MoneyGram 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

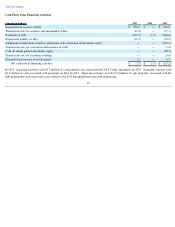

by increased total commission expenses of $51.5 million

, consulting and outsourcing of $22.1 million and increased capital expenditures of

$15.4 million .

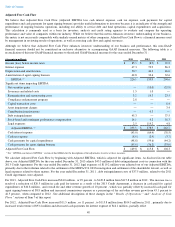

Stockholders’ Deficit

Stockholders’ Deficit — The Company is authorized to repurchase up to 12,000,000 shares of our common stock. As of December 31, 2013

,

we had repurchased a total of 6,795,017

shares of our common stock under this authorization and have remaining authorization to purchase up

to 5,204,983 shares. No repurchase of stock occurred in 2013 .

Under the terms of our outstanding credit facilities, we are limited in our ability to pay dividends on our common stock. No dividends were paid

on our common stock in 2013 , and we do not anticipate declaring any dividends on our common stock during 2014 .

Off-Balance Sheet Arrangements

None.

Critical Accounting Policies and Estimates

The preparation of financial statements in conformity with GAAP requires estimates and assumptions that affect the reported amounts and

related disclosures in the consolidated financial statements. Actual results could differ from those estimates. On a regular basis, management

reviews its accounting policies, assumptions and estimates to ensure that our financial statements are presented fairly and in accordance with

GAAP. Our significant accounting policies are discussed in Note 2 — Summary of Significant Accounting Policies

of the Notes to the

Consolidated Financial Statements.

Critical accounting policies are those policies that management believes are very important to the portrayal of our financial position and results

of operations, and that require management to make estimates that are difficult, subjective or complex. Based on these criteria, management has

identified and discussed with the Audit Committee the following critical accounting policies and estimates, including the methodology and

disclosures related to those estimates.

Goodwill — We have two

reporting units: Global Funds Transfer and Financial Paper Products. Our Global Funds Transfer reporting unit is the

only reporting unit that carries goodwill. On an annual basis, or more frequently upon the occurrence of certain events, we test for goodwill

impairment using a two-

step process. The first step is to identify a potential impairment by comparing the fair value of a reporting unit with its

carrying amount. The fair value of a reporting unit is determined based on a discounted cash flow analysis or other methods of valuation. A

discounted cash flow analysis requires us to make various assumptions, including assumptions about future cash flows, growth rates and

discount rates. The assumptions about future cash flows and growth rates are based on our long-

term projections by reporting unit. In addition,

an assumed terminal value is used to project future cash flows beyond base years. Assumptions used in our impairment testing are consistent

with our internal forecasts and operating plans. Our discount rate is based on our debt and equity balances, adjusted for current market conditions

and investor expectations of return on our equity. If the fair value of a reporting unit exceeds its carrying amount, there is no impairment. If not,

the second step of the goodwill impairment test compares the implied fair value of the reporting unit’

s goodwill with its carrying amount. To the

extent the carrying amount of the reporting unit’s goodwill exceeds its implied fair value, a write-down of the reporting unit’

s goodwill would be

necessary.

We did not recognize a goodwill impairment loss for 2013 , 2012 or 2011

. The carrying value of goodwill assigned to the Global Funds

Transfer reporting unit at December 31, 2013 was $435.2 million

. No goodwill is assigned to the Financial Paper Products reporting unit. The

annual impairment test indicated a fair value for the Global Funds Transfer reporting unit that was substantially in excess of the reporting unit’

s

carrying value. In order to evaluate the sensitivity of the fair value calculations, we applied a hypothetical 10 percent decrease to the fair value of

the Global Funds Transfer reporting unit. Had the estimated fair value been hypothetically lower by 10 percent as of December 31, 2013

, the

fair value of goodwill would still be substantially in excess of the reporting unit’s carrying value.

Fair Value of Investment Securities

— The Company has available-for-

sale investments that are recorded at their estimated fair value. Our

available-for-sale investments are comprised primarily of U.S. government agency debenture securities and residential mortgage-

backed

securities collateralized by U.S. government agency debenture securities. In addition, we hold other asset-

backed securities and have historically

held three trading investments.

We estimate fair value for our investments as an “exit price,”

or the exchange price that would be received for an asset in an orderly transaction

between market participants. Observable price quotes for our exact securities are not available. For our government agency debentures and

residential mortgage-

backed securities, similar securities trade with sufficient regularity to allow observation of market inputs needed to estimate

fair value. For our other asset-

backed securities, the overall liquidity and trading within the relevant markets is not strong. Accordingly,

observable market inputs are not as readily available and estimating fair value is more subjective.

49