MoneyGram 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

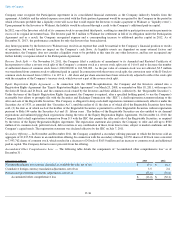

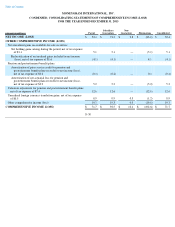

the Company had $1.7 million and $38.7 million of liability recorded in the “Accounts payable and other liabilities”

line in the Consolidated

Balance Sheets as of December 31, 2013 and 2012 , respectively. A charge of $0.2 million , $108.8 million and $1.9 million

, net of insurance

recoveries, were recorded in the “Transaction and operations support” line in the Consolidated Statements of Operations during 2013 , 2012

and

2011 , respectively, for legal proceedings.

Litigation Commenced Against the Company:

The Company is involved in various claims and litigation that arise from time to time in ordinary course of the Company's business.

Management does not believe that after final disposition any of these matters is likely to have a material adverse impact on the Company's

financial condition, results of operations and cash flows.

Government Investigations

State Civil Investigative Demands — MoneyGram has received Civil Investigative Demands from a working group of nine

state attorneys

general who have initiated an investigation into whether the Company took adequate steps to prevent consumer fraud during the period from

2007 to 2011. The Civil Investigative Demands seek information and documents relating to the Company’

s procedures to prevent fraudulent

transfers and consumer complaint information. MoneyGram continues to cooperate fully with the states in this matter. MoneyGram has

submitted the information and documents requested by the states. No claims have been filed against MoneyGram in connection with this

investigation. Accordingly, we are unable to estimate the potential dollar amount of any loss in connection with this investigation or whether any

loss in connection with this investigation could have a material adverse effect on our results of operations, cash flows or financial position. The

Company does not believe there is a basis for any claim or recovery with respect to this matter and intends to vigorously defend itself if any

claim is asserted.

Other Matters —

The Company is involved in various other government inquiries and other matters that arise from time to time. Management

does not believe that after final disposition any of these other matters is likely to have a material adverse impact on the Company’

s financial

condition, results of operations and cash flows.

Actions Commenced by the Company

CDO Litigation —

In March 2012, the Company initiated an arbitration proceeding before the Financial Industry Regulatory Authority against

Goldman Sachs & Co., or Goldman Sachs. The arbitration relates to MoneyGram’

s purchase of Residential Mortgage Backed Securities and

Collateral Debt Obligations that Goldman Sachs sold to MoneyGram during the 2005 through 2007 timeframe. The Company alleges, among

other things, that Goldman Sachs made material misrepresentations and omissions in connection with the sale of these products, ultimately

causing significant losses to the Company for which the Company is currently seeking damages. Goldman Sachs owns, together with certain of

its affiliates, approximately 19 percent of the shares of the Company’

s common stock on a diluted basis, assuming conversion of the D Stock

currently owned by Goldman Sachs and its affiliates.

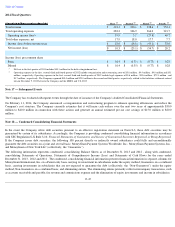

Tax Litigation — On May 14, 2012 and December 17, 2012, the Company filed petitions in the U.S. Tax Court challenging the 2005-

2007 and

2009 Notices of Deficiency, respectively, pursuant to which the IRS determined that the Company owes additional corporate income taxes

because certain deductions relating to securities losses were capital in nature, rather than ordinary losses. The Company asserts that it properly

deducted its securities losses and that, consequently, no additional corporate income taxes are owed. The IRS filed its responses to the

Company’s petitions in July 2012 and February 2013 reasserting its original position relating to the years 2005-

2007 and 2009. The cases have

been consolidated before the U.S. Tax Court. In December 2013, the IRS filed a motion with the court for partial summary judgment in the case,

and in February 2014 the Company filed its response to that motion which included the Company's request for partial summary judgment.

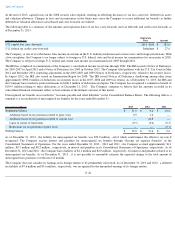

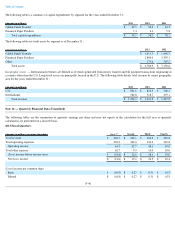

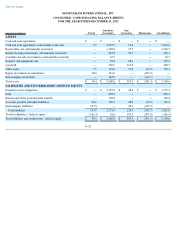

Note 15 — Segment Information

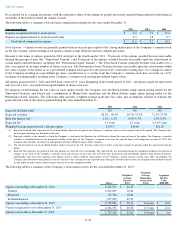

The Company’

s reporting segments are primarily organized based on the nature of products and services offered and the type of consumer

served. The Company has two

reporting segments: Global Funds Transfer and Financial Paper Products. The Global Funds Transfer segment

provides global money transfers and, in the U.S., Canada, Puerto Rico, bill payment services to consumers through a network of agents and, in

select markets, company-

operated locations. The Financial Paper Products segment provides money orders to consumers through retail and

financial institution locations in the U.S. and Puerto Rico, and provides official check services to financial institutions in the U.S. One

of the

Company's agents of both the Global Funds Transfer segment and the Financial Paper Products segment accounted for 27 percent ,

28 percent

and 29 percent of total revenue in 2013 , 2012 and 2011

, respectively. Businesses that are not operated within these segments are categorized as

“Other,” and primarily relate to discontinued products and businesses. "Other" also contains corporate items. Segment pre-

tax operating income

and segment operating margin are used to review segment performance and to allocate resources.

Segment accounting policies are the same as those described in Note 2 — Summary of Significant Accounting Policies

. The Company manages

its investment portfolio on a consolidated level, with no specific investment security assigned to a particular

F-44