MoneyGram 2013 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

No vested restricted stock units were convertible as of

December 31, 2013 .

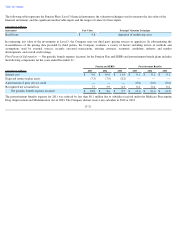

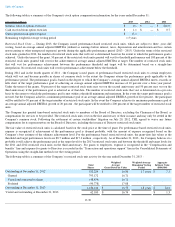

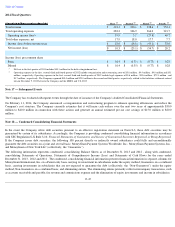

The following table is a summary of the Company's restricted stock and restricted stock unit compensation information for the years ended

December 31 :

Unrecognized restricted stock unit expense and the remaining weighted-average vesting period are presented under the Company’

s current

estimate of achievement of the performance goal on the third anniversary. Unrecognized restricted stock unit expense, as of December 31, 2013

,

under the minimum and maximum thresholds are $2.4 million and $14.1 million , respectively.

Stock Appreciation Rights —

In November 2011, the Company issued a grant of stock appreciation rights to certain employees which entitle the

holder to any per share appreciation from the price at issuance. The grants vest and become exercisable over a four-year

period in an equal

number of shares each year. Upon exercise, the employee will receive an amount that is equal to the excess of the closing sale price of the

Company’s common stock at the time of exercise over the grant price paid in cash up to a maximum of $12.00 .

The fair value of stock appreciation rights was calculated using a Black-

Scholes single option pricing model and is recorded as a liability in the

“Accounts payable and other liabilities”

line in the Consolidated Balance Sheets. Expense for stock appreciation rights is recognized in the

“Compensation and benefits” line in the Consolidated Statements of Operations using the straight-

line method over the vesting period. Expense

related to stock appreciation rights was nominal for 2013 and 2012 .

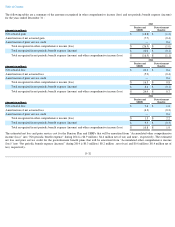

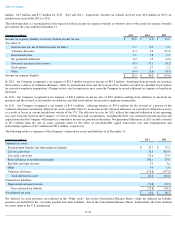

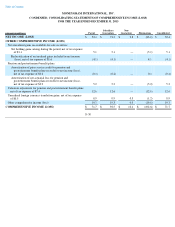

The following table is a summary of the Company’s stock appreciation rights activity for the year ended December 31, 2013 :

Note 13 — Income Taxes

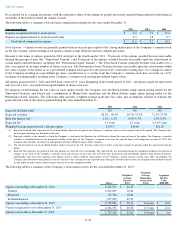

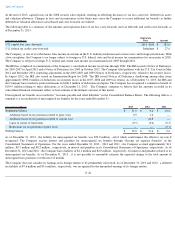

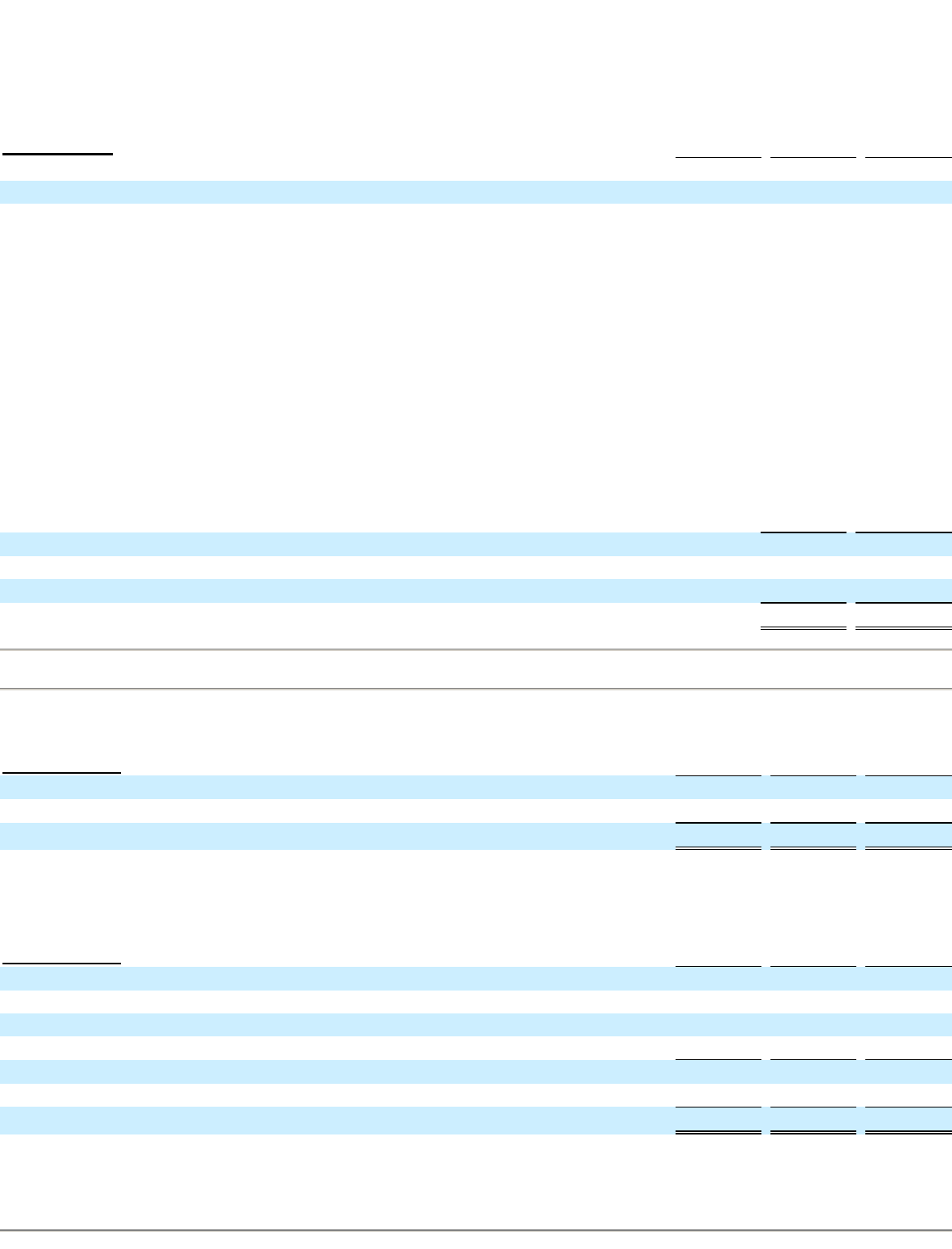

The following table is a summary of the components of income (loss) before income taxes for the years ended December 31 :

Foreign income consists of statutory income and losses from the Company’s international subsidiaries. Most of the Company’

s wholly owned

subsidiaries recognize revenue based solely on services agreements with the primary U.S. operating subsidiary. The following table is a

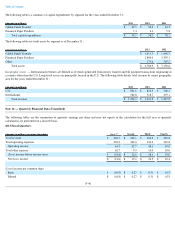

summary of the income tax expense (benefit) for the years ended December 31 :

As of December 31, 2013 and 2012 , the Company had a net income tax payable of $53.7 million and $52.3 million

, respectively, recorded in

the “Accounts payable and other liabilities” line in the Consolidated Balance Sheets. Income taxes paid were $8.0

F-40

(Dollars in millions) 2013

2012

2011

Market value of restricted stock units converted

$

0.8

$

0.6

$

0.6

Unrecognized restricted stock unit expense

$

9.5

Total

Shares

Weighted

Average

Price

Stock appreciation rights outstanding at December 31, 2012

8,600

$

17.03

Granted

4,743

17.00

Forfeited

(1,923

)

17.03

Stock appreciation rights outstanding at December 31, 2013

11,420

$

17.02

(Amounts in millions) 2013

2012

2011

U.S.

$

69.9

$

(9.6

)

$

39.7

Foreign

15.4

0.7

0.1

Income (loss) before income taxes

$

85.3

$

(8.9

)

$

39.8

(Amounts in millions) 2013

2012

2011

Current:

Federal

$

9.7

$

6.1

$

40.0

State

0.1

0.5

6.3

Foreign

11.1

4.0

6.9

Current income tax expense

20.9

10.6

53.2

Deferred income tax expense (benefit)

12.0

29.8

(72.8

)

Income tax expense (benefit)

$

32.9

$

40.4

$

(19.6

)