MoneyGram 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

review markets where we may have an opportunity to increase our presence through agent signings and acquisitions, specifically in countries or

cities where we are underrepresented based on the World Bank's estimated country market size.

Compliance with laws and regulations is a highly complex and integral part of our day-to-

day operations. Our operations are subject to a wide

range of laws and regulations in the U.S. and other countries. We have continued to increase our compliance personnel headcount and make

investments in our compliance-related technology and infrastructure. Since 2009 we have invested over $120.0 million

in our compliance and

anti-fraud programs and prevented more than $365.0 million

in fraud losses during the same time period. In December of 2013, we launched our

Compliance Enhancement Program, which is focused on improving our services for the consumers and completing the programs recommended

in adherence with the DPA. On an ongoing basis we see a trend among state, federal and international regulators towards enhanced scrutiny of

anti-money laundering compliance programs, as well as consumer fraud prevention and education.

Anticipated Trends for 2014

This discussion of trends expected to impact our business in 2014

is based on information presently available and contains certain assumptions,

including assumptions regarding future economic conditions. Differences in actual economic conditions during 2014

compared with our

assumptions could have a material impact on our results. See “ Cautionary Statements Regarding Forward-Looking Statements ”

and Part I,

Item 1A, “ Risk Factors ” of this Annual Report on Form 10-

K for additional factors that could cause results to differ materially from those

contemplated by the following forward-looking statements.

Throughout 2013, global economic conditions remained weak. We cannot predict the duration or extent of the severity of these weak economic

conditions, nor the extent to which these conditions could negatively affect our business, operating results or financial condition. While the

money remittance industry has generally been resilient during times of economic softness, the current global economic conditions have

continued to adversely impact the demand for money remittances. The World Bank is projecting eight percent remittance growth in 2014

, which

is an acceleration from 2013 estimates. Our growth has historically exceeded the World Bank projections.

We continue to review markets in which we may have an opportunity to increase prices based on increased brand awareness, loyalty and

competitive positioning. We are monitoring consumer behavior to ensure that we continue our market share growth. Pricing actions from our

competitors may also result in pricing changes for our products and services. As a result of our agent expansion and retention efforts,

commissions expense and signing bonuses may increase throughout 2014 .

We believe self-service channels are incremental to our existing strong cash-to-

cash business and that MoneyGram can continue to strengthen

our overall market position with accelerated investments. In 2014 , we anticipate increasing our investment in our self-

service channels business,

which includes MoneyGram Online, mobile, account deposit services and kiosk-

based money transfer and bill payment options. These channels

for the money transfer products performed extremely well, recording 30% fee and other revenue growth as a result of 47% transaction growth for

the twelve months ended December 31, 2013 .

For our Financial Paper Products segment, we expect the decline in overall paper-based transactions to continue in 2014

. As a result of the

pricing initiatives undertaken in prior years, we have reduced the commission rates paid to our official check financial institution customers and

instituted certain per item and other fees for both the official check and money order services. In addition, the historically low interest rate

environment has resulted in low or no commissions being paid to our official check financial institution customers. As a result, we anticipate that

the Financial Paper Products segment will continue to experience a decline in outstanding balances in 2014 .

We continue to see a trend among state, federal and international regulators toward enhanced scrutiny of anti-

money laundering compliance, as

well as consumer fraud prevention and education. We have taken and will continue to take proactive steps that we feel are in the best interest of

consumers to prevent consumer fraud, although we do not know which regions we may choose in which to take future action. Additionally, the

terms of the DPA impose additional costs upon the Company related to compliance and other required terms, and such additional compliance

costs could be substantial. As a result of the first annual monitor report, most of the major technology upgrades will need to be implemented in

the next 12 months. As we continue to revise our processes and enhance our technology systems to meet regulatory trends and to comply with

the terms of the DPA, our operating expenses for compliance may increase. Additional compliance obligations could also have an adverse

impact on the Company's operations.

In February 2014, we announced our Global Transformation Program, which is centered around facilities and headcount rationalization, system

efficiencies and headcount right-shoring and outsourcing. In relation to the Global Transformation Program, we are estimating to incur

$30.0

million to $40.0 million in cash outlays over the next two years and generate an annual estimated pre-tax cost savings of approximately

$15.0

million to $20.0 million exiting fiscal year 2015.

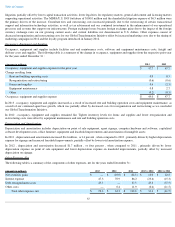

Financial Measures and Key Metrics

This Form 10-

K includes financial information prepared in accordance with accounting principles generally accepted in the U.S., or GAAP, as

well as certain non-GAAP financial measures that we use to assess our overall performance.

29