MoneyGram 2013 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2013 MoneyGram annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

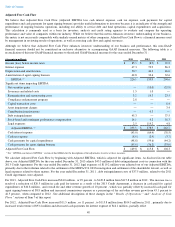

In assessing the need for a valuation allowance, we consider both positive and negative evidence related to the likelihood that the deferred tax

assets will be realized. Our assessment of whether a valuation allowance is required or should be adjusted requires judgment and is completed on

a taxing jurisdiction basis.

We consider, among other matters: the nature, frequency and severity of any cumulative financial reporting losses; the ability to carry back

losses to prior years; future reversals of existing taxable temporary differences; tax planning strategies; and projections of future taxable income.

We also consider our best estimate of the outcome of any on-

going examinations based on the technical merits of the position, historical

procedures and case law, among other items.

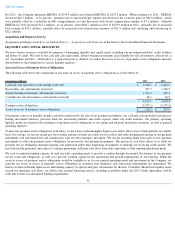

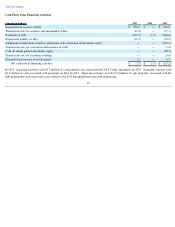

As of December 31, 2013 , we have recorded a valuation allowance of $174.8 million against gross net deferred tax assets of $185.4 million

.

The valuation allowance primarily relates to our tax loss carryovers and basis difference in revalued investments.

While we believe that the basis for estimating our valuation allowance is strong, changes in our current estimates due to unanticipated events, or

other factors, could have a material effect on our financial condition and results of operations.

Stock-based compensation — The Company has a stock-

based compensation plan, which includes stock options, restricted stock units, restricted

stock awards and stock appreciation rights. Certain awards are subject to market and performance conditions at threshold, target and maximum

levels.

For purposes of determining the fair value of stock option awards, the Company uses the Black-Scholes single option pricing model for the time-

based tranches and awards and a combination of Monte-Carlo simulation and the Black-

Scholes single option pricing model for the

performance-based tranches. Compensation cost, net of estimated forfeitures, is recognized using a straight-

line method over the vesting or

service period.

Assumptions for stock-

based compensation include estimating the future volatility of our stock price, expected dividend yield, employee

turnover and employee exercise activity.

Performance-

based share awards require management to make assumptions regarding the likelihood of achieving market and performance goals.

Assumptions used in our assessment are consistent with our internal forecasts and operating plans and assume achievement of performance

conditions as outlined in Note 12 — Stock-Based Compensation of the Notes to the Consolidated Financial Statements .

Recent Accounting Developments

Recent accounting developments are set forth in Note 2 — Summary of Significant Accounting Policies

of the Notes to the Consolidated

Financial Statements.

CAUTIONARY STATEMENTS REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K and the documents incorporated by reference herein may contain forward-

looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, including statements with respect to, among other things, the financial

condition, results of operations, plans, objectives, future performance and business of MoneyGram and its subsidiaries. Forward-

looking

statements can be identified by words such as “believes,” “estimates,” “expects,” “projects,” “plans,” “anticipates,” “continues,” “will,”

“should,” “could,” “may,” “would” and other similar expressions. These forward-

looking statements speak only as of the date they are made, and

MoneyGram undertakes no obligation to publicly update or revise any forward-

looking statement, except as required by federal securities law.

These forward-looking statements are based on management’

s current expectations, beliefs and assumptions and are subject to certain risks,

uncertainties and changes in circumstances due to a number of factors. These factors include, but are not limited to:

51

•

our ability to compete effectively;

•

our ability to maintain key agent or biller relationships, a reduction in business or transaction volume from these relationships, including our

largest agent, Walmart, or our agents offering money transfer services under their own brand or engaging other money transfer service

providers;

•

our ability to manage fraud risks from consumers or agents;

• the ability of us and our agents to comply with U.S. and international laws and regulations, including the Dodd-

Frank Act;

•

litigation involving MoneyGram or its agents, which could result in material settlements, fines or penalties;

•

possible uncertainties relating to compliance with and the impact of the DPA;

•

ongoing investigations involving MoneyGram by the U.S. federal government and state governments which could result in criminal or civil

penalties, revocation of required licenses or registrations, termination of contracts, other administrative actions or lawsuits and negative

publicity;