MoneyGram 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

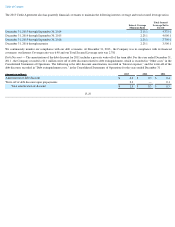

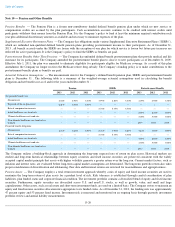

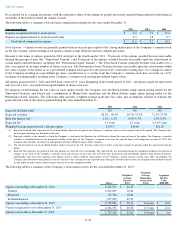

The following table represents the Pension Plan's Level 3 financial instrument, the valuation techniques used to measure the fair value of the

financial instrument, and the significant unobservable inputs and the ranges of values for those inputs.

In estimating fair value of the investments in Level 3, the Company may use third party pricing sources or appraisers. In substantiating the

reasonableness of the pricing data provided by third parties, the Company evaluates a variety of factors including review of methods and

assumptions used by external sources, recently executed transactions, existing contracts, economic conditions, industry and market

developments, and overall credit ratings.

Plan Financial Information

—

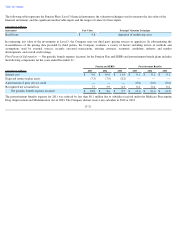

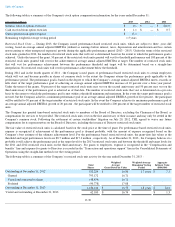

Net periodic benefit expense (income) for the Pension Plan and SERPs and postretirement benefit plans includes

the following components for the years ended December 31 :

The postretirement benefits expense for 2011 was reduced by less than $0.1 million

due to subsidies received under the Medicare Prescription

Drug, Improvement and Modernization Act of 2003. The Company did not receive any subsidies in 2012 or 2013 .

F-31

(Amounts in millions)

Instrument

Fair Value

Principal Valuation Technique

Real Estate

$

4.8

Appraisal of underlying asset

Pension and SERPs

Postretirement Benefits

(Amounts in millions) 2013

2012

2011

2013

2012

2011

Interest cost

$

9.6

$

10.6

$

11.4

$

0.1

$

0.1

$

0.1

Expected return on plan assets

(7.3

)

(7.9

)

(8.2

)

—

—

—

Amortization of prior service credit —

—

—

(

0.6

)

(0.6

)

(0.6

)

Recognized net actuarial loss

7.7

5.9

6.3

0.4

0.4

0.2

Net periodic benefit expense (income)

$

10.0

$

8.6

$

9.5

$

(0.1

)

$

(0.1

)

$

(0.3

)