MoneyGram 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

In 2012 , bill payment fee and other revenue decreased six percent and transactions declined three percent. Excluding the 2011

PropertyBridge

divestiture, fee and other revenue decreased one percent and transactions grew five percent. The divestiture accounted for $5.1 million

of the

decline. Excluding the divestiture, volume growth accounted for an increase of $4.6 million , which was offset by a $6.0 million

decline related

to the lower average fees from changes in industry mix.

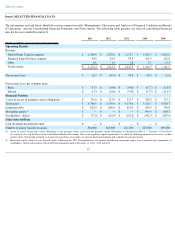

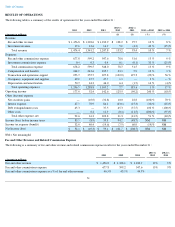

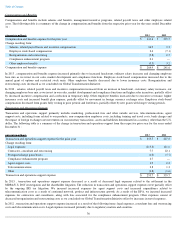

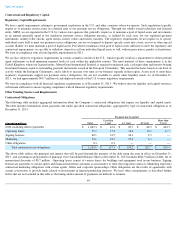

Global Funds Transfer Fee and Other Commissions Expense

The following table details the changes in fee and other commissions for the Global Funds Transfer segment from the respective prior year for

the years ended December 31 :

In 2013 , the Global Funds Transfer commission expense increased 13 percent , or $79.3 million

. The increase in commission expense was

primarily driven by transaction growth from the money transfer product, changes in the corridor and agent mix, the movement in foreign

currency exchange rates, a step-

up in the commission rate for a large agent and increased signing bonus amortization from our agent expansion

and retention efforts, which was partially offset the transaction declines from the bill payment product.

In 2012 , the Global Funds Transfer commission expense increased 10 percent , or $51.9 million

. The increase in commission expense was

primarily the result of the transaction growth from the money transfer product. Also contributing to the increases were changes in the corridor

and agent mix and the increased signing bonus amortization from our agent expansion and retention efforts, which was partially offset by the

transaction declines from the bill payment product and movement in foreign currency exchange rates.

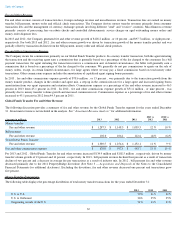

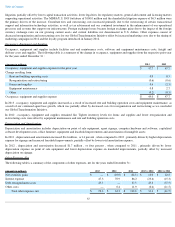

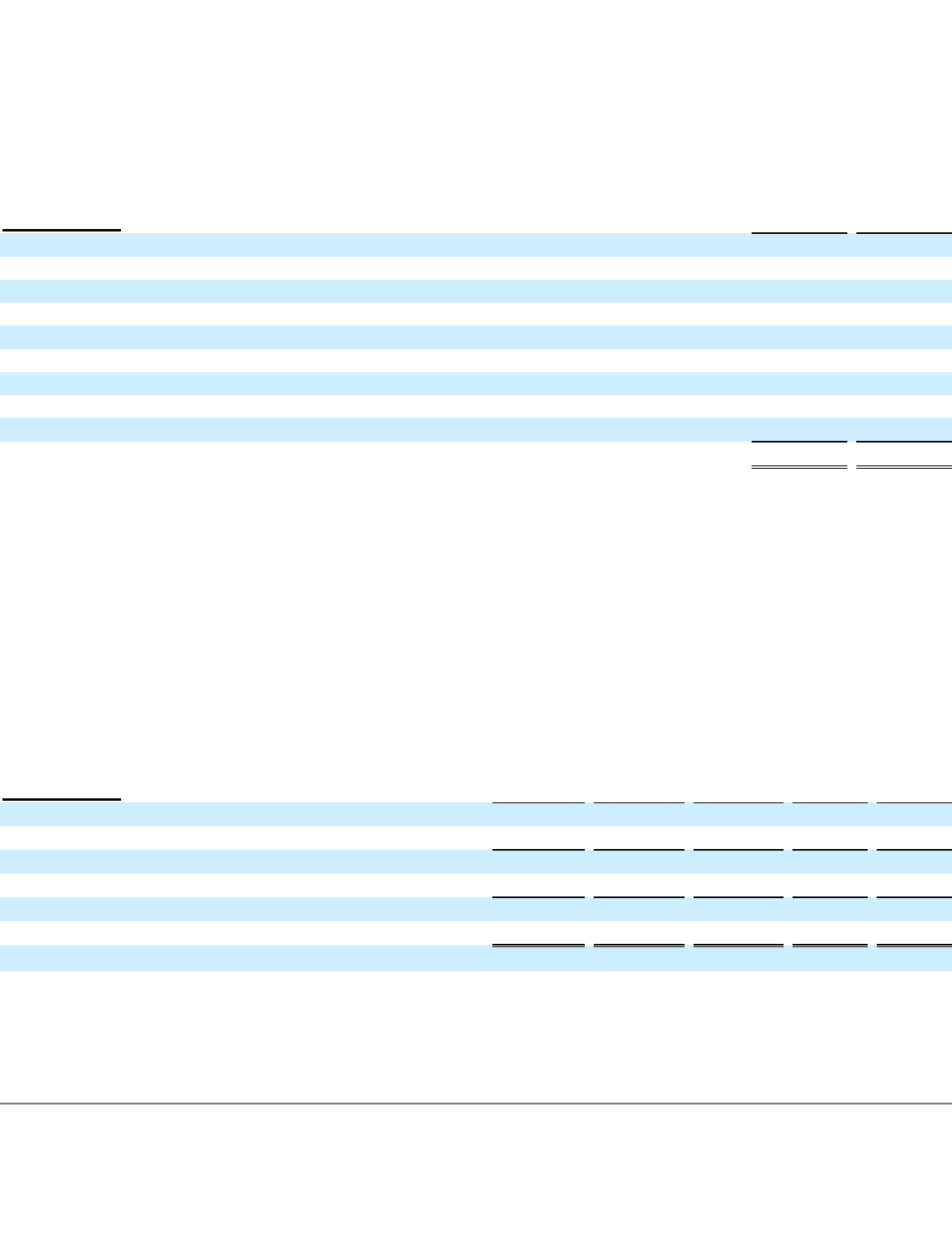

Financial Paper Products Fee and Other Revenue and Fee and Other Commissions Expense

The following discussion provides a summary of fee and other revenue and fee and other commissions expense for the Financial Paper Product

segment for the years ended December 31 . Investment revenue is not included in the analysis below. See " Investment Revenue Analysis

" for

additional information.

Money order fee and other revenue decreased in 2013 and 2012 due to transaction declines of nine percent and five percent

, respectively,

primarily due to attrition of agents and the continued migration by consumers to other payment methods. Official check fee and other revenue

decreased in 2013 and 2012 due to the attrition of official check financial institutions. Fee and other commissions expense decreased by

40

percent and 25 percent in 2013 and 2012 , respectively, due primarily to lower volumes.

34

(Amounts in millions) 2013

2012

Global Funds Transfer commissions expense for the prior year

$

597.6

$

545.7

Change resulting from:

Money transfer volume growth

60.6

49.0

Money transfer commission rates

7.6

16.4

Bill payment volumes

(1.6

)

(3.9

)

Bill payment commission rates

1.0

(1.2

)

Signing bonus amortization

8.9

1.2

Foreign currency exchange rate

2.8

(9.4

)

Other

—

(

0.2

)

Global Funds Transfer commissions expense

$

676.9

$

597.6

(Amounts in millions) 2013

2012

2011

2013 vs

2012

2012 vs

2011

Money order:

Fee and other revenue

$

51.1

$

55.4

$

57.3

(8

)%

(3

)%

Official check:

Fee and other revenue

16.2

18.3

21.1

(11

)%

(13

)%

Total Financial Paper Products:

Fee and other revenue

$

67.3

$

73.7

$

78.4

(9

)%

(6

)%

Fee and other commissions expense

$

0.9

$

1.5

$

2.0

(40

)%

(25

)%