MoneyGram 2013 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

During 2013 , the Company recognized a loss of $0.1 million

on furniture and equipment related to the closing of an office location and disposal

of equipment at agent locations and signage. During 2012 , the Company recognized losses of $0.9 million

, primarily related to disposal of

furniture and equipment related to the closing of two office locations. Losses on disposals in 2011

were nominal. The losses were recorded in the

“Occupancy, equipment and supplies” line in the Consolidated Statements of Operations.

In 2011 , the Company recognized a $2.4 million impairment charge on the sale of land. During 2011 , the Company also recognized a

$0.7

million

capitalized software impairment charge, primarily in connection with the disposition of assets in the Global Funds Transfer segment. The

impairment charges recorded in 2011 were included in the “Other costs” line in the Consolidated Statements of Operations.

Note 8 — Goodwill and Intangible Assets

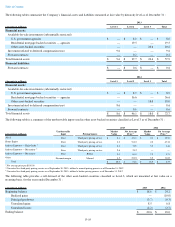

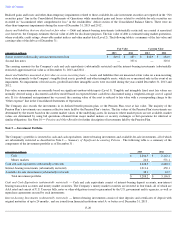

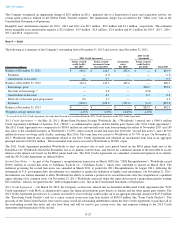

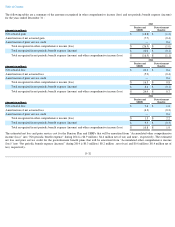

The following table is a roll-forward of goodwill by reporting segment:

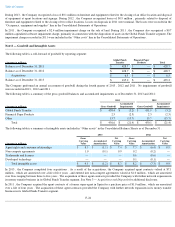

The Company performed an annual assessment of goodwill during the fourth quarter of 2013 , 2012 and 2011

. No impairments of goodwill

were recorded in 2013 , 2012 and 2011 .

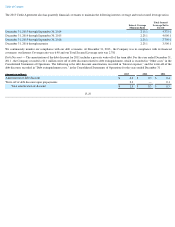

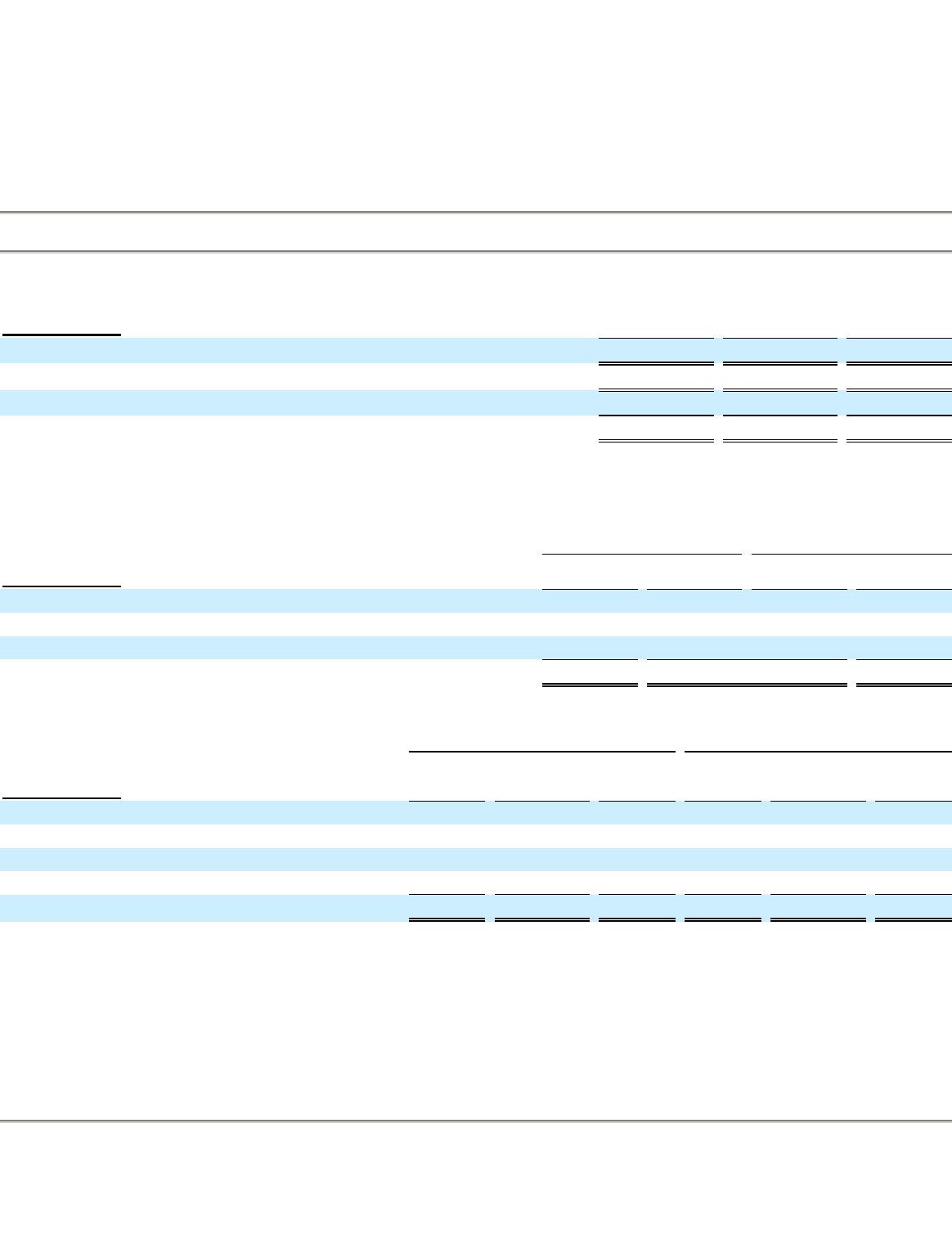

The following table is a summary of the gross goodwill balances and accumulated impairments as of December 31, 2013 and 2012 :

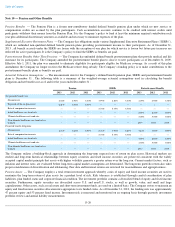

The following table is a summary of intangible assets included in “Other assets” in the Consolidated Balance Sheets as of December 31 :

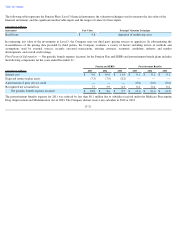

In 2013 , the Company completed four acquisitions . As a result of the acquisitions, the Company acquired agent contracts valued at

$7.1

million , which are amortized over a life of five years , and entered into non-compete agreements valued at $1.0 million

, which are amortized

over lives ranging between three to five years

. The acquisition of these agent contracts provided the Company with further network expansion in

its money transfer business in its Global Funds Transfer segment. See Note 3 — Acquisitions and Disposals for additional disclosure.

In 2011 , the Company acquired the agent contracts of a former super-agent in Spain for a purchase price of $1.0 million

, which are amortized

over a life of four years

. The acquisition of these agent contracts provided the Company with further network expansion in its money transfer

business in its Global Funds Transfer segment.

F-24

(Amounts in millions) Global Funds

Transfer

Financial Paper

Products

Total

Balance as of December 31, 2011

$

428.7

$

—

$

428.7

Balance as of December 31, 2012

$

428.7

$

—

$

428.7

Acquisitions

$

6.5

$

—

$

6.5

Balance as of December 31, 2013

$

435.2

$

—

$

435.2

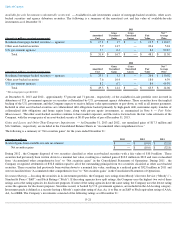

2013

2012

(Amounts in millions) Gross Goodwill

Accumulated

Impairments

Gross Goodwill

Accumulated

Impairments

Global Funds Transfer

$

438.4

$

(3.2

)

$

431.9

$

(3.2

)

Financial Paper Products

2.5

(2.5

)

2.5

(2.5

)

Other

15.7

(15.7

)

15.7

(15.7

)

Total

$

456.6

$

(21.4

)

$

450.1

$

(21.4

)

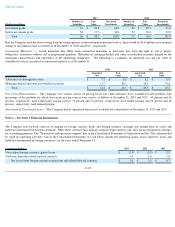

2013

2012

(Amounts in millions)

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Agent rights and consumer relationships

$

8.5

$

(1.1

)

$

7.4

$

7.3

$

(6.4

)

$

0.9

Non-compete agreements

1.0

(0.1

)

0.9

0.2

(0.2

)

—

Trademarks and licenses

—

—

—

0.6

(0.6

)

—

Developed technology

—

—

—

0.1

(0.1

)

—

Total intangible assets

$

9.5

$

(1.2

)

$

8.3

$

8.2

$

(7.3

)

$

0.9