MoneyGram 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

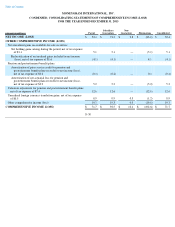

Table of Contents

Note 14 — Commitments and Contingencies

Operating Leases — The Company has various non-

cancelable operating leases for buildings and equipment that terminate through 2023.

Certain of these leases contain rent holidays and rent escalation clauses based on pre-

determined annual rate increases. The Company recognizes

rent expense under the straight-line method over the term of the lease. Any difference between the straight-

line rent amounts and amounts

payable under the leases are recorded as deferred rent in “Accounts payable and other liabilities”

in the Consolidated Balance Sheets. Cash or

lease incentives received under certain leases are recorded as deferred rent when the incentive is received and amortized as a reduction to rent

over the term of the lease using the straight-

line method. Incentives received relating to tenant improvements are recognized as a reduction of

rent expense under the straight-

line method over the term of the lease. Tenant improvements are capitalized as leasehold improvements and

depreciated over the shorter of the remaining term of the lease or 10 years . The deferred rent liability relating to these incentives was

$2.6

million at December 31, 2013 and 2012 , respectively.

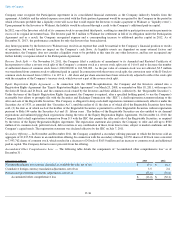

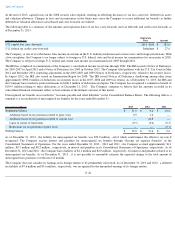

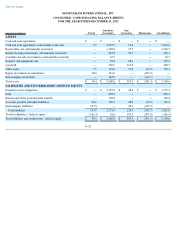

The following table is a summary of the minimum rental expense under operating leases for the years ended December 31 :

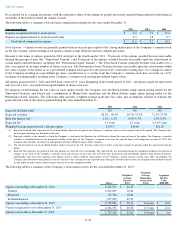

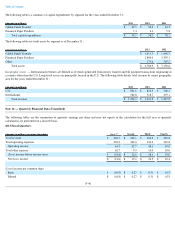

The following table is a summary of the minimum future rental payments for all non-

cancelable operating leases with an initial term of more

than one year at December 31, 2013 (amounts in millions):

Letters of Credit

— At December 31, 2013 , the Company had $0.4 million

of letters of credit. These letters of credit reduce the amount

available under the Revolving Credit Facility.

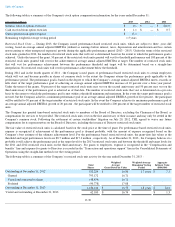

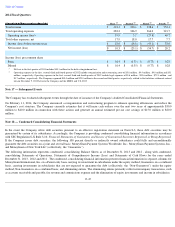

Minimum Commission Guarantees

—

In limited circumstances, as an incentive to new or renewing agents, the Company may grant minimum

commission guarantees for a specified period of time at a contractually specified amount. Under the guarantees, the Company will pay to the

agent the difference between the contractually specified minimum commission and the actual commissions earned by the agent. Expense related

to the guarantee is recognized in the “Fee and other commissions expense” line in the Consolidated Statements of Operations.

As of December 31, 2013 , the liability for minimum commission guarantees is $4.0 million

and the maximum amount that could be paid under

the minimum commission guarantees is $13.3 million over a weighted average remaining term of 3.9 years

. The maximum payment is

calculated as the contractually guaranteed minimum commission multiplied by the remaining term of the contract and, therefore, assumes that

the agent generates no money transfer transactions during the remainder of its contract. However, under the terms of certain agent contracts, the

Company may terminate the contract if the projected or actual volume of transactions falls beneath a contractually specified amount. With

respect to minimum commission guarantees expiring in 2013 and 2012 , the Company paid $1.5 million and $0.5 million , respectively, or

56

percent and 22 percent , respectively, of the estimated maximum payment for the year.

Other Commitments — The Company has agreements with certain co-

investors to provide funds related to investments in limited partnership

interests. As of December 31, 2013 , the total amount of unfunded commitments related to these agreements was $0.3 million .

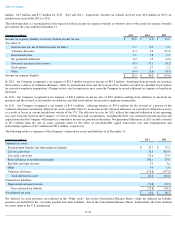

Legal Proceedings

—

The matters set forth below are subject to uncertainties and outcomes that are not predictable. The Company accrues for

these matters as any resulting losses become probable and can be reasonably estimated. Further, the Company maintains insurance coverage for

many claims and litigation alleged. In relation to various legal matters, including those described below,

F-43

(Amounts in millions) 2013

2012

2011

Rent expense

$

16.2

$

15.6

$

16.6

Contingent rent

0.2

—

—

Sublease agreements

(1.0

)

(0.7

)

(0.3

)

Minimum rent expense under operating leases

$

15.4

$

14.9

$

16.3

2014

$

15.2

2015

12.0

2016

6.0

2017

5.4

2018

5.0

Thereafter

11.7

Total

$

55.3