MoneyGram 2013 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

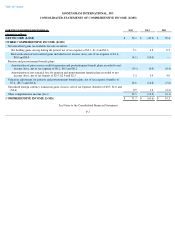

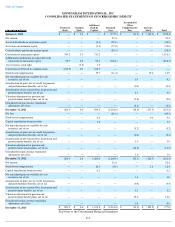

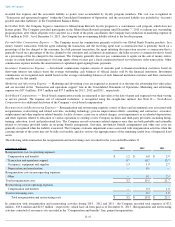

MONEYGRAM INTERNATIONAL, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

See Notes to the Consolidated Financial Statements

F-7

FOR THE YEAR ENDED DECEMBER 31, 2013

2012

2011

(Amounts in millions)

NET INCOME (LOSS)

$

52.4

$

(49.3

)

$

59.4

OTHER COMPREHENSIVE INCOME (LOSS)

Net unrealized gains on available-for-sale securities:

Net holding gains arising during the period, net of tax expense of $3.1, $1.4 and $0.6

5.1

4.8

0.3

Reclassification of net realized gains included in net income (loss), net of tax expense of $1.6,

$0.0 and $0.0

(4.1

)

(10.0

)

—

Pension and postretirement benefit plans:

Amortization of prior service credit for pension and postretirement benefit plans recorded to net

income (loss), net of tax expense of $0.2, $0.2 and $0.2

(0.4

)

(0.4

)

(0.4

)

Amortization of net actuarial loss for pension and postretirement benefit plans recorded to net

income (loss), net of tax benefit of $2.9, $2.4 and $2.5

5.2

3.9

4.0

Valuation adjustment for pension and postretirement benefit plans, net of tax expense (benefit) of

$7.4, ($8.7) and ($3.6)

12.6

(14.2

)

(5.8

)

Unrealized foreign currency translation gains (losses), net of tax expense (benefit) of $0.5, $1.0 and

($2.6)

0.9

1.6

(4.2

)

Other comprehensive income (loss)

19.3

(14.3

)

(6.1

)

COMPREHENSIVE INCOME (LOSS)

$

71.7

$

(63.6

)

$

53.3