MoneyGram 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

MONEYGRAM INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Description of the Business and Basis of Presentation

References to “MoneyGram,” the “Company,” “we,” “us” and “our”

are to MoneyGram International, Inc. and its subsidiaries and consolidated

entities.

Nature of Operations

— MoneyGram offers products and services under its two

reporting segments: Global Funds Transfer and Financial Paper

Products. The Global Funds Transfer segment provides global money transfer services and bill payment services to consumers through a

network of agents. The Financial Paper Products segment provides official check outsourcing services and money orders through financial

institutions and agents.

Basis of Presentation

—

The consolidated financial statements of MoneyGram are prepared in conformity with accounting principles generally

accepted in the United States of America (“GAAP”).

The Consolidated Balance Sheets are unclassified due to the timing uncertainty

surrounding the payment of settlement obligations.

Use of Estimates —

The process of preparing financial statements in conformity with U.S. GAAP requires the use of estimates and judgments

that affect the reported amount of assets, liabilities, revenue and expenses. These estimates and judgments are based on historical experience,

future expectations and other factors and assumptions the Company believes to be reasonable under the circumstances. These estimates and

judgments are reviewed on an ongoing basis and are revised when necessary. Changes in estimates are recorded in the period of change. Actual

amounts may differ from these estimates.

Principles of Consolidation

—

The consolidated financial statements include the accounts of MoneyGram International, Inc. and its

subsidiaries. Intercompany profits, transactions and account balances have been eliminated in consolidation.

The Company participates in various trust arrangements (special purpose entities or “SPEs”)

related to official check processing agreements with

financial institutions and structured investments within the investment portfolio. Working in cooperation with certain financial institutions, the

Company historically established separate consolidated SPEs that provided these financial institutions with additional assurance of its ability to

clear their official checks. The Company maintains control of the assets of the SPEs and receives all investment revenue generated by the assets.

The Company remains liable to satisfy the obligations of the SPEs, both contractually and by operation of the Uniform Commercial Code, as

issuer and drawer of the official checks. As the Company is the primary beneficiary and bears the primary burden of any losses, the SPEs are

consolidated in the consolidated financial statements. The assets of the SPEs are recorded in the Consolidated Balance Sheets in a manner

consistent with the assets of the Company based on the nature of the asset. Accordingly, the obligations have been recorded in the Consolidated

Balance Sheets under “Payment service obligations.”

The investment revenue generated by the assets of the SPEs is allocated to the Financial

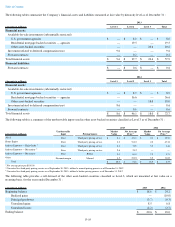

Paper Products segment in the Consolidated Statements of Operations. For the years ending December 31, 2013 and 2012 , the Company’

s SPEs

had cash and cash equivalents of $8.7 million and $29.9 million , respectively, and payment service obligations of $7.2 million and

$24.0

million , respectively.

In connection with the SPEs, the Company must maintain certain specified ratios of greater than 100 percent

of segregated assets to outstanding

payment instruments. These specified ratios require the Company to contribute additional assets if the fair value of the segregated assets is less

than the outstanding payment instruments at any time. The segregated assets consist solely of cash and cash equivalents; therefore, the Company

does not anticipate a need to contribute additional assets in the future to maintain the specified ratios as required by the SPEs. Under certain

limited circumstances, the related financial institution customers have the right to either demand liquidation of the segregated assets or to replace

the Company as the administrator of the SPE. Such limited circumstances consist of material (and in most cases continued) failure of

MoneyGram to uphold its warranties and obligations pursuant to its underlying agreements with the financial institution customers.

Certain structured investments owned by the Company represent beneficial interests in grantor trusts or other similar entities. These trusts

typically contain an investment grade security, generally a U.S. Treasury strip, and an investment in the residual interest in a collateralized debt

obligation, or in some cases, a limited partnership interest. For certain of these trusts, the Company owns a percentage of the beneficial interests

that results in the Company absorbing a majority of the expected losses. Therefore, the Company consolidates these trusts by recording and

accounting for the assets of the trust separately in the consolidated financial statements.

F-10