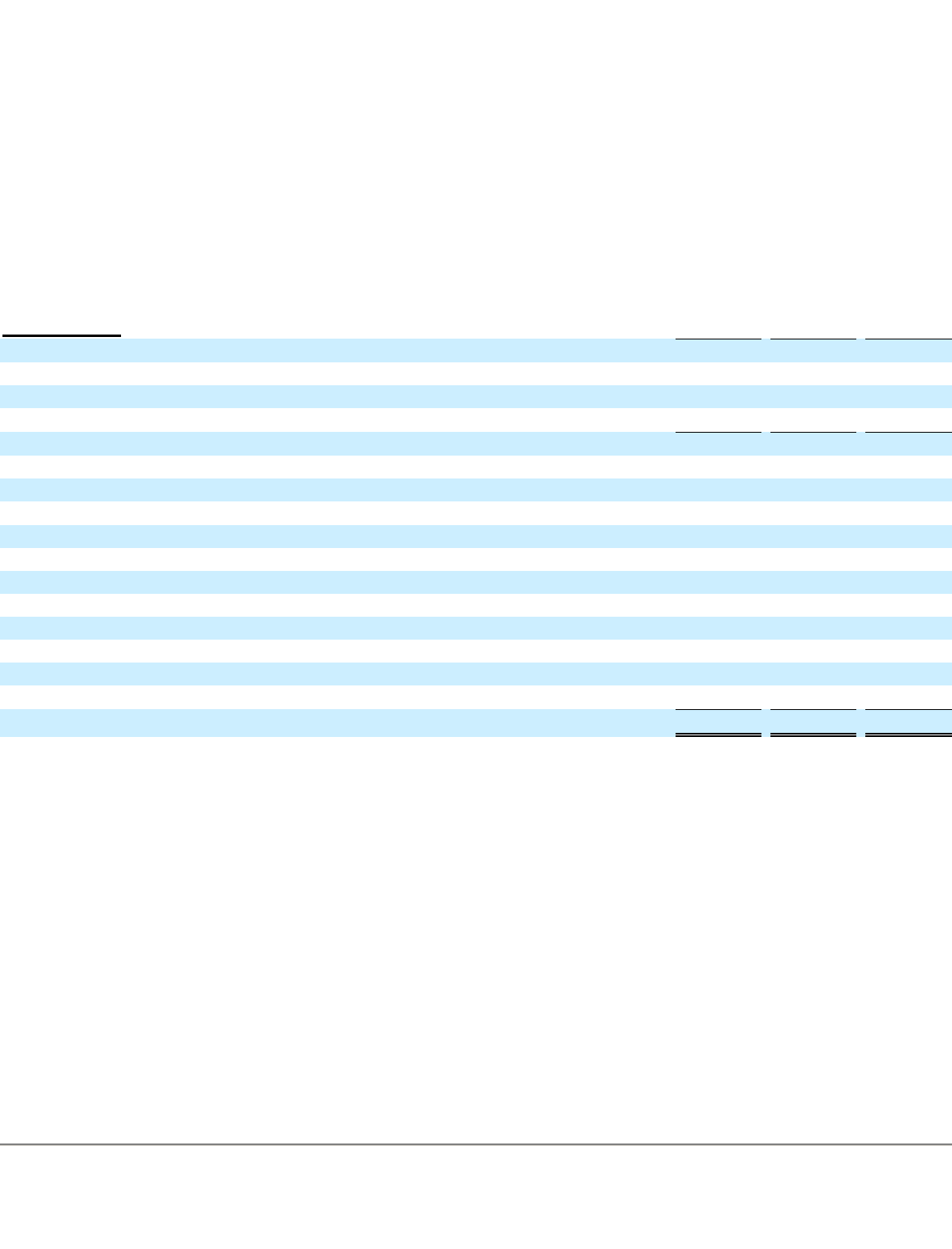

Earnings Before Interest, Taxes, Depreciation And Amortization (“EBITDA”) And Adjusted EBITDA

We believe that EBITDA (earnings before interest, taxes, depreciation and amortization, including agent signing bonus amortization) and

Adjusted EBITDA (EBITDA adjusted for significant items) provide useful information to investors because they are indicators of the strength

and performance of our ongoing business operations, including our ability to service debt and fund capital expenditures, acquisitions and

operations. These calculations are commonly used as a basis for investors, analysts and credit rating agencies to evaluate and compare the

operating performance and value of companies within our industry. In addition, our debt agreements require compliance with financial measures

similar to Adjusted EBITDA. Finally, EBITDA and Adjusted EBITDA are financial measures used by management in reviewing results of

operations, forecasting, assessing cash flow and capital, allocating resources and establishing employee incentive programs.

Although we believe that EBITDA and Adjusted EBITDA enhance investors' understanding of our business and performance, these non-

GAAP

financial measures should not be considered an exclusive alternative to accompanying GAAP financial measures. These metrics are not

necessarily comparable with similarly named metrics of other companies. The following table is a reconciliation of these non-

GAAP financial

measures to the related GAAP financial measures for the years ended December 31:

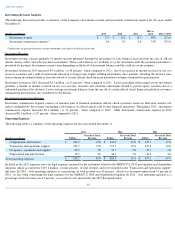

(1)

Severance and related costs primarily from executive terminations.

(2)

Professional and legal fees related to the 2011 Recapitalization.

(3)

Impairments of assets in 2011 relate to the disposition of a business and software and intangible asset impairments.

(4)

Expense resulting from payment by an investor to Walmart upon liquidation of such investor's investment as required by the Participation Agreement. See

Note 11

— Stockholders' Deficit of the Notes to the Consolidated Financial Statements for additional information.

(5)

In 2013, debt extinguishment costs relate to the termination of our 2011 Credit Agreement and the Note Repurchase in connection with the 2013 Credit Agreement. In 2011, debt

extinguishment costs relate to the termination of our 2008 senior facility in connection with the 2011 Recapitalization and the partial redemption of our second lien notes.

(6)

Stock-based compensation and one-time contingent performance award payable after three years based on achievement of certain performance targets.

(7)

Legal expenses are primarily in connection with the settlement related to the MDPA/U.S. DOJ investigation and certain ongoing legal matters.

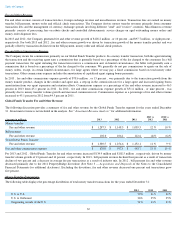

As disclosed in our table above, our Adjusted EBITDA for the year ended December 31, 2013 adjusts $45.3 million

of debt extinguishment costs

in connection with the 2013 Credit Agreement. For the year ended December 31, 2012 , legal expenses of $119.2 million

were adjusted out of

our Adjusted EBITDA, primarily due to the forfeiture related to the settlement of the MDPA/U.S. DOJ investigation and settlement of the

shareholder lawsuit, as well as legal expenses related to these matters. For the year ended December 31, 2011

, debt extinguishment costs of

$37.5 million , related to the 2011 Credit Agreement, were adjusted.

For 2013 , the Company generated EBITDA of $226.1 million and Adjusted EBITDA of $295.5 million . When compared to 2012

, EBITDA

increased $86.2 million , or 62 percent

, primarily due to the reduction of legal expenses, decreased reorganization and restructuring costs of

$16.1 million , which was partially offset by debt extinguishment costs and an increase in stock-based compensation of $4.9 million . In 2013

,

Adjusted EBITDA increased $16.6 million , or six percent

, as a result of continued growth of our money transfer product. See additional

descriptions of these changes in the " Results of Operations " section of Item 7 of this report.

40

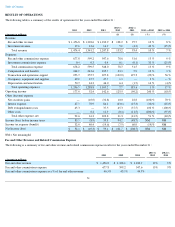

(Amounts in millions) 2013

2012

2011

Income (loss) before income taxes

$

85.3

$

(8.9

)

$

39.8

Interest expense

47.3

70.9

86.2

Depreciation and amortization

50.7

44.3

46.0

Amortization of agent signing bonuses

42.8

33.6

32.6

EBITDA

226.1

139.9

204.6

Significant items impacting EBITDA:

Net securities gains —

(

10.0

)

(32.8

)

Severance and related costs

(1)

1.5

1.0

—

Reorganization and restructuring costs

3.2

19.3

23.5

Compliance enhancement program

2.8

—

—

Capital transaction costs

(2)

—

—

6.4

Asset impairment charges

(3)

—

—

3.4

Contribution from investors

(4)

—

0.3

—

Debt extinguishment

(5)

45.3

—

37.5

Stock-based and contingent performance compensation

(6)

14.1

9.2

16.3

Legal expenses

(7)

2.5

119.2

4.8

Adjusted EBITDA

$

295.5

$

278.9

$

263.7